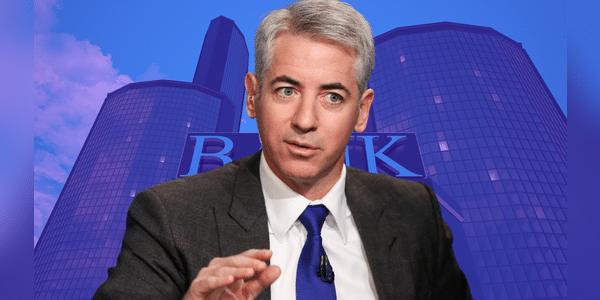

Fed's actions in bailing out banks will have catastrophic consequences, warns Bill Ackman

It seems to be succeeding in extinguishing the fire in the banking sector (although we can argue about the form). However, a well-known financier thinks that it is not about extinguishing, but rather about adding fuel to the fire. Why does he think these moves will set off an even bigger disaster?

Bill Ackman warned that Wall Street's bailout of First Republic threatens other banks, the financial system and the U.S. economy. JPMorgan $JPM, Bank of America $BAC and nine other banks announced Thursday that they will inject a total of $30 billion in uninsured deposits into First Republic Bank $FRBA for at least 120 days.

Ackman warned that if FRBA is hit by a tidal wave of withdrawals and fails to repay its debts, Wall Street banks will be at risk and will also suffer losses. The billionaire investor and head of Pershing Square argued that the big banks' show of confidence does not address the underlying problem - a lack of confidence in the banking system.

http…