Analysis of Textron, an interesting player focusing on almost all types of aircraft

Are you interested in weapons, military equipment or even drones? If so, I have an interesting stock tip for you in the form of Textron $TXT, which we'll take a look at today.

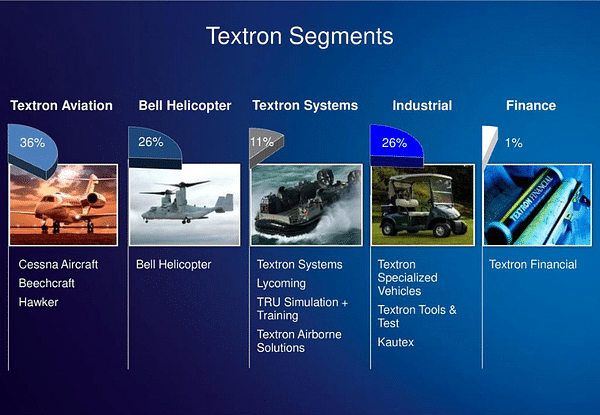

Textron is an American multinational conglomerate company that manufactures and sells a wide range of products and services in a variety of industries, including aerospace, defense, weapons, automotive, and environmental.

In the aerospace and defense industry, Textron manufactures aircraft, helicopters, drones, air traffic control systems, and other equipment and services for the military and civilian markets. Brands include Beechcraft, Cessna, Bell Helicopter and Textron Systems.

In the weapons industry, Textron manufactures bullets, ammunition and other armaments for military and civilian markets. In the automotive industry, Textron manufactures and sells the Arctic Cat car brand and also manufactures and sells automotive components.

In the environmental sector, Textron is involved in manufacturing technologies to reduce emissions and address other environmental issues.

Textron also manufactures unmanned aerial vehicles, which are known as drones. Some of Textron Systems' main products include the Shadow Series, Aerosonde Series, and Scorpion Series drones. These drones are designed for military purposes and can be used for reconnaissance, surveillance, intelligence gathering, and other tasks. Textron also offers unmanned helicopters for a variety of purposes, such as helicopters for emergency responders or for oilfield and pipeline exploration.

Aerospace: The company manufactures airplanes, helicopters, and other aviation equipment. Well-known products include Beechcraft King Air, Cessna Citation and Bell Helicopter.

Defence and Security: The company manufactures military vehicles, weapons and other equipment for the military and security forces.

Industrial Manufacturing: The company manufactures machinery and equipment for industrial manufacturing, such as agricultural equipment.

Financial Services: Textron provides financial services such as leasing and financing for the purchase of aircraft, helicopters and other equipment.

Where does the company operate?

Argentina, Australia, Belgium, Brazil, Canada, Colombia, China, Denmark, Egypt, Finland, France, Germany, Hong Kong, India, Indonesia, Ireland, Italy, Japan, Japan, South Africa, South Korea, Kuwait, Lebanon, Malaysia, Mexico, Philippines, South Korea, Mexico, Austria, Netherlands, Norway, New Zealand, Oman, Peru, Poland, Portugal, Russia, Saudi Arabia, Singapore, Slovakia, Slovenia, United Arab Emirates, United Kingdom, Spain, Sweden, Switzerland, Taiwan, Thailand, Turkey, Ukraine, Uruguay, United States, Venezuela.

Finance

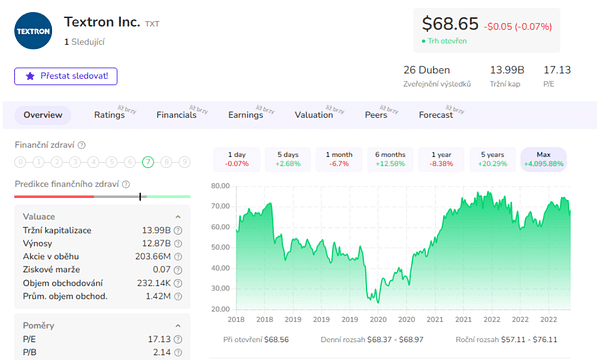

Sales: in the last 12 months Textron reported total sales of $12.87 billion, here we see the last years growth where in 2020 sales were $11.6 billion.

Operating Profit: Textron's operating profit in 2022 was $883 million, an increase of 2.2% over the previous year ($864 million).

Net Profit: Textron's net profit in 2022 was $861 million, an increase of 15.6% compared to the previous year ($746 million).

Earnings per share: Earnings per share was the highest in 2021 at $4.05 per share. In 2020, it was $3.33 per share.

Overall, Textron has seen growth in all areas in recent months and years. Operating costs have increased slightly, but the company has been able to improve its operating profit.

Balance Sheet

Total Assets: Textron's total assets as of December 30, 2022 were $16.29 billion. This represents an increase of 3.0% compared to the previous year ($15.83 billion).

Total liabilities: Textron reported total liabilities of $9.18 billion in 2022, an increase of 1.9% compared to the prior year ($9.01 billion).

Total capital: Textron's total capital as of December 30, 2022 was $10.66 billion, an increase of 1.4% compared to the prior year ($10.58 billion).

Shareholders' equity: Textron's shareholders' equity as of December 30, 2022 was $7.11 billion, an increase of 4.4% compared to the prior year ($6.82 billion).

Total Debt: Textron's total debt as of December 30, 2022 was $3.56 billion, a decrease of 5.5% compared to the prior year ($3.77 billion).

Overall, Textron has seen an increase in its assets and equity but a decrease in working capital over the past 12 months. The company has reduced total debt and net debt, which bodes well for the company's financial stability.

Cash Flow

Operating cash flow: Textron reported operating cash flow of $1.49 billion in the past 12 months. This is an increase of 46.3% compared to the prior year ($1.01 billion).

Investing cash flow: In 2022, Textron reported investing cash flow of -$447 million. This is an improvement of 37.4% compared to the previous year (-$266 million).

Financial cash flow: In 2022, Textron reported financial cash flow of USD -1.09 billion. This is a decrease of 52.2% compared to the previous year (-$502 million).

Free cash flow: Textron reported free cash flow of $1.13 billion in 2022, an increase of 67.6% compared to the previous year ($675 million).

Capital Expenditures: Textron's total capital expenditures in 2022 were -$354 million, a decrease of 4.1% compared to the prior year (-$339 million).

Share Repurchases: Textron repurchased $867 million of stock in the past 12 months, a decrease from the prior year ($503 million).

Overall, Textron has seen an improvement in its operating and investing cash flow but a deterioration in its financial cash flow over the past 12 months. Free cash flow improved mainly due to lower capital expenditures and higher operating cash flow.

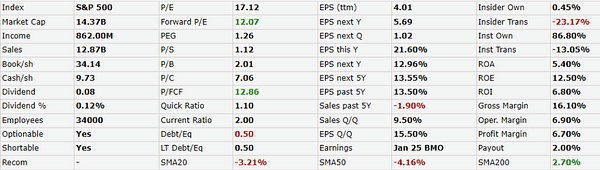

Textron'sP/E is 17.12. The company's forward P/E is 12.07, this could indicate that investors expect the company's profitability to grow in the future.

Textron'sPEG ratio is 1.26. This implies that the stock is slightly expensive given the company's profitability growth.

Textron'sP/B ratio is 2.01. This means that the stock is trading at a slightly higher price than the value of its assets.

Textron'sP/S ratio is 1.12. This means that the stock is trading at a slightly higher price than the value of its market share.

Overall, Textron's stock is relatively expensive compared to its profitability and the value of its assets and market share, and even compared to its competitors. However, the forward P/E and expected growth in profitability suggest that investors expect future growth for the company. But I don't like the low returns and the level of net margins - the company is interesting with its products, but I wasn't really impressed with the numbers.

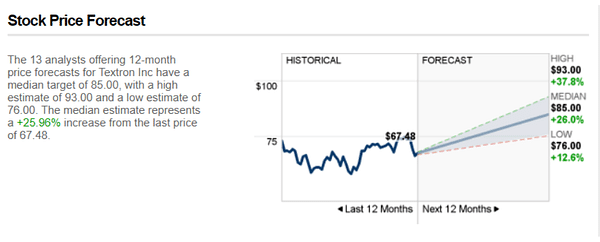

Analyst expectations

The 13 analysts offering 12-month price forecasts for Textron Inc have a median target of 85.00, with a high estimate of 93.00 and a low estimate of 76.00. The median estimate represents a +25.96% increase from the last price of 67.48.

- How do you like the company? 🤔

Please note that this is not financial advice. Every investment must go through a thorough analysis.