The markets have not been playing their cards right lately. Despite the less than ideal economic situation, there are some nice stocks that pay high dividend yields and can serve as a defensive component of a portfolio. Billionaire Barry Sternlicht is invested in one such stock.

The Fed (US central bank) raised interest rates by 0.25 percentage points, although some expected it not to do so given the recent bank collapses. Billionaire Barry Sternlicht, co-founder and CEO of Starwood Capital, considers the rate hike unnecessary and counterproductive.

Jerome Powell, the Fed chairman, clearly didn't need to do what he did.

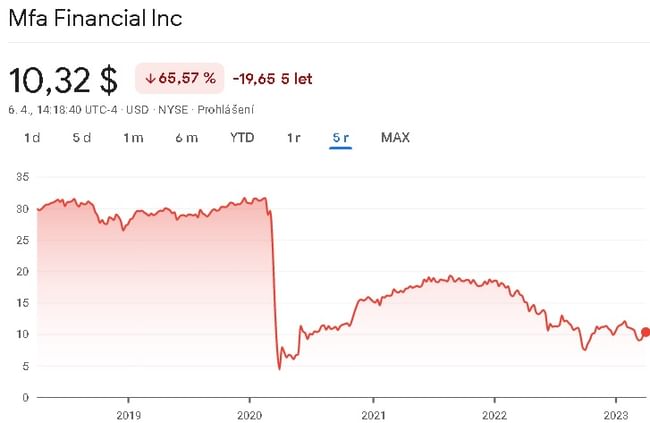

Although Sternlicht is concerned about the impact of a rate hike on the economy, he is heavily invested in MFA Financial $MFA, a dividend stock with a 15% yield.

MFA Financial is structured as a REIT (real estate investment trust) with a portfolio consisting primarily of residential whole loans, residential and commercial real estate securities, and assets related to MSRs (Mortgage Servicing Rights). At the end of last year, the MFA investment portfolio totaled $8 billion, down from $8.3 billion at the end of Q4 2021.

MFA Financial is focused on diversifying its portfolio and managing risk properly, which should help the company navigate the difficult economic conditions. In addition, the company appears to be able to maintain a strong return on its portfolio, which further supports Sternlicht's confidence in its potential for growth.

Sternlicht, which is concerned about the impact of rising interest rates on the economy, has up to 68% of MFA holdings in its portfolio. He currently owns 10,638,539 shares worth $97.13 million. MFA's quarterly dividend payout is $0.35, yielding 15.3%.

Stephen Laws, an analyst at Raymond James, has a positive outlook for MFA based on selective new investments, conservative leverage, strong portfolio returns, and the stock trading at ~80% of economic book value.

Given our outlook for attractive portfolio returns, increased focus on business lending, and current valuation relative to our target, we believe the risk-reward is compelling.

Laws rates MFA stock an outperform (buy) with a price target of $12.5, suggesting 37% upside in the months ahead.

The average Wall Street target is $12.33, creating room for one-year returns of 35%. The stock is rated as a moderate buy based on 2 buys and 1 hold. This outlook signals that Sternlicht's investment in MFA Financial could prove to be an interesting opportunity for investors looking for returns in later economic conditions.

Some critics of Sternlicht's investment argue that given his concerns about rising interest rates and their potential impact on the economy, he should be more cautious about investing in a company that is dependent on interest rates and the mortgage market. However, his confidence in MFA is supported by the company's strong performance and positive analyst ratings.

In conclusion, Barry Sternlicht's investment in MFA Financial indicates that he is confident in the company's ability to achieve positive growth despite elevated interest rates and potential market challenges. His confidence in MFA, backed by a positive analyst rating, could be a signal to investors looking for interesting opportunities in these uncertain economic times.

Investors should carefully consider their individual investment objectives and risk tolerance before deciding to invest in MFA Financial or other stocks. It is important to consult with your financial advisor and conduct your own research before making any investment decision.

NOTICE: I am not a financial advisor, and this material does not serve as a financial or investment recommendation. The content of this material is purely informational.