We will probably never agree on which stock is the best one to buy now. But today, let's take a look at which stocks TipRanks' top analysts agree on.

Investing in the stock market can be a challenging task, especially for beginners. With so many stocks to choose from and constant market fluctuations, it can be challenging to determine which stocks are worth investing in. However, top analysts can help investors make informed decisions by analyzing and recommending stocks based on their research and expertise. Investors can then take inspiration from the analysts' results. In this article, we'll take a look at two stocks that TipRanks' top analysts have recommended for investors to buy today.

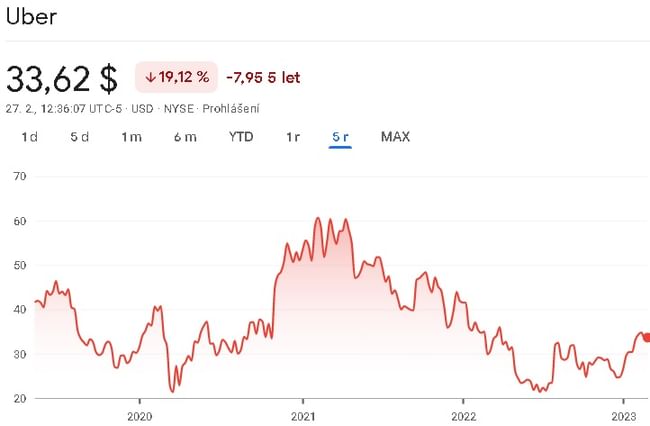

Uber Technologies $UBER

Uber Technologies is a transportation and food delivery company based in San Francisco, California. It was founded in 2009 by Travis Kalanick and Garrett Camp and has since grown into a global transportation company operating in more than 900 metropolitan areas around the world.

Uber's primary business is a ride-sharing platform that connects riders with drivers through a mobile app. In addition, the company also operates a food delivery service called Uber Eats, which allows customers to order food from local restaurants and have it delivered to their door.

Benefits:

- Convenience: Uber offers a convenient and affordable alternative to traditional transportation options. Users can easily request rides or food delivery from their mobile devices, and the service is available in many cities around the world.

- Cost-effective: In many cases, Uber's prices are lower than those of traditional taxi or car services, making it a more cost-effective option for consumers.

- Innovation: Uber has been at the forefront of innovation in the transportation industry, introducing new technologies and features to improve the user experience.

Disadvantages:

- Safety Concerns: There have been several safety issues related to Uber, including incidents of assault and harassment by drivers as well as accidents involving Uber vehicles.

- Regulatory issues: Uber has faced significant regulatory issues in many cities around the world, with some governments attempting to ban or restrict the company's operations.

- Labor disputes: There have been disputes between Uber and its drivers over worker classification and benefits, with some drivers arguing that they should be classified as employees rather than independent contractors.

18 leading analysts recently rated the company as a buy.

Personally, I don't know what prompted them to do so, because while the company's sales have grown by an average of about 36%, the company is virtually unprofitable. Of course, this also means that it has virtually zero net margin.

As far as debt is concerned, here the company has well covered its short-term liabilities, with its short-term assets. The debt-to-equity ratio here comes out to 1.26, which I think is fine for companies like this.

The only thing I see here, and what might also convince analysts to enter, is just the company's ability to adapt to different environments. For example, when the 2020 pandemic reigned, the passenger transportation segment didn't fare well. But the company was resilient, and immediately came up with a new service tailored to the times, which was home delivery. In short, these analysts believe in this company's ability, which is why they are so bullish on it.

I personally do not have this company in my portfolio and I am not looking to add this company to my portfolio at this time. For me, the reason is simple. In short, I think it is too early to invest. Unless the company is profitable, I'm staying away at the moment.

Aspen Aerogels $ASPN

Aspen Aerogels is a leading manufacturer of high-performance aerogel insulation materials that provide superior thermal insulation, fire protection and acoustic dampening properties. Headquartered in Northborough, Massachusetts, the company operates worldwide in various segments of the energy, petrochemical, construction, aerospace and industrial markets.

Benefits:

- Market leadership: Aspen Aerogels is a leading manufacturer of high-performance aerogel insulation materials with a strong brand reputation and well-established customer relationships.

- Diversified product portfolio: the company offers a range of aerogel insulation products for a variety of applications and industries, helping to mitigate the risk of dependence on a single product or market segment.

- Strong growth potential: the global insulation market is growing rapidly, driven by factors such as energy efficiency regulations and increased demand for sustainable building materials.

- Experienced management team: The company's management team is highly experienced and knowledgeable, with many accomplishments in the chemical and materials industries.

Disadvantages:

- Dependence on energy markets: Aspen Aerogels' products are primarily used in the energy and petrochemical industries, which are subject to fluctuations in demand and commodity prices.

- High manufacturing costs: Aerogel insulation materials are expensive to produce, which could limit the Company's ability to compete on price with other insulation materials in certain markets.

- Intense competition: Aspen Aerogels operates in a highly competitive market with several other companies that offer similar insulation products. This could make it difficult for the company to maintain market share and profitability in the long term.

Here, 3 leading analysts who have recently rated the company as a good buy agree on this stock.

To me, there is a very similar problem here as in the previous case. While the company's revenues have grown at an average of about 14% per year in recent years, the company is not profitable by any stretch of the imagination. The company's products are quite expensive to produce and, as a result, the company reinvests all of its revenues. In other words, these revenues are swallowed up by costs.

As far as the financial balance sheet is concerned, and the financial stability that goes with it, everything is absolutely fine. In fact, the company has enough cash on hand to cover all the liabilities it currently has. So I find the company quite stable at the moment.

Personally, I think it is too early to invest. The company is not even profitable at the moment. The potential here is decent, so I don't think the company is not worth considering even when it is normally profitable. Personally, this company is going on my watchlist.

WARNING: I am not a financial advisor, and this material does not serve as a financial or investment recommendation. The content of this material is purely informational.