Lately, I have often come across the view that the turmoil in the banking sector is a big problem for the current economy. Today, let's take a look at what one of the most well-known figures, James Bullard, has to say about this.

The U.S. economy is unlikely to be plunged into recession despite the recent failures of some banks, believes St. Louis Federal Reserve (Fed) President James Bullard. He said in an interview that 20% of bank deposits are leaving the system, but he sees no reason to worry about a significant drop in lending. According to Bullard, banks should maintain enough liquidity and capital to make loans, which should keep the economy on track.

Bullard also rejected a proposal to cut the interest rate on the Fed's reverse repo facility, which was intended to encourage money market funds to lend back to banks. He said the Fed has no plans to make such a change. Instead, he stressed that financial stress in the U.S. banking sector is likely to continue to ease and that the Fed should remain focused on fighting inflation.

Interest rates were raised by 0.25% late last month, the most since 2007. Although Bullard does not have a vote on the Federal Open Market Committee (FOMC) in 2023, his views are still taken into account when setting monetary policy.

The good news about where we are right now is that the labor market is very strong and financial stress seems to have eased, at least for now, so it's a good time to continue to fight inflation and try to get on that disinflationary path.

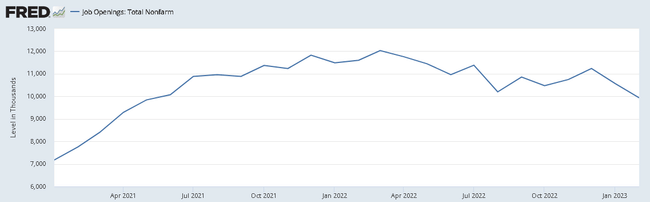

Bullard says the labor market is very strong, which, along with easing financial stress, makes this a good time to fight inflation and try to get on that disinflationary path. Although the recent Job Openings and Labor Turnover Survey (JOLTS) report showed the largest drop in job openings in two years, Bullard isn't taking many signals from the data and sees the labor market as tight.

Financial stress in the banking sector is one of the main risks to the economy as it could cause credit conditions to tighten, which could lead to a slowdown in economic growth. Bullard's comments are therefore encouraging for those who hope that the US economy will avoid recession and maintain its growth trend.

Bullard also stressed the importance of the Fed's strategy to fight inflation. Bullard's belief that the Fed should continue to focus its efforts on inflation shows that the institution understands the need to keep the economy stable and protect the purchasing power of American citizens.

However, Bullard also notes the importance of caution in the implementation of monetary policy to avoid disrupting the labor market. He states that although the JOLTS report shows a decline in job opportunities, the labor market is still tight and has the potential to grow further.

In order to achieve a disinflationary path and stabilize the economy, it will be crucial for the Fed to properly balance its policy between managing inflation and supporting the labor market. This may include thoughtful interest rate hikes and other measures that will help ensure that the U.S. economy remains strong and competitive on a global level.

Some analysts say Bullard's position may signal that the Fed will continue to raise interest rates in the coming months to fight inflation and keep the economy on a sustainable disinflationary path. Given that inflation affects the cost of living and the overall stability of the economy, it is important that the Fed act quickly and effectively.

In conclusion, Bullard's optimistic view of the U.S. economy is encouraging and suggests that the current financial stress in the banking sector should not have a devastating impact on economic growth. His views also point to the importance of focusing on fighting inflation and maintaining a disinflationary path, while also promoting a strong labor market and economic stability. If the Fed is able to strike the right balance in its monetary policy, the U.S. economy is likely to continue to grow and prosper.

Bullard's statement also serves as a reminder that U.S. banks should continue to maintain sufficient liquidity and capital to be able to lend to businesses and consumers. In this way, banks can help sustain economic growth and minimize the risk of recession due to tighter credit conditions.

In this context, it is also important to mention the role of government and other institutions in promoting economic stability. Cooperation between institutions such as the Fed, the government and the banking sector can help ensure that measures are taken to improve the economic situation and prevent a recession.

One of the main challenges facing the Fed is finding a balance between the need to raise interest rates to keep inflation under control while keeping the economy on a growth path. This can be a difficult task, but Bullard's optimism suggests that the Fed is ready and able to tackle these challenges.

Overall, Bullard's position suggests that the U.S. economy has a bright future, provided the Fed and other institutions successfully address the challenges it faces. His optimistic view and confidence in the strength of the labor market and the ability of banks to manage financial stress creates hope for the U.S. economy and its citizens as they struggle to cope with inflation and uncertainty on a global level.

WARNING: I am not a financial advisor, and this material does not serve as a financial or investment recommendation. The content of this material is purely informational.