The economy is not out of the woods and is still under pressure. A lot of investors are now in uncertainty and are looking for different investment opportunities. Analysts and portfolio managers are looking for these opportunities as well. Today, we'll look at two stocks recently discovered by Goldman Sachs analysts.

The slow decline in inflation, coupled with a relatively strong labor market, has investors worried about further tightening by the Fed. This could put further pressure on the stock price. However, the overall backdrop of continued growth momentum is not necessarily bad for stocks, according to Goldman Sachs strategist Kamakshya Trivedi.

Our overall view is increasingly consistent with slow disinflation with some further improvement in global growth. This mix should keep upward pressure on yields but ultimately limit the damage to equities.

Along with this, analysts at Goldman Sach revealed which two stocks they see potential for growth of more than 60%.

Sea, Ltd. $SE

Sea Limited (also known as Sea or Garena) is a Singapore-based multinational technology company founded in 2009 by Forrest Li. The company's core businesses include digital entertainment, e-commerce and digital financial services.

Sea's digital entertainment division is best known for its online gaming platform Garena, which offers a range of games including Free Fire, a popular mobile battle royale game. In addition to games, Sea also operates Shopee, an online shopping platform, and SeaMoney, a digital financial services platform.

Sea's strong performance in the gaming and e-commerce sectors is supported by its growing presence in Southeast Asia, a fast-growing region with a large and increasingly affluent population. However, the company faces significant competition from established players such as Tencent and Alibaba, as well as emerging startups.

Pros:

- Diversified business portfolio: Sea has a diversified business portfolio that includes digital entertainment, e-commerce and digital financial services. This diversification helps reduce the risk of over-reliance on one business segment.

- Leading position in gaming: Sea's digital entertainment division, Garena, is a leading player in the gaming industry with a strong presence in Southeast Asia. Its popular game Free Fire has become one of the most downloaded mobile games in the world.

- Strong management team: Sea's founder and CEO Forrest Li has a history of building successful businesses in Southeast Asia and the company has assembled a strong management team with experience in technology, gaming and e-commerce.

Disadvantages:

- Limited geographic reach: while the company has a strong presence in Southeast Asia, it is not yet as widely recognized in other parts of the world. This could limit its growth potential in the long term.

- High competition: the company faces significant competition from established players such as Tencent and Alibaba, as well as emerging startups in the gaming and e-commerce industries. This could lead to increased pressure on Sea's margins and market share.

- Dependence on a single game: While Free Fire has been the main driver of Sea's growth, the company is heavily dependent on the success of this game. Any decline in the popularity of Free Fire could have a significant impact on Sea's revenue and profitability.

- It is not yet profitable: Sea is not yet profitable, this suggests that the company is prioritizing growth over profitability, which could be a problem for some investors.

For this company, I see the geographic area where the company has the most revenue as a fairly large problem. That area is the south advantaged Asia. So it is reasonable to assume that a significant portion of the company's revenue will come from Asia in general, where I see quite a lot of geopolitical risk. But it's more of a personal problem for me. So another problem that is there is just the dependence of the gaming segment on just one game, where it is a matter of time before someone develops a better, and also more popular game. This is a fundamental problem in my opinion. For me personally, I wouldn't get into the company completely, and would look elsewhere.

On the other hand, analyst Pang Vittayaamnuaykoon, covering the company for Goldman Sachs, believes the stock will outperform the market as he sees an accelerated path to profitability this year.

In the medium to long term, we predict a percentage growth in e-commerce for teens, reflecting our view that Shopee will start reinvesting after turning a profit (while remaining profitable) to defend its leadership position and expand in growth areas... On the play, we believe the Street has already seen a steady decline in EBITDA, providing downside support; while SeaMoney, largely overlooked, will break even in 1Q23E. We now believe SE will generate EBITDA of $1.1bn/$4.1bn by FY23/25E," Vittayaamnuaykoon said.

A total of 6 analysts have looked at this company recently, with 5 analysts rating this company as a potential buy and 1 analyst rating this company as a good one to hold, that is, if you already own the company.

The 6 analysts who have recently looked at the company agree on an average target price of $88. However, they give a high price target of $132, which would imply an upside of roughly 80%.

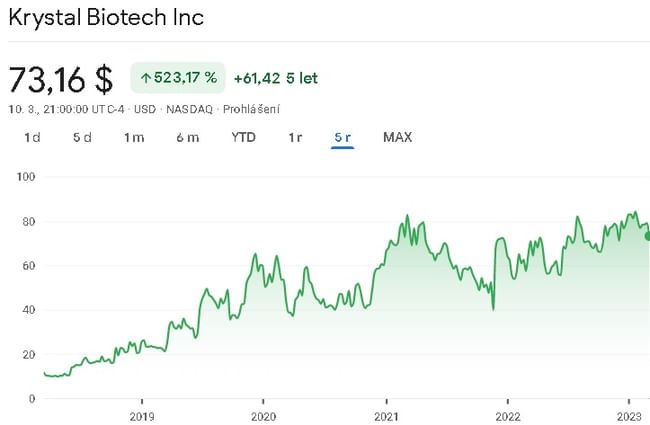

Krystal Biotech $KRYS

Krystal Biotech is a clinical-stage biotechnology company focused on developing gene therapies to treat rare and debilitating skin diseases. The company's lead product candidate, KB103, is a gene therapy for the treatment of dystrophic epidermolysis bullosa (DEB), a rare genetic skin disorder that causes painful blistering and skin erosion. Krystal Biotech's technology uses a proprietary platform called Skin TARgeted Delivery (STAR-D) to deliver the gene therapy directly to the affected area of the skin. Krystal Biotech was founded in 2015 and is based in Pittsburgh, Pennsylvania. The company completed its initial public offering (IPO) in August 2018.

The company's lead drug candidate, B-VEC (branded as Vyjuvek), was the subject of a recent Phase 3 study in the treatment of DEB. This is a rare, often fatal, blistering skin condition caused by a deficiency of a specific collagen protein. The drug candidate, B-VEC, targets the treatment of both recessive and dominant forms of this genetic disease. Last December, the company announced positive results from a Phase 3 clinical trial and has since received notification from the FDA that the PDUFA date for the Biologics License Application, a key step in the regulatory approval of the new drug, is set for May 19, 2023.

The Company has two other candidates. The second candidate is currently in Phase 2 clinical trials, and Phase 1 clinical trials are expected to commence for the 3rd candidate in the first half of 2023.

Strengths:

- Proprietary Technology: Krystal Biotech's STAR-D platform represents a unique approach to delivering gene therapy directly to the skin that could provide a competitive advantage over other gene therapy approaches.

- Rare Disease Focus: By targeting rare diseases such as DEB, Krystal Biotech is addressing an underserved market with high unmet medical needs.

Weaknesses:

- Clinical Phase: Krystal Biotech is a clinical-stage company, meaning its products are still in development and not yet approved for commercial use. There is no guarantee that these products will be successful in clinical trials or that they will gain regulatory approval.

- Dependence on Partnerships: Krystal Biotech has entered into partnerships with other companies to develop and commercialize its products, which means that its success is partially dependent on the success of these partnerships.

I personally do not invest in companies that are in the clinical stage. There is too much risk for me. Judging by analyst comments, I judge that this stock is essentially a bet on its lead product, which is said to be approved soon. But as I say, it's still a bet.

On the other hand, Goldman Sachs analyst Madhu Kumar is very positive on this stock.

The 5/19 PDUFA for Vyjuvek for dystrophic epidermolysis bullosa (DEB) remains a key NT event for KRYS shareholders. Our 90% POS and investor interviews suggest potential approval and discussions around Vyjuvek are now primarily focused on the launch.

A total of 6 analysts recently looked at the company, and all 6 rated the company as a potential buy candidate.

The 6 analysts that have recently looked at the company agree on an average target price of $114. Again, the higher price target here is $133, which would represent an 82% increase.

WARNING: I am not a financial advisor, and this material does not serve as a financial or investment recommendation. The content of this material is purely informational.