Today, we'll take a look at the top picks from JPMorgan analysts, who say they see the most upside potential for these two stocks in 2023. Specifically, these are stocks in the energy and biopharmaceutical sectors, so these could be two interesting picks in terms of risk:reward.

Two stocks recently earned "Top Pick" designations from analysts at banking giant J.P. Morgan. Using a combination of market data, company news and analyst commentary, we can get a sense of what makes these stocks compelling picks for 2023.

Could they be a good choice for us? We'll take a look 👇

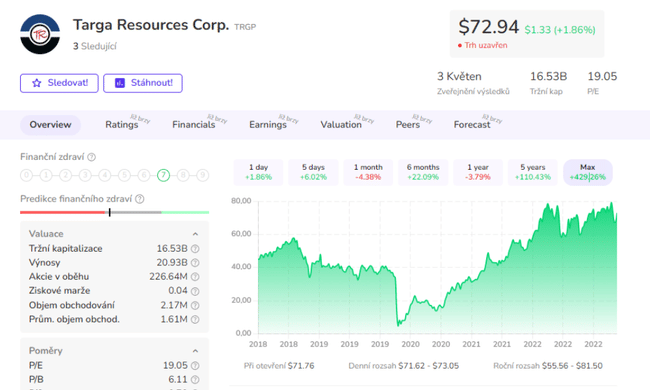

Targa Resources Corporation $TRGP

Let's start in the energy industry with Targa Resources. This is a midstream company that operates in the area between wellheads and end customers. Midstream companies control networks of pipelines and infrastructure facilities and transport hydrocarbon products to where they are needed.

In short, Targa Resources is an American company that collects, processes, stores, transports and sells liquefied natural gas, petroleum products and other liquid hydrocarbons.

Targa is one of the largest independent midstream operators in North America, focused on the transportation of natural gas and natural gas liquids; its network of assets is centered around the prolific producing areas of Texas, New Mexico, Oklahoma and the Gulf Coast of Louisiana.

Targa is relatively insulated from the cost of natural gas and oil in commodity markets because it transports products through its network on a "toll road" model; that is, producers pay by contract to move specified amounts through the system. This model enabled Targa to achieve increased earnings and cash flow in the recently announced 4Q22, despite a year-on-year decline in revenue.

All of this combined caught the attention of JPMorgan analyst Jeremy Tonet, who writes: "We continue to believe that the favorable Permian footprint and TRGP franchise create a favorable risk-reward proposition. With a fully integrated Permian NGL value chain, we see TRGP as a differentiated growth story versus all competitors... We reaffirm TRGP as the best choice given Permian's integrated wellhead to export value chain, NGL operating leverage, direct commodity price appreciation, deleveraging visibility and enhanced shareholder returns."

Tonet not only lays out an optimistic path for the stock, but also gives it an Overweight (i.e. Buy) rating along with a $119 price target that implies one-year upside potential of 76%.

The company is also focused on rewarding shareholders in the form of a dividend, which is at 1.96%, and share buybacks. What I don't like, however, is the relatively high debt and negative investment cash flow.

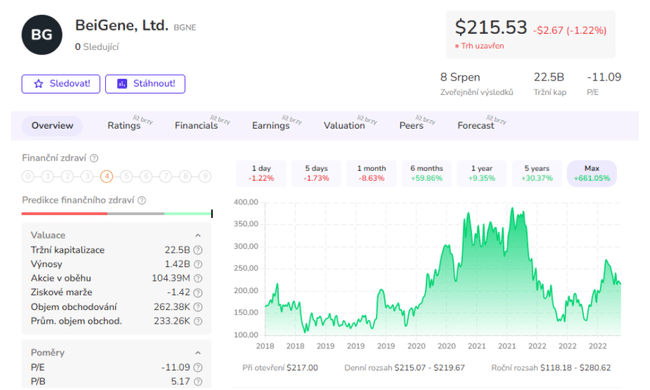

BeiGene, LLC $BGNE

JPM's next best pick is BeiGene, a clinical-stage biopharmaceutical company as well as a commercialization-stage company. BeiGene, LLC is a biotechnology company that focuses on the research, development and commercialization of new drugs for the treatment of cancer and other diseases. The company focuses on the discovery and development of drugs that target specific molecular targets in cells, allowing it to treat patients with cancer and other diseases more effectively and with fewer side effects. The company currently has more than 60 clinical programs targeting approximately 80% of cancers, giving it a tremendous advantage in scale compared to peers.

A key factor for investors in this stock is that it has already succeeded in getting new drugs into circulation. BeiGene has three drugs - all for the treatment of cancer - approved for use and is working to expand sales.

The approved drugs are tislelizumab, branded under its own name, zanubrutinib, branded as Brukinsa, and pamiparib, branded as Partruvix; BeiGene describes the first two as its "cornerstones." All three are approved in multiple jurisdictions and are used in the treatment of various cancers and hematological cancers.

According to the numbers, BeiGene realized $102.2 million in revenue from tislelizumab in 4Q22 and $564.7 million from the drug for the full year 2022. These results were up 72% and 97% from 2022 figures. The second "cornerstone," Brukinsa, saw revenue of $176.1 million for 4Q22 and $564.7 million for the full year; these numbers represented year-over-year growth of 101% and 159%, respectively.

BeiGene's total top line in 2022 was $1.4 billion, compared to $1.2 billion in 2021. Total revenue for 2022 included product sales of $1.3 billion, up 97.9% from the previous year.

In covering the stock, JPMorgan analyst Xiling Chen focused on the company's sales achievements and prospects.

"We expect sales momentum in the U.S. to accelerate further in 2023 on the back of the CLL/SLL launches. In this vein, we slightly raise our near- and long-term U.S. sales estimates for Brukins. We currently expect the product to reach sales of US$1bn this year and peak at ~US$4bn in 2032. This is slightly below consensus and we see additional room for growth associated with the commercial performance of the BeiGene team, as well as further indicative expansion," Xiling wrote.

"We continue to emphasize BeiGene as our current top pick with strong Brookings CLL/SLL momentum in the U.S. creating potential sales beats over the next few quarters," the analyst summarized.

These comments support Chen's Overweight (i.e. Buy) rating on the stock, while the $297 price target implies a one-year gain of ~35%.

- How do you like the company? 🤔

Please note that this is not financial advice.