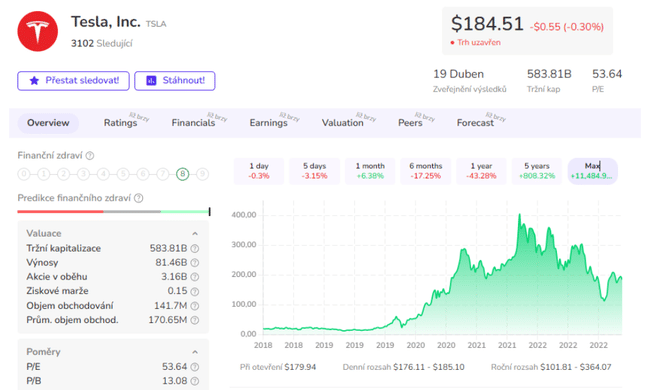

Tesla is facing a wave of selling after a warning signal pointed to a possible drop in its share price of up to 14%. The company, whose stock has risen more than 70% this year, is cutting car prices, which could hurt its profits. The founder of Fairlead Strategies warns that if the technical picture doesn't improve, Tesla shares could fall to $160.

Shares of Tesla $TSLA will tend to fall after a technical sell signal is issued, according to Fairlead Strategies founder Katie Stockton. The electric vehicle maker experienced a surge at the beginning of the year, with its stock up as much as 77%, but it's now losing some of those gains.

Stockton says the decline could continue to as low as $160 per share, a potential 14% drop from the current level of $185.

She said:

"Tesla is the first of the big tech companies to challenge support with an impending sell-off below its 50-day moving average. This is a bearish short-term development and the daily MACD indicator is now pulled back and likely to form a sell signal, with further support only around $160."

The MACD indicator tracks the trend of moving averages of stock prices. It sends buy and sell signals. Stockton uses MACD to capture momentum and trend in different time frames. The indicator is useful because it generates either a buy signal or a sell signal.

The potential drop in Tesla stock comes amid further price cuts from the company, which analysts warned about after the Q1 delivery update showed a surge in inventory. The analysts said, "Gradual price cuts are likely necessary amid inventory builds, especially as production in Austin and Berlin grows."

Tesla on Thursday slashed prices of the Model 3 and Model Y by at least $1,000 in the U.S., while cutting prices of the Model X and Model S by about $5,000. These price cuts should weaken Tesla's profit margins, which is what Wall Street is focusing on in addition to the delivery data. Analysts said, "Margins will be a big question mark as the price cuts will impact this front, though we believe automotive gross margins above 20% remain a key threshold in the coming quarters."

Investors will get more information on Tesla's Q1 results when the results and outlook are released after the market closes on April 19. And Tesla will have to impress investors if it wants to maintain its 50% year-over-year profit growth and come up with a really blockbuster deal, as the latest delivery numbers may show growth, but even so, investors aren't happy considering the price cuts.

Please note that this is not financial advice. Every investment must undergo a thorough analysis.