Bristol-Myers: Breakthrough cancer treatment and a promising future

Bristol-Myers Squibb is an American pharmaceutical company with a strong position in immunology and oncology. For more than 160 years, the company has produced innovative medicines that help people around the world fight cancer, heart disease and other serious illnesses. But how is the company doing in terms of numbers?

Bristol-Myers Squibb Company $BMY is an American pharmaceutical company founded in 1858. It is the world's leading manufacturer of innovative medicines and biologics. The company's main areas of focus are oncology, hematology, immunology and cardiovascular health.

Its best-known products include the anticancer drugs Opdivo and Yervoy, the anticoagulants Coumadin and Eliquis, and the antihypertensives Monopril and Plavix.

$BMY has several competitive advantages. It is a leader in immunotherapy, particularly in the treatment of melanoma and kidney cancer. It has very strong patent protection on its key drugs and biologics, which provides it with higher profit margins.

The company also conducts extensive research and development, which has resulted in a broad portfolio of innovative products in various stages of clinical testing. BMY operates globally and more than half of its revenues come from the US, with the remainder mainly from Europe and emerging markets.

Key risks for BMY include strong competition in the industry, particularly in oncology. At the same time, the heavy reliance on a few key products increases the risk of the impact of the loss of patent protection. Another risk may be the regulatory environment in the US and abroad, which is constantly changing, presenting uncertainty regarding the approval and reimbursement of new drugs.

However, BMY has great potential for the future, with a broad portfolio of drugs in clinical development in promising therapeutic areas. If it successfully launches new drugs, it can significantly strengthen its position in the industry, particularly in immunotherapy.

Where is the potential for the future?

The merger with Celgene, completed in 2019, will allow the company to focus even more on innovative biotechnology. This could generate higher profits and value shareholder investment in the future.

Going forward, I also expect Bristol-Myers Squibb to continue to grow and strengthen its market position. I see the following as key areas of progress:

-Development ofimmunotherapy and cancer treatments. BMY is a leader in immuno-oncology, a field with enormous potential. The successful launch of new immunotherapies can significantly increase sales and profits in the coming years.

-Investment in promising candidates in late stages of development. BMY has dozens of promising molecules in clinical development for various cancers and other diseases. Successfully bringing some of these to market would boost growth.

-Strengthening its position in other attractive therapeutic areas such as cardiovascular disease and HIV. BMY has the potential to expand its portfolio of drugs and revenues into these promising areas.

-Acquiring smaller companies with innovative technologies. BMY has the cash and financial strength to strengthen its portfolio through acquisitions of promising biotechnology companies. This would help it keep pace with its competitors.

-Maintaining stable financial results and increasing shareholder value. I expect BMY to continue to generate solid cash flows, increase dividends and value shareholder investments.

Finance

BMY's revenues have grown in recent years, reaching a record $46.2 billion in 2022. The main sources of growth were Opdivo, Eliquis, and indicasquolane. The strong revenue growth reflects the successful launch of innovative drugs and expansion into new therapeutic areas such as immunology.

Cost of sales grew more slowly than revenue, which was positively reflected in the improving gross margin. Operating expenses remained relatively stable, although they increased slightly in 2021 due to investments in research and sales. The company thus generated strong operating cash flow, which enabled it to invest in future growth while increasing dividends to shareholders.

Both profit before tax and net profit grew, except in 2020, when they were negatively impacted by the amortisation of intangible assets and restructuring costs.

BMY also has a stable financial position with ample cash and low debt. Cash flow from operations exceeds capital needs, allowing the company to increase spending on research, development and acquisitions. High operating cash flow and cash reserves provide the means to address potential future problems.

The financial results demonstrate that BMY is a strong, profitable company with extensive opportunities for further growth. Key areas for future expansion are oncology, immunity and inflammatory diseases.

Cash Flow

BMY's cash flow from operations has grown over the past year, reaching $13.1 billion in the past 12 months. Operating cash gives the company free cash to invest in future growth, pay down debt and increase dividends.

Cash flow from investing activities is negative as BMY regularly invests in the acquisition of intangible assets and tangible assets. Capital expenditures have been around $1 billion per year in recent years.

Cash flows from financing activities have also been negative in recent years as the company repays debt and pays dividends to shareholders. In 2022, the company repaid $11.4 billion of debt and paid $8 billion to repurchase its own shares.

Free cash flow, or operating cash less capital expenditures, was nearly $12 billion in the most recent year. This shows that the company is generating enough cash to cover capital needs, pay down debt and increase shareholder payouts. Strong operating cash flow is the foundation of the company's financial strength and stability.

Therefore, if new drug launches are successful, further strengthening of operating cash flow can be expected in the future. This should enable BMY to increase dividends to shareholders and to finance future acquisitions or strategic investments from its own resources.

BMS currently has a market capitalisation of USD 148 billion. The company's stock trades at a price-to-earnings (P/E) ratio of 8.59, which is lower than the S&P 500 index (23.79). This suggests that BMS stock is relatively undervalued relative to the index and the sector average. The price-to-sales (P/S) ratio of 3.21 also indicates an attractive valuation.

The company has paid dividends totaling $2.28 per share in the last one year, yielding a dividend yield of 3.25%. BMY has been increasing its dividend payout for a long time, so the dividend yield is very attractive for investors.

The majority of BMY's shares are owned by institutional investors (79.4%), with a low proportion of insiders (0.07%). This demonstrates the confidence professional investors have in the company and the potential for further growth in the stock.

The company is showing strong and growing operating results. Over the last 5 years, sales have grown at an average of 17.3% per year and net profit at an average of 4.5% per year. The operating margin is high (21.5%) and the net margin is 13.7%. The return on investment (11,8 %) and return on equity (19,8 %) are also solid. The company's financial indicators are therefore certainly very strong.

Based on fundamental analysis and valuation, BMY shares appear to be an attractive investment opportunity. The company is a leader in promising therapeutic areas, has a broad product portfolio, strong financial results and stable future prospects.

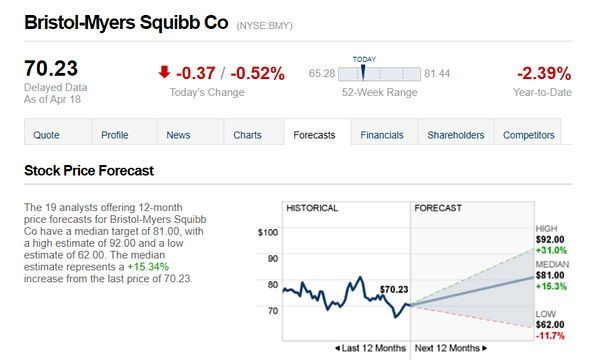

Analysts' expectations

The 19 analysts offering 12-month price forecasts for Bristol-Myers Squibb Co have a median target of 81.00, with a high estimate of 92.00 and a low estimate of 62.00. The median estimate represents an increase of +15.34% from the last price of 70.23.

- What do you think of the company? 🤔

Please note that this is not financial advice. Every investment must go through a thorough analysis.