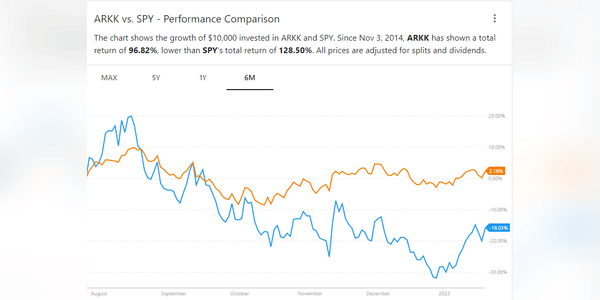

Cathie Wood is crushing the market this year. Is the manager of a well-known fund a genius investor or just lucky?

Cathie Wood became famous for her performance during the huge boom in technology stocks before and during the pandemic. But then came what everyone probably expected. A huge crash and a dark period for her fund. But now it may be looking like the light at the end of the tunnel. Or does it?

At the moment, it looks like Cathie has put the market in her pocket. Nine of the $ARKK Innovation fund's holdings have rocketed so far. The main credit for this goes to a few names.

And that's good news for the popular $6.8 billion fund. It's now up more than 15% this year. That easily beats the S&P 500's 2.4% annual return.

It's a much-needed bounce. Last year, the ETF lost more than 60% of its value, making it one of the worst performing ETFs. ARK Innovation is benefiting from what appears to be investors' willingness to buy speculative investments after the…