Since January, we have seen the stock markets pick up nicely and erase the losses from last year. This is true for both stock indices and individual stocks. When we're talking about large, mostly technology corporations, except for $NVDA, perhaps we can't expect doubles in the coming months. But if we move to smaller companies that have something to offer, the possibilities are immediately different.

1. Atlus Power Inc. ($AMPS)

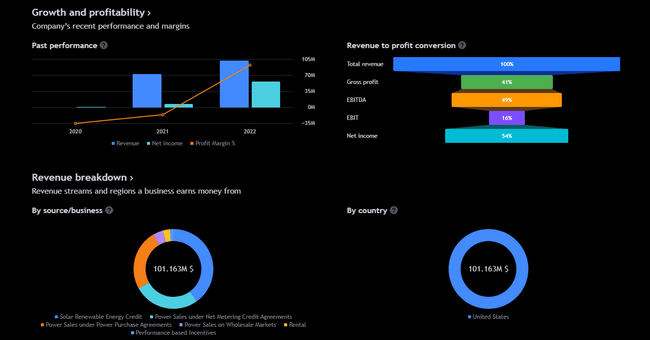

Altus Power is a renewable energy company based in the United States. It was founded in 2009 and specializes in the development, acquisition and management of clean energy projects. Altus Power's primary focus is solar and wind energy + providing sustainable energy solutions for commercial, industrial and municipal clients.

The company offers a wide range of services, including project financing, development, construction and operations. Altus Power works closely with its customers to design and implement customized renewable energy solutions that meet their specific energy needs and sustainability goals.

It also provides ongoing monitoring and maintenance of projects to ensure their optimal performance and long-term viability.

This company is highly profitable and makes decent money for what is currently one of the cheaper stocks. The company's earnings are over 50% of total profits not yet taxed. The company only operates in the United States for now, but that may change quickly in the future as the market and the company grows.

CEO Gregg Felton recently announced the purchase of 75,000 shares. He bought shares between $4.37 and $4.50 on Form 4. The trades were routed through his company, Felton Asset Management, bringing its holdings to more than 11.85 million. Felton also directly owns over 3.68 million shares.

2. Standard Biotools Inc ($LAB)

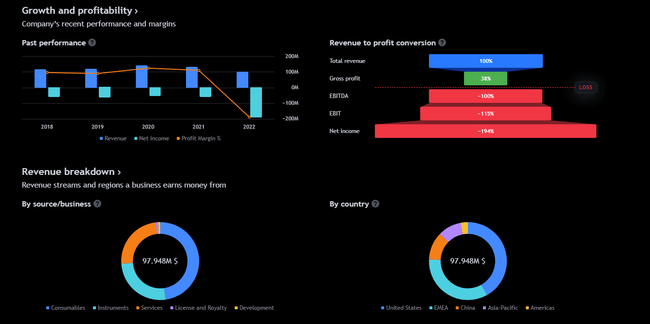

Standard Biotools Inc. is a company focused on manufacturing and supplying biotechnology tools for life science research and diagnostics. The company was founded to provide researchers and laboratories with quality and innovative products that advance the life sciences.

Standard Biotools products include a wide range of instruments and kits for molecular biology, genetics, proteomics and cell biology. The most commonly offered products include PCR (polymerase chain reaction) reagent kits, enzymes, nucleic acids, electrophoresis systems, primers and probes for DNA and RNA amplification and detection, chromatography columns, immunology reagents and much more.

The company is dedicated to ensuring the high quality and reliability of its products that meet the standards for laboratory research and diagnostics.

Currently, the company is struggling in a big loss and is unable to make a profit. Despite this, there were insiders who bought shares.

The latest to join were CEO Eli Casdin and CFO Jeffrey Black. Casdin's purchases totaled 1.2 million shares at prices ranging from $1.855 to $2.2982. Black's purchases totaled just under 86,000 shares at prices ranging from $2.14 to $2.32.

In the area of research and development, Standard Biotools works with academic institutions, scientific organizations and industry partners to drive innovation in biotechnology and bring new technologies and products to market.

3. Chimerix ($CMRX)

Chimerix is a biopharmaceutical company based in Durham, North Carolina, in the United States. It was founded in 2000 and focuses on developing drugs for the treatment of infectious diseases, including viral infections and cancer.

Chimerix is known for its technology called "chemical tagging". This technology allows researchers to track and analyse the movement and interactions of chemical compounds in living organisms. Chimerix uses thistechnology to discover and develop new drugs with the potential to treat serious diseases.

The main drug developed by Chimerix is brincidofovir. This is an antiviral drug that was originally developed for the treatment of cytomegalovirus (CMV) infection in patients with weakened immune systems, such as organ transplant patients. Brincidofovir is also being studied for its effectiveness against other viruses, including adenoviruses and varicella-zoster virus (the causative agent of chickenpox and shingles).

The form is rapidly growing its sales are multiplying each year. That the stock is now around $1 apiece, so it offers a good opportunity for a potential purchase.

Based on recent activity, insiders seem optimistic.

Directors Robert Meyer and Martha Demski, as well as CEO Michael Sherman and CFO Michael Andriole, have acquired thousands of shares at average prices between $1.11 and $1.14. The largest purchase was from the company's CEO, who bought more than 80,000 shares in his Michael A Sherman Trust.

Given the great potential for future growth, these shares may seem like great investment opportunities for the future, and perhaps they will actually happen.

All the companies are doing, shall we say, well and their trading directors are buying their shares in bulk. That's usually exactly the news an investor wants to hear from management.

If someone is buying from within the company, it is never just a matter of doing it, but there is some set of information behind it that leads them to make that move.

This is not financial advice. I am providing publicly available data and sharing my views on how I would handle the situation myself. Investing is risky and everyone is responsible for their decisions.

Interesting companies. I'd be most worried about the third one if it can't make money for itself. The other one, I like what she's doing, I'll look into it more. The first one sounds cool too, and I like renewables, I just feel like there are a lot of bigger players in the field in that today, but they are all the companies mentioned are cheap, so a few shares wouldn't spoil much. Do you have a favorite of the three? 😊