Often, in connection with the fall in the thu, there is talk of growth in various types of shares and sectors. But this time, a well-known billionaire comes up with a completely different prediction. What is it?

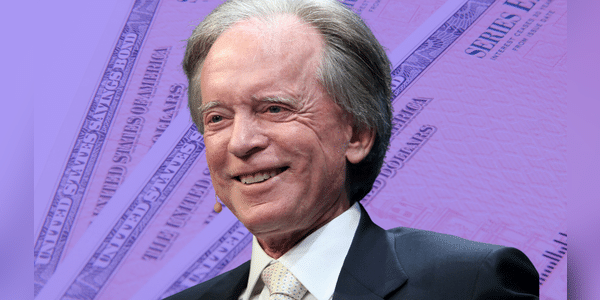

Who is Bill Gross?

Bill Gross is an American investment manager and philanthropist who was born in 1944 in Middletown, Ohio. Gross is best known as the co-founder and former head of Pacific Investment Management Company (PIMCO), an asset and bond management fund.

Gross studied psychology and economics at Duke University and earned a master's degree in economics from the University of California, Los Angeles (UCLA). In 1971, along with four other investment managers, he founded Pacific Investment Management Company (PIMCO), which became one of the world's largest asset managers.

At PIMCO, Gross was the chief investment officer and head of an investment team that managed more than $2 trillion in assets. However, he left the company in 2014 to join…