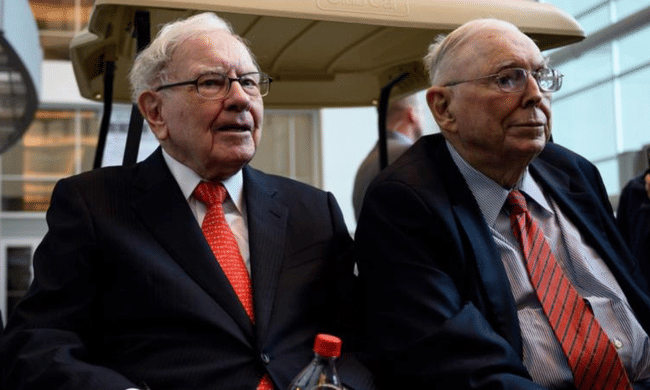

Charlie Munger, Warren Buffett's longtime investment partner, warned of a storm brewing in the US commercial real estate market. According to the 99-year-old investor and vice-president of Berkshire Hathaway, the US banking system is awash with "bad loans".

Charlie Munger, Warren Buffett's longtime investment partner, warned of a storm brewing in the US commercial real estate market. The US banking system, he said, is awash with "bad loans" as property prices fall.

The 99-year-old investor and vice-president of Berkshire Hathaway spoke out at a time when the financial markets are being rocked by potential commercial property and banking crashes.

"It's not as bad as 2008," Munger said, "but there's trouble happening in banking, just like everywhere else. In good times, people get used to bad habits... And when the bad times come, too much is lost.

Munger made this comment about the troubles of California's First Republic Bank $FRC. After all, Berkshire has a long history of supporting U.S. banks during financial turmoil. It invested billions of dollars in Goldman Sachs during the 2007-2008 crisis and in Bank of America in 2011. But this year, it has stood by while Silicon Valley and Signature Bank collapsed.

"Some of the bank investments have paid off, but we've had some disappointments," Munger said. "Running a bank intelligently is not easy; there are many temptations to do the wrong thing."

Their reticence stems in part from the risks in the banks' large commercial real estate loan portfolios. "A lot of real estate is not that good anymore," Munger said. "We have a lot of distressed office buildings, shopping centers and other properties. There's going to be a lot of distress.

"A lot of things are going to go bad, and we're going to wonder why we let it happen." "But the United States, being a fighter, can pick itself up off the floor and come up with solutions that will please even the skeptics. It's going to be a wild ride, but in my opinion it will end well."

Warren Buffett has not been left behind in this regard, and he also recently weighed in on the situation.

- More banks will fail, but people should not worry about the safety of American bank deposits, Warren Buffett said.

- People shouldn't worry about losing their money and the deposits they have in U.S. banks, Buffett said

Buffett pointed out that the current banking chaos does not resemble the environment that triggered the global financial crisis in 2008.

"You don't need to turn a stupid decision by executives into a panic by all the citizens of the United States over something they don't need to panic about," he said. "They didn't make the same mistakes they made in '08 or '09, but they mismanaged assets and liabilities, and bankers were tempted to do that forever, and it backfired."

Speaking about inflation and how the U.S. is doing, Buffett noted that "extreme inflation is always possible."

Both inflation and recession "can cause a lot of problems, and a recession can turn into a depression," he added. "You can disrupt the economy much more easily than you can put it back together again."

Note that this is not financial advice.