The Fed is endangering the economy by not prioritizing bank stability, said Mark Zandi of Moody's. He said the Fed's 25-basis-point rate hike has contributed to tighter credit conditions at banks, so the debt crisis will come much sooner.

The Fed is not prioritizing the stability of the U.S. banking system - and that's putting the economy at risk, says Moody's chief economist Mark Zandi.

In an interview last Thursday, he estimated that the tighter credit conditions since the collapse of Silicon Valley Bank equate to two or three 25 basis point interest rate hikes. In addition, central bankers raised benchmark rates by another 25 basis points at their meeting.

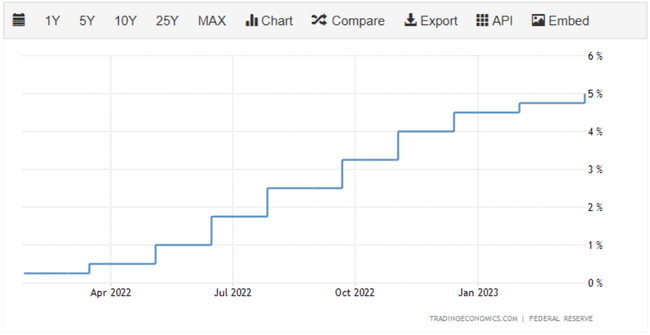

The Fed raised rates another 25 points to 4.75%-5% in March 2023, pushing borrowing costs to new highs (the most since 2007) as inflation remains high. The decision came in line with most investors' expectations, though some believed the central bank should pause the tightening cycle to bolster financial stability.

"This moves the target for the federal funds rate closer to 6%. I think that's a pretty significant increase in interest rates and I think it puts the economy at risk," Zandi warned.

The Fed funds rate is now officially targeted at 4.75-5% after central bankers already raised rates by 1,700% last year to control inflation.

But that caused massive losses in banks' bond portfolios, triggering the collapse of SVBs and putting other regional banks under pressure from depositors seeking safety with larger banks.

Market commentators such as Paul Krugman and Bill Ackman have urged the Fed to suspend or withdraw its rate hike regime altogether as concerns about the banking system have escalated.

Zandi also believes Fed officials should have paused rates at their last meeting to examine the full impact of the banking crisis on the economy.

"The first priority has to be the stability of the banking system, and obviously they didn't do that, and I think they are taking the risk of a crisis and a debt crisis here," he said.

(252) Fed should pause here, says economist Mark Zandi - YouTube

Please note that this is not financial advice.