Analysis: These 3 banks are in danger due to the current market carnage. Will they make it?

SVB started it. She took several other banks with her in no time. Now Credit Suisse is fighting for survival. But there are plenty of others that might not make it through the biggest crash since 2008. Where do they stand?

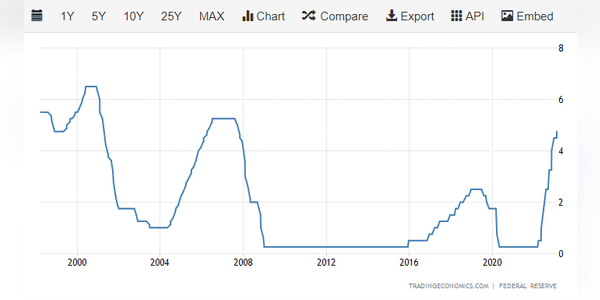

Silicon Valley Bank was ill-prepared for rising interest rates. Other banks are showing similar warning signs. As interest rates have risen, many banks have become more profitable because the gap between what they earn on loans and investments and what they pay for funding has widened. However, there are always exceptions.

SVB Financial Group (SIVB) sold $21 billion of securities on March 8 at a loss of $1.8 billion. SVB said on March 9 that it was repositioning to "increase asset sensitivity, take advantage of the potential of higher short-term rates, partially lock in funding costs, better protect net interest income and net interest margin, and improve profitability…