You may have noticed yesterday that there was a lot of talk about AT1 bonds and the associated losses in many companies. So in this article we'll look at AT1 Bonds - what they actually mean, what the risks are, and why Credit Suisse is tarnishing their reputation.

What are AT1 bonds?

AT1 bonds are hybrid bonds that are issued by banks and financial institutions. AT1 stands for "Additional Tier 1" and this category of bonds is part of the Basel III banking regulations. These bonds are considered the riskiest of the hybrid bonds because they are designed to protect bank capital in the event of financial problems.

AT1 bonds have several specific features. The first is that they have a fixed interest rate that is higher than the interest rates of conventional bonds, reflecting the higher risk associated with these bonds. The second characteristic is that they have an unlimited duration, which means that they do not mature like regular bonds. This means that a bank can only redeem AT1 bonds if it meets certain conditions set by the issuer or if it decides to issue new bonds for refinancing.

Another specific feature of AT1 bonds is that they have a so-called "trigger" clause. This means that if the bank capital falls below a certain threshold, the AT1 bonds can be automatically converted into shares or can be cancelled = deleted.

Where is the problem at this point and why $CS may have permanently damaged demand for AT1?

"The extraordinary government support will trigger a full amortisation of the nominal value of all AT1s from Credit Suisse of about 16 billion [Swiss francs]," the Swiss financial market watchdog said.

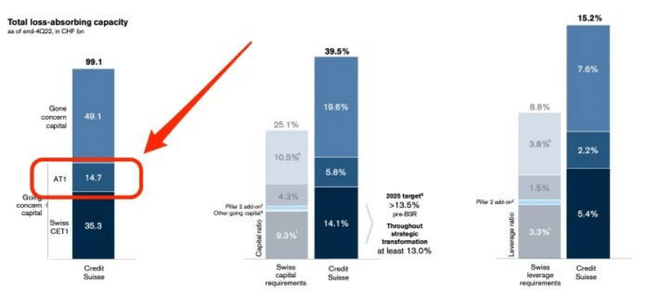

Credit Suisse has indeed issued a lot of AT1 bonds in the past decade. Here's a presentation Credit Suisse gave to investors last week, when it was trying to save itself, which said that at the end of 2022, Credit Suisse had about 14.7 billion Swiss francs worth of outstanding AT1 bonds.

🚨🚨🚨

Lawyers from Switzerland, the United States and the United Kingdom are talking to a number of Credit Suisse Additional Tier 1 (AT1) bondholders about possible legal action after the state-backed bailout of Credit Suisse by UBS wiped out all AT1 bonds.

Under the UBS-Credit Suisse merger agreement, Credit Suisse AT1 bondholders will get nothing, while shareholders, who usually rank below bondholders in terms of who gets paid when a bank or company collapses, will receive $3.23 billion.

🚨🚨🚨

Funds managed by Lazard, Freres Gestion, PIMCO and GAM Investments were among the most exposed to Credit Suisse AT1 at the end of February.

PIMCO has also been vocal about these bonds. In fact, PIMCO lost $340 million with the write-down of Credit Suisse AT1 bonds, not an entirely insignificant amount.

But this whole situation doesn't just cast a bad light on Credit Suisse and AT1 holders 👇

AT1 bonds issued by other European banks fell sharply on Monday as Credit Suisse's treatment of AT1 bondholders highlighted the risks of investing in this type of bond.

This is seen by many as a major problem going forward that will permanently affect demand for this type of bond.

Please note that this is not financial advice.