Don't know what to buy now? Here are 3 favourites from Morgan Stanley.

Today we follow up on yesterday's article where I discussed the possible end of the bear market that Mike Wilson sees. So today we're going to look at 3 stocks that are favorites at Morgan Stanley.

Morgan Stanley's US Equity Strategy team, led by Mike Wilson, stresses the importance of taking a long-term view on investing in stocks as they expect a more favorable earnings environment in the coming year. This improved outlook is attributed to factors such as monetary policy accommodation, receding inflation, unmet demand and a rebound in global economic growth. In light of these developments, Wilson's team has compiled a list called the "30 for 2025," which includes stocks with resilient business models and the potential to expand their competitive advantage. In this article, we dive into three highlighted stocks - Blackstone Group $BX, Northrop Grumman $NOC, and Eli Lilly & Co $LLY.

Blackstone Group $BX

Blackstone Group, founded in 1985 by Stephen A. Schwarzman and Peter G. Peterson, has grown into the world's largest alternative asset manager with an impressive $975 billion in assets under management (AUM). The company's primary investment focus is in private equity, real estate, credit and hedge fund solutions with a diverse range of investors, including pension funds, insurance companies, endowments and sovereign wealth funds.

The fourth quarter report highlights the company's ability to attract significant capital with a remarkable $43.1 billion in fund inflows. This capital inflow enabled the company to expand AUM by 11% to $975 billion. In addition, Blackstone's fee-related revenue grew 9% to $4.4 billion, while its distributable revenue grew 7% to $6.6 billion.

Blackstone's strong performance can be attributed to its robust investment strategy and diverse portfolio, which includes investments in sectors such as technology, healthcare, industrial and consumer goods. The firm is known for its expertise in identifying undervalued assets, investing in them and unlocking their true potential through strategic management and operational improvements. Blackstone's success in these efforts has delivered consistent returns to its investors.

Investors are attracted to Blackstone Group's stock because of its 5.3% dividend yield, which provides a steady stream of income.

Morgan Stanley analyst Michael Cyprys assigned an Overweight rating to the company, indicating a positive outlook on its future performance. He set a target price of $115 for Blackstone, suggesting a potential 35% upside over the next 12 months.

Blackstone's position as the world's largest alternative asset manager, combined with its proven investment strategies and strong financial performance, make it an attractive long-term investment option. As the global economy continues to recover and more investors seek alternative investment opportunities, Blackstone Group is well positioned to benefit from this trend and extend its competitive advantage.

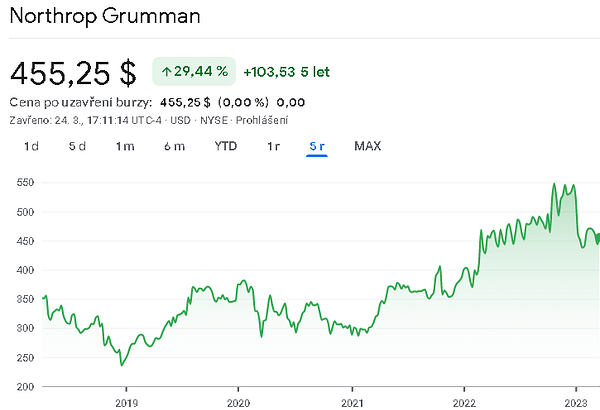

Northrop Grumman $NOC

Northrop Grumman, founded in 1994 through the merger of Northrop Corporation and Grumman Corporation, has become one of the largest and most respected aerospace and defense companies in the world. With a market capitalization of $69 billion, the company provides leading-edge products and services to government and commercial clients covering a wide range of industries including aerospace, space, cybersecurity and advanced technology.

The company's Q4 report shows strong financial performance with 16.6% year-over-year (YoY) revenue growth to $10.03 billion, as well as a 25% increase in adjusted earnings to $7.50. These positive results can be attributed to Northrop Grumman's diverse product portfolio and its focus on innovation, as well as continued demand for its services from government and commercial clients.

Northrop Grumman operates through four main business segments:

Aeronautics Systems: this segment focuses on the design, development, manufacture and support of manned and unmanned aircraft, spacecraft and high-energy laser systems. Some notable programs include the B-21 Raider, RQ-4 Global Hawk, and MQ-4C Triton.

Defense Systems: This division offers a wide range of products and services such as missile defense systems, military vehicles, and logistics support. Key programs include the Integrated Air and Missile Defense Battle Command System (IBCS) and Ground/Air Task-Oriented Radar (G/ATOR).

Mission Systems: This segment provides advanced capabilities in areas such as command and control, communications, intelligence, and surveillance. Notable programs include the Advanced Technology Microwave Sounder (ATMS) and the Joint Tactical Ground Station (JTAGS).

Space Systems: This business unit focuses on space exploration, satellite technology, and strategic missile systems. Prominent programs include the James Webb Space Telescope, the Orion spacecraft, and the Ground Based Strategic Deterrent (GBSD).

Kristine Liwag, an analyst at Morgan Stanley, assigned Northrop Grumman an Overweight rating, indicating her confidence in the company's future growth potential. Liwag has set a $601 price target for the company, indicating a potential upside of 36% over the next 12 months.

In conclusion, Northrop Grumman's solid financial performance, diverse business segments and commitment to innovation make it an attractive long-term investment option. As global demand for advanced aerospace, defense and security solutions continues to grow, the company is well positioned to capitalize on these trends and maintain its competitive advantage in this sector.

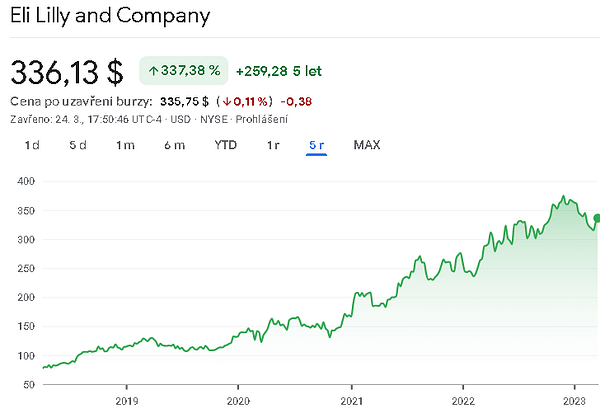

Eli Lilly & Co $LLY

Eli Lilly, founded in 1876 by Colonel Eli Lilly, has evolved into a multinational pharmaceutical company with a market capitalization of nearly $315 billion. The company is dedicated to discovering, developing, manufacturing and marketing innovative medicines that address unmet medical needs around the world. Eli Lilly's primary therapeutic areas include diabetes, oncology, immunology, neuroscience and cardiovascular disease.

Despite the company's fourth-quarter report showing a 9% year-over-year (YoY) decline in revenue to $7.3 billion, its adjusted earnings per share (EPS) of $2.09 was well ahead of the projected $0.85. This above-average performance can be attributed to the company's strong product portfolio and its strategic investments in research and development (R&D).

Eli Lilly's innovative product pipeline includes several successful drugs, such as Trulicity (for diabetes), Verzenio (for breast cancer), Taltz (for psoriasis and related conditions) and Emgality (for migraine prevention). The company's robust R&D pipeline represents potential therapies targeting a variety of diseases, including Alzheimer's disease, Parkinson's disease and cancer.

Collaborations and partnerships are a critical part of Eli Lilly's business strategy. The company has formed strategic alliances with many biotechnology companies, academic institutions and research organizations to develop and commercialize new therapies. These collaborations have given Eli Lilly access to cutting-edge research and technology, which has accelerated the development of breakthrough therapies.

Morgan Stanley analyst Terence Flynn gave Eli Lilly an Overweight rating, reflecting his optimism about the company's future growth potential. Flynn set a price target of $444 for Eli Lilly, suggesting 33% growth over the next 12 months.

In short, Eli Lilly's resilience in the face of declining revenue, combined with its strong product portfolio, research and development, and strategic collaborations position the company as an attractive long-term investment opportunity. As global demand for innovative therapies continues to grow and the company develops its pipeline, Eli Lilly is well equipped to capitalize on these trends and maintain its competitive advantage in the pharmaceutical industry.

Conclusion:

Morgan Stanley's long-term view of equity investing highlights the potential rewards for investors who adopt a patient and prudent approach. The "30 for 2025" list, which includes Blackstone Group, Northrop Grumman, and Eli Lilly, includes companies with sustainable business models that are well positioned to take advantage of favorable market conditions and expand their competitive advantage.

With accommodative monetary policy, easing inflation, pent-up demand and a recovery in global economic growth on the horizon, these companies are poised to offer investors significant returns over the next few years. While short-term market fluctuations can be unpredictable, Morgan Stanley's recommendations underscore the value of a long-term investment strategy that focuses on companies with strong fundamentals and promising growth potential.

WARNING: I am not a financial advisor, and this material does not serve as a financial or investment recommendation. The content of this material is purely informational.