A strong brand, a large number of products and a stable sector? This is Clorox Co, manufacturer and seller of cleaning products. What does the company look like now and how has it dealt with the pandemic? We'll break that down below.

Clorox Co is an American company that specializes in the manufacture and sale of consumer chemicals and products for household and industry. Some of its best-known brands include Clorox, Pine-Sol, Liquid-Plumr, Glad, Brita and Burt's Bees. The company focuses on manufacturing cleaning, household, hygiene and personal care products.

Clorox Co offers a wide range of products, its main products include:

Clorox - disinfectants, detergents, washing powders, kitchen and toiletries.

Pine-Sol- cleaners for floors, walls and other surfaces.

Glad - garbage bags, garbage containers.

Burt's Bees - natural cosmetics and skin care products.

Brita - filtering water pitchers and other water filtration products.

Liquid-Plumr- drain and sewer cleaners.

Competitive advantages

Strong brands: the Company has strong brands such as Clorox, Pine-Sol and Burt's Bees that are well known and respected by customers. This enables it to compete in the marketplace with a high level of credibility and brand awareness.

Innovation. This differentiates it from its competitors and enables it to keep up with changing trends and consumer needs.

The company offersa wide range of cleaning, hygiene and personal care products. K

Finance

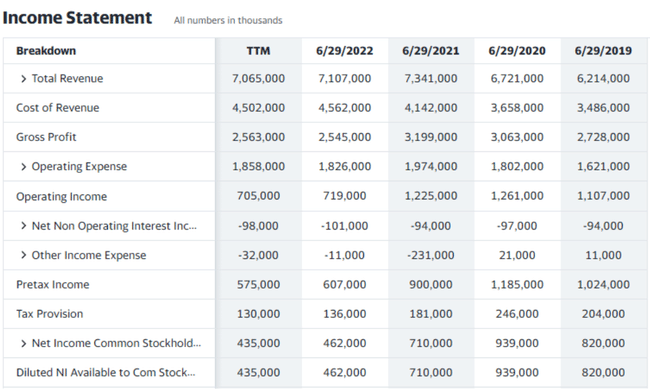

In terms of revenue , we see a slight decline from 2021 to 2022. This decline may be due to lower demand for some products due to the pandemic, at least that's all the info I've tracked on this.

Thecost of production (Cost of Revenue) is increasing slightly, while the cost of operations is fluctuating slightly, but staying within such a medium term average for the company (no big growth or decline).

Clorox Co'soperating profit was $705 million in the latest period, down slightly from the previous year. This decrease can be attributed to an increase in operating expenses and lower sales. Overall, however, we see a downward trend here from 2020, which I don't like.

Clorox Co'snet profit in the latest period was $435 million, a slight decrease from the previous year. Again, this is negative news in my opinion, no one wants to see a series of declines in operating and net profit.

Overall, Clorox Co has had a stable financial performance with slight fluctuations in sales and profits in recent years. Gross profit increased slightly while net profit and earnings per share decreased slightly.

Balance Sheet

Clorox Co's total assets in the latest year were $6.158 billion, a slight decrease from the previous year, while total liabilities in the latest year were $5.429 billion, also a slight decrease from the previous year.

Clorox Co's total capital in the latest period stood at $3.030 billion, a slight increase from the previous year. This increase can be attributed to an increase in bond issuance.

The equity of Clorox Co in the last year reached a value of $729 million, a slight increase from the previous year. This increase may be due to the profit in the previous period and the issue of new shares.

Clorox's total debt in the latest period reached $3.103 billion, a slight increase from the previous year.

Overall, Clorox Co has a stable financial position with slight fluctuations in total assets, liabilities and capital. The company's shareholders' equity and total capital increased slightly, while total debt also increased slightly. Working capital was negative, which may indicate potential liquidity issues.

In terms of cash flow, overall, Clorox has stable cash flow with slight fluctuations in operating, investing and financing cash flow. The ending cash position has declined slightly, which may indicate that the company has potential liquidity issues. Interest payments were unchanged while capital expenditures declined. Debt issuance declined slightly, which may indicate a reduced need to finance investments.

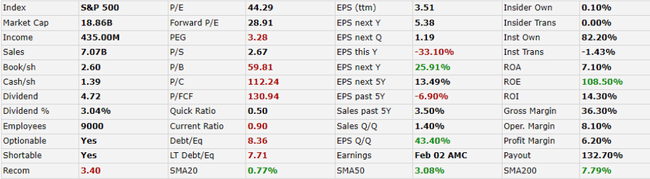

The company's market capitalization stands at $18.86 billion. The company's P/E ratio is 44.29, which means that the share price is quite high, even compared to its competitors. The company's PEG ratio is 3.28, indicating that the share price is overpriced compared to the company's growth potential. The company's P/S ratio is 2.67, which is above the sector average. The ROA of the company is 7.10% and the ROE of the company is high 108.50%. The company's dividend yield is 3.04%, which is not bad.

Overall, the company's market capitalization and earnings are quite high. The P/E ratio and PEG ratio suggest that the stock price is overvalued. The ROE of the company is high, which means that the company can use its capital efficiently. The dividend yield is attractive. The recommendation for this company is slightly negative. Overall, the company has good financial performance but the share price is overpriced.

What do analysts expect?

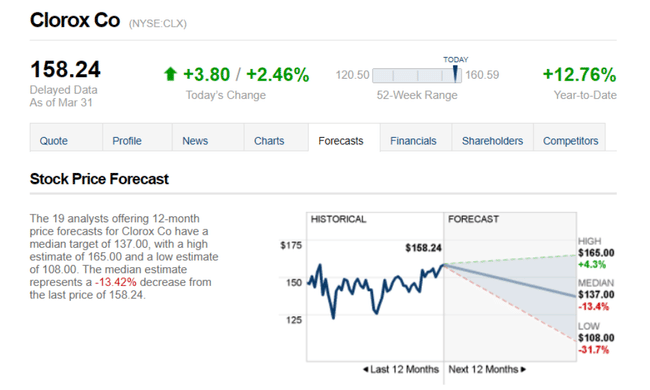

The 19 analysts offering 12-month price forecasts for Clorox Co have a median target of 137.00, with a high estimate of 165.00 and a low estimate of 108.00. The median estimate represents a decline of -13.42% from the last price of 158.24.

- What do you think about the company? 🤔

Please note that this is not financial advice. Every investment must go through a thorough analysis.