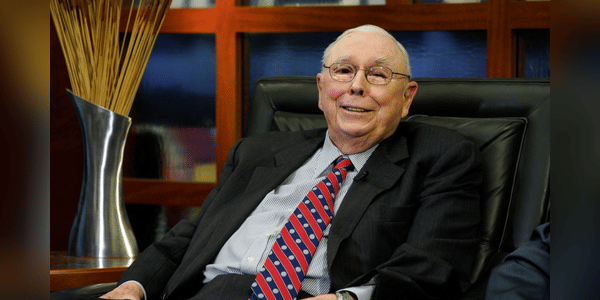

Charlie Munger, Warren Buffett's right-hand man, is considered one of the most successful investors and business minds of our time. His investment philosophy provides us with valuable insights that can be put to good use in both the business and investment worlds.

Today, we'll focus on the essentials of the musings of this great man who may often stand in the shadow of Warren Buffett, but his importance and knowledge are just as important to Berkshire as those of Buffett.

Insights from the musings of Charlie Munger 👇

The Importance of Rational Thinking and Decision Making: Charlie Munger stresses the importance of rational thinking and decision making, especially when it comes to investing. He encourages individuals to think independently and avoid being influenced by popular opinion or herd mentality.

The power of mental models: Munger emphasizes the importance of having a diverse set of mental models to help understand the world and make better decisions. He believes that…