Today's market situation is quite uncertain. We have high interest rates, high inflation, banks are failing. Nobody really knows what is going to happen. Some say we are going to see growth, others expect a further decline. In situations like this, it pays to look for more defensive stocks from defensive sectors, and this sector may be ideal for that.

The healthcare sector has increasingly been seen as an attractive investment opportunity in recent years, largely due to its defensive nature. So let's take a look at the reasons why the Healthcare Sector is considered an attractive investment area.

The defensive nature of healthcare

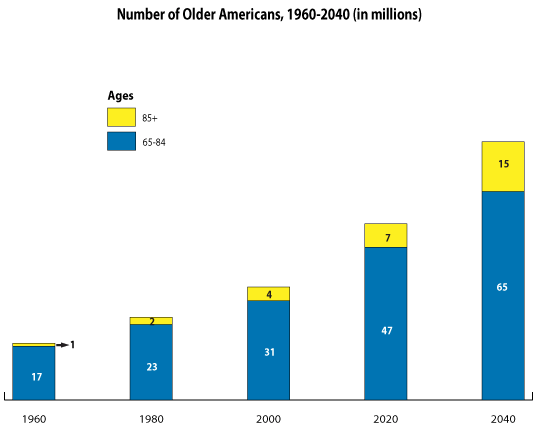

The healthcare sector is considered defensive because it is less dependent on overall economic growth. Unlike cyclical sectors such as automotive or construction, demand for healthcare is constant, even during economic downturns. This steady demand for healthcare services and products contributes to the defensive nature of the sector, making it an attractive investment opportunity. In addition, demographic trends such as an ageing population and increasing numbers of chronic diseases increase the demand for healthcare in the long term.

Simply put, this sector is essential in any economic times. People can afford to buy a new car, or they can cut back to some extent on their grocery spending. But what they can't completely cut back on is spending on medical care, which in many cases is very important.

A modest valuation of the sector

One thing to consider here is that we are talking about the defensive part of the sector, that is, companies that are fixed and entrenched. Indeed, at first glance, this sector may appear to be overpriced, but if we look at the ETFs covering this sector $XLV, for example, the average P/E multiple for XLV as a whole was 17.2 times earnings at the end of the first quarter.

So it's also important not to chase the modern non-profits, I'm not completely discounting those stocks here. If we look at some other well-known names in this sector for example, $BMY is currently trading at a P/E of 20, and $CVS has a P/E of around 24. Given the quality of these large companies, the price-to-earnings ratios seem relatively reasonable to me.

Stable, rising dividends

This ties in a bit with the previous reason. There are plenty of quality companies in this industry that have a long history of increasing dividends that are well covered. In fact, dividends are something that many times bring joy to investors even in tough times. In addition, companies that pay stable and increasing dividends over the long term tend to do a little better than the rest of the market, they are simply not as volatile.

So if we get into times when the stock price is going to fluctuate, we can count on the dividend coming in regardless of whether there's a recession or whether we're experiencing a big boom. You can find plenty of quality dividend stocks in this sector, such as $BMY, $PFE, or the sector ETF $XLV, which has been paying a dividend for 22 years and currently yields around 1.5%

Innovation in the sector

The healthcare sector is known for its ability to innovate, making it an attractive sector to invest in. The development of new drugs, treatments and technologies contributes to the growth of healthcare companies and increases the value of their shares.

Thus, it can be said that even though this sector is quite defensive in its focus, it can still offer growth opportunities, which is the great thing about this sector. its new products and possible services do not have to wait long for demand, as they are developed based on consumer needs.

But there is one risk that comes with this quite a lot, and I don't think it should be taken lightly. It can happen, and yes it does happen, that new drugs that companies develop may not pass the approval of the regulatory authorities. In that case, the companies may lose more of the money that they have invested in researching that rejected drug.

Conclusion:

The healthcare sector is an attractive investment opportunity due to its defensive nature, modest valuation, steady growing dividends, and industry innovation. The Healthcare Select Sector SPDR ETF (XLV) is a good choice for investors looking for a defensive investment with growth potential in this sector and don't want to worry about picking individual stocks. However, before investing in this sector, it is important to carefully consider the potential risks and take into account your individual investment objectives and risk tolerance.

WARNING: I am not a financial advisor, and this material does not serve as a financial or investment recommendation. The content of this material is purely informational.

Thanks for the article, $XLV will consider it, but the price would have to come down even more.

Somehow I thought $JNJ would be there too :)

$CVS is my second largest position due to current prices and I have the urge to reach for $PFE as well, but I don't want to overdo it with the pharma ones. 😁

I don't get anything out of them, but as a defensive of course. What else would be defensive if not this

I already have CVS in my portfolio and I'm just waiting to see if there's a discount before I buy. In general, I see this sector as less risky and with potential to grow.

It is clearly one of the best sectors for long-term investors. Many stocks are expensive, but CVS Pfizer, NVAX and a few others can now be bought at a discount.