Is this the best dividend company of the last few decades?

Dividend companies differ in many ways. Quite often, investors are interested in certainty and stability. The company we are looking at today certainly has that. Many people are not even afraid to say that it is the best dividend company in the world.

The best company is debatable. Not so much about the other figures. They are quite clear! Let's take a look at them. Procter and Gamble $PG-0.1% is one of the largest companies in the world that specializes in the manufacture and sale of a wide range of consumer products for the home and personal care. The company was founded in 1837 in the US and today has offices all over the world.

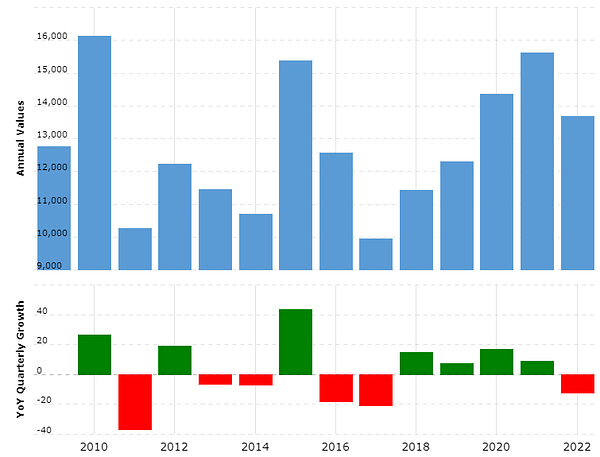

Procter and Gamble is known for its iconic brands such as Ariel, Gillette, Head & Shoulders, Pampers and Tide, which are sold in more than 180 countries. The company is also known for its innovation and research and development of new products. The company employs more than 100,000 people worldwide. It has a market cap of over 300 billion and revenues of over 80.

https://www.youtube.com/watch?v=z251wmzHpoA

Procter and Gamble is a stable and successful company with strong brands and a broad product portfolio. The company has a strong focus on innovation and new product development, which allows it to maintain a competitive advantage in the market.

However, like many other companies, Procter and Gamble faces challenges in sustainability and ethical issues. For example, the company has been criticised for testing its products on animals and for using palm oil, which can have a negative impact on the environment.

Sector and competition

Procter and Gamble is active in the consumer goods sector, which is very competitive and dynamic. The company focuses on the manufacture and sale of household and personal care products such as laundry detergents, cosmetics, toiletries and others.

Competition in this sector is very strong, both from other large market players such as Unilever, Colgate-Palmolive and Nestlé, as well as from smaller and specialised companies. These companies try to attract customers to their brands with innovative products, competitive pricing and aggressive marketing.

However, Procter and Gamble is a popular manufacturer and has strong brands that retain a large number of customers. The company also invests a lot of money in research and development, which allows it to maintain its competitive advantage. In addition, Procter and Gamble has an extensive global distribution network, which allows it to efficiently ship products all over the world.

Due to the high level of competition in this sector, Procter and Gamble is also looking to expand into new markets and attract new customers. For example, the company is focusing on emerging markets in Asia and Africa and is trying to adapt its products and marketing strategies to local cultures and preferences.

Overall, Procter and Gamble faces strong competition in the consumer products sector, but maintains its position as one of the leading companies in this area thanks to its strong brands, innovative approach and global distribution network.

Is it the best in the world?

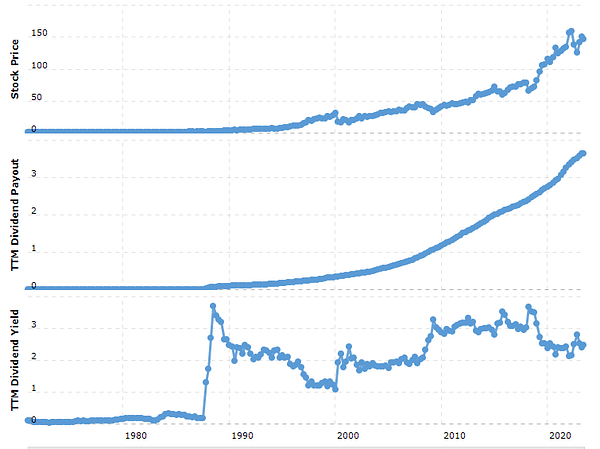

Procter and Gamble is known as a company that regularly pays high dividends to its shareholders. It has been one of the best dividend paying companies in the world in the past and is still considered a very stable and profitable investment. However, it is impossible to say unequivocally whether Procter and Gamble is the best dividend company in the world because it depends on many factors. And, of course, on which perspective you look at it from.

When evaluating dividend companies, it is important to consider several factors such as the amount of dividend yield, stability of dividend payout, dividend growth, financial stability of the company and many other factors.

Procter and Gamble currently has a dividend yield of around 2.5%, which is a relatively high number compared to the average yield on the stock in the market. The company also pays dividends regularly and has increased its dividend every year in recent years.

However, there are other companies that have even higher dividend yields and a longer history of stable dividend payments. For example, Johnson & Johnson currently has a dividend yield of around 2.9% and has been paying dividends for over 50 years.

All in all, Procter and Gamble is an extremely high-quality, stable and profitable dividend company, but it depends on each investor's investment strategy and preferences whether they consider it the best dividend company in the world.

Dividend

It's probably worth dwelling on the dividend a bit more.

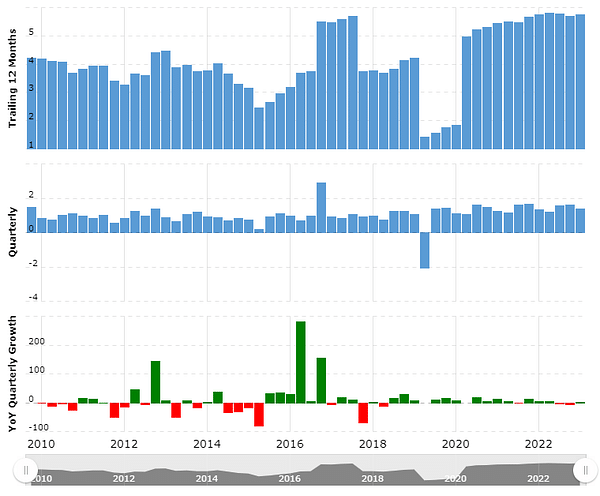

Payout ratio is a metric that shows us how much of a company's profits it pays out to its shareholders as a dividend. If the ratio is high, it means that the company is paying out more of its profits as a dividend and has less money to invest back into the business.

In the case of Procter and Gamble, the payout/reward ratio is currently 62.5% of earnings, which is an attractive number. Next year, in theory, this ratio should improve even further.

Procter & Gamble had strong results, with organic sales up more than 7% across all ten product categories. The largest sales increases were in the women's care categories, while the child care and family care categories saw increases in the tens of percent range. The company experienced organic sales growth in six of its seven regions, primarily in the corporate, U.S. and European markets.

Core earnings per share increased 3% from the prior year and the company returned $3.6 billion in cash to shareholders. Despite the volatility in the macro and consumer environment and continued cost and exchange rate pressures, P&G remains confident in its strategies and its ability to execute them.

Disclaimer: This is in no way an investment recommendation. It is purely my summary and analysis based on data from the internet and other sources. Investing in the financial markets is risky and everyone should invest based on their own decisions. I am just an amateur sharing my opinions.