3 great small cap stocks that analysts say will dominate their industry

Even the biggest companies had to start sometime. Most of them started as small caps and eventually rose to the most influential places in the market. Amazon's $AMZN-1.3% stock was worth just $7 in 1998, and Tesla's $TSLA+0.5%, which made its largest shareholder the richest man on the planet, had a market cap of $1 billion just 13 years ago. Today it's 600 times that.

Small caps tend to be pretty much ignored by the public. But there are bright exceptions in the form of stocks that were expensive and have now reached much lower levels or those that have surfaced through news and hype.

Many investors, especially in the Czech Republic, are familiar with Palantir $PLTR , which has been XTB's most traded stock of the month several times.

If someone doesn't want to look at individual stocks, which carry the possibility of many times the earnings but also the risk, and wants to invest in smaller companies, they can look at the Russell 2000 index. The Russell 2000 Index contains, as the name suggests, 2000 small cap companies. As a result, you get great diversification and higher potential appreciation than on the big global indices.

For those who aren't afraid and want to take a little bit of that risk, I've got 3 small market cap companies with great future growth potential.

1. CarParts.com ($PRTS-0.9%)

Formerly known as U.S. Auto Parts, this online auto parts retailer has undergone a major restructuring under new management.

By expanding its web-based brands under the CarParts.com banner, the company has streamlined its business and sales have increased during the COVID-19 pandemic . CarParts.com is investing in technology and marketing, and the company is rapidly adding new distribution centers. Delivery times in 80% of the U.S. are in the order of days.

CarParts.com, Inc.

PRTSCarParts offers a wide range of replacement parts for various makes and models of vehicles, including engine parts, brake systems, electronics, body parts, lighting, cooling, interior accessories and much more. Their range includes both original parts and second hand parts from various manufacturers.

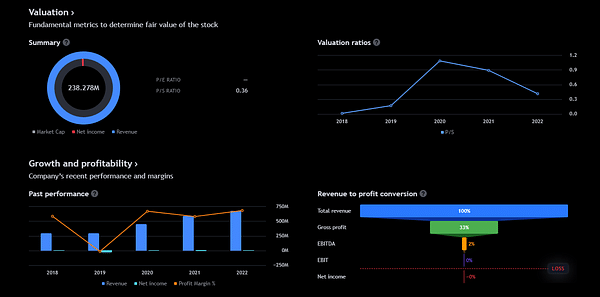

Many would surely expect that a company like this must be at a loss like other similar companies. However, this is not the case here and the company is currently in the black.

In the main and so far only market, which is the USA, CarParts has built up a decent reputation. In the future, the branches could be expanded and the company could become international. This would certainly attract many more investors.

2. ACM Research ($ACMR+2.6%)

ACM Research specializes in developing and manufacturing high-performance equipment for cleaning, plasma etching, coating, and other processes used in the manufacture of semiconductors and similar microelectronic components.

Their products and technologies are designed for advanced applications in areas such as memory chips, 3D integrated circuits, optoelectronics and more.

ACM Research, Inc.

ACMRAn investment in ACM Research provides exposure to a high-growth industry without exposure to the downside risk of commodity chip prices.

ACM is a U.S. company that operates the majority of its business in China, providing investors with a relatively safe investment method for gaining exposure to the Chinese market. ACM is one of the few small-cap companies that offers high growth potential and solid profitability.

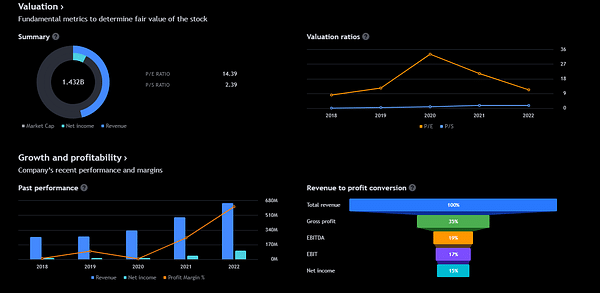

Recent results have been very successful for the company as it beatanalysts' estimates by 418%! There is now a 77% decline between the peak and the current price. If you buy now and take the stock to the 2022 peak, you will earn over 300%%.

We also saw a 3/1 stock split last year. The company is now profitable by keeping 10% of total revenue.

3. Perion Network ($PERI-1.6%)

Ad tech stocks have boomed during the pandemic, along with broader gains in digital advertising and connected TV. One of the big winners has been Perion Network $PERI-1.6%, an Israeli company that focuses on connecting advertisers and publishers through its smart hub.

This gives it a unique position in a market that is not responding.

Perion Network Ltd.

PERIPerion works very closely with Microsoft $MSFT-0.5%, which it helps monetize with its Bing search engine. The latter is growing rapidly in the current era thanks to AI, and this suits the company very well. When you work with someone as big as Microsoft, it definitely pays off in your bank account and popularity.

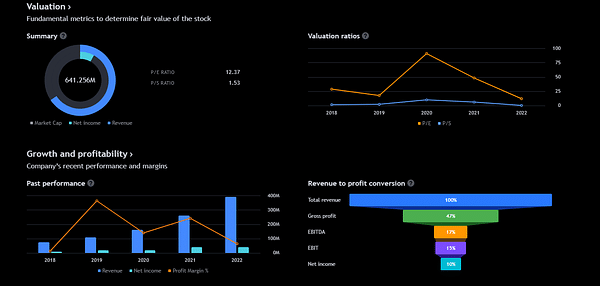

The company is growing rapidly through acquisitions while also solidifying its position in premium ads by offering features like QR code scanning, customizable backgrounds, and in-game ads during sporting events. The company was on track for 42% revenue growth in 2021 and 29% growth in 2022.

Like ACM Research, Perion is also profitable. As of 2020, it is enjoying 800% stock growth. It has also consistently beaten analysts' estimates since 2018, and even the current poor market conditions aren't giving it any trouble.

Thecompany's earnings have almost reached $100M, but it will definitely come out ahead in the coming years. Unlike others, Perion doesn't specialize exclusively in the US, but operates in other markets as well. They also have a diversified business plan.

Each of these companies has a lot to offer in the future and today's low prices offer a great opportunity to build potential positions. With the exception of CarParts, the other two are profitable, which isn't always the norm with stocks this cheap. But even in this market there are hidden gems to be found. Not many people know about them, and that's exactly their advantage. It's up to each person to decide how to tackle it.

This is not financial advice. I am providing publicly available data and sharing my views on how I would handle the situations myself. Investing is risky and everyone is responsible for their decisions.