Analysis of the fifth-largest US airline, which experts predict will deliver decent EPS growth

Alaska Air Group, the fifth-largest airline in the U.S., is struggling to recover from the pandemic and looks to be a flexible, quality airline with a well-developed network of destinations. Although the company had a challenging 2020, it is expected to see significant growth in net income and EPS next year. Is this a good time to invest?

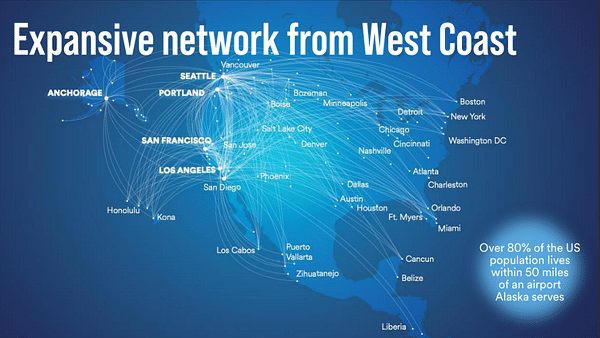

Alaska Air Group is an airline holding company. It includes Alaska Airlines, Horizon Air, and McGee Air Services. Alaska Airlines is the fifth largest airline in the U.S. and operates flights to more than 115 destinations in the U.S., Canada, Mexico and Costa Rica. Horizon Air operates regional flights in the Pacific Northwest and McGee Air Services provides ground services for Alaska Airlines and other airlines. Alaska Air Group is also a member of the Oneworld airline alliance.

Major markets are the US, Canada and Mexico 👇

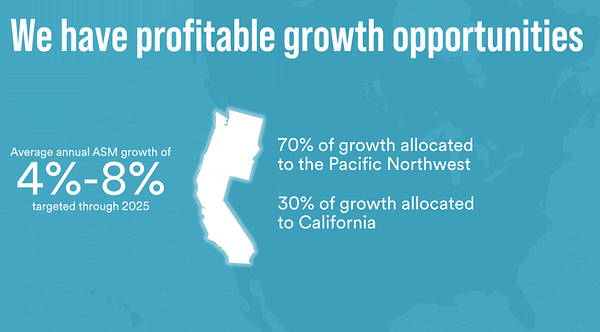

According to last quarter's report, the company believes it has room to continue to grow 👇

Competitive advantages

Destination Network: Alaska Airlines has a developed network of destinations that include both major airports and smaller regional airports. This sets it apart from competing airlines that focus primarily on major airports.

Service quality: Alaska Airlines is known for its high standards of service quality, such as comfortable seats, quality food and drink and excellent customer support.

Flexibility: Alaska Airlines tries to be very flexible when it comes to flight schedule and fare changes. This includes the ability to change flights without a fee, the ability to choose your seat in advance, and the ability to change fares without a fee.

Frequent Flyer Program: Alaska Airlines has a very popular frequent flyer program that allows customers to earn points for ticket purchases and other services. These points can then be used for additional ticket purchases or other benefits.

Safety: Alaska Airlines has high safety standards and is regularly rated as one of the safest airlines in the US. This can be an important factor for customers who want to travel safely and without worry.

Finance

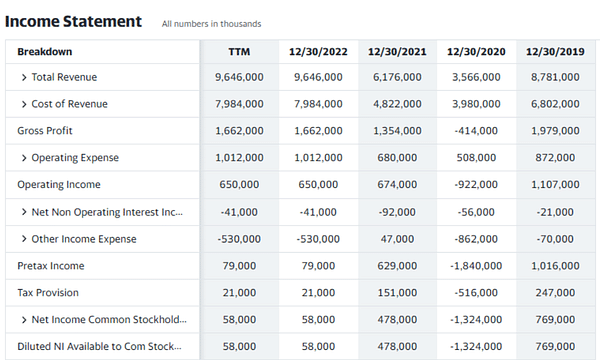

As you can see, 2020 was a fairly critical year for the company as the reverberations of the pandemic significantly reduced revenues and profits. However, the company has since managed to pick itself up and is once again riding its growth line.

Overall, all indications are that the company is generating decent revenue and controlling its costs well. However, it is not generating a significant amount of profit after all costs, including taxes and interest expense, which I don't like very much.

If we look at the Balance Sheet, we see that the company's total assets have increased to $14.2 billion in the last year. The majority of the company's assets are in real estate, factories and equipment, representing over $6 billion in total assets.

The company's total liabilities have also increased, reaching $10.4 billion in the last year. The largest liability is long-term debt, which is $3.8 billion, with net debt of $1.8 billion - The company has been working to reduce debt in recent years, and they've been doing that, too.

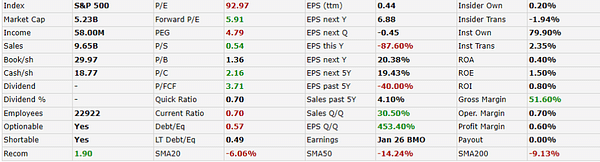

Yes, the P/E ratio is definitely scary, but you also need to look at the forward P/E and expectations going into next year, where the company is looking at a bigger boost to earnings and revenue growth.

The company has had a tough year, and specifically the last one was with an 87.6% drop in EPS. However, the company is expected to record EPS growth of 20.38% next year and 19.43% over the next five years.

The price to book value ratio of the company is 1.36, indicating that the stock is currently trading at a reasonable price relative to its book value. The company has a relatively low debt-to-equity ratio of 0.57, which suggests that the company has a manageable amount of debt, but it is a higher average than can be found among their competitors.

What I really don't like though is looking at the margins and returns (ROA, ROE and ROI), I haven't seen figures this low perhaps and a closer look at the company and why this is the case is definitely needed.

So from my side, the $40 price tag doesn't look all that bad, but I don't like the performance of recent years and the poor margins. However, the company as a whole has a lot to offer and I probably wouldn't be afraid to give them a chance and explore them further.

Analyst Predictions

The 13 analysts offering 12-month price forecasts for Alaska Air Group Inc have a median target of 62.00, with a high estimate of 91.00 and a low estimate of 58.50. The median estimate represents an increase of +52.60% from the last price of 40.63.

- How do you like the company? 🤔

Please note that this is not financial advice. Every investment must go through a thorough analysis.