2 dividend companies with high growth potential

Dividend companies are always interesting for investors looking for passive income. But it's even better when the share price of the company itself rises along with the dividend. Today, we'll look at 2 that analysts believe have just that potential.

AbbVie $ABBV+1.3%

AbbVie is a pharmaceutical company with a strong brand and reputation, particularly in the area of drugs for immune diseases and gastroenterology. Its largest drug , Humira, for the treatment of rheumatoid arthritis and Crohn's disease, generates nearly half of its revenue.

AbbVie

ABBVIn terms of growth, AbbVie faces near-term challenges in the form of the loss of its patent on Humira, which expires in the U.S. in 2023. The company is therefore aggressively expanding its drug portfolio through acquisition and has a pipeline of new drugs in development, particularly in the areas of neuroscience, oncology and immunology. The flagship drugs in the portfolio include Skyrizi, Rinvoq and Imbruvica. With their help and other new drugs, it has the potential to replace some of the revenues following the loss of Humira.

https://www.youtube.com/watch?v=RDI7_E7QD7M

As for its dividend, the company pays a higher-than-average dividend yield of around 4.2%. It has been raising the dividend continuously for eight years. But its payout means the dividend is currently a bit out of options. Moreover, the company is likely to be under more pressure to maintain and increase its dividend after losing revenue from Humira.

Overall, AbbVie can generate medium-term business growth in the coming years, albeit more in the lower single-digit percentage range. However, maintaining a high dividend rate will become increasingly challenging. Markets are concerned that it will not achieve growth this year after the loss of Humira, which could have a negative impact on its shares. Acquisitions therefore remain key to maintaining growth and dividend flow. But these are theories. Looking at the statements, it doesn't look that bad.

AbbVie has been on a solid path of financial stability lately. According to its latest results, it paid down $1.4 billion of debt and bought back $2 billion of stock. The company's total debt is manageable, maturities are spread over 25 years, and interest rates are lower than the cost of equity.

Despite the recent volatility, long-term shareholders seem pleased with the company's results and prospects and consider it an attractive long-term buy because of its growing dividend. The company will have to overcome the challenge of losing its patent on Humira to grow further, but a strong pipeline of new drugs and strong financials keep analysts on a positive note.

Marine Products Corporation $MPX-1.3%

Marine Products Corporation is a small manufacturer and marketer of boats. Their main brands are Chaparral and Robalo cabin boats .

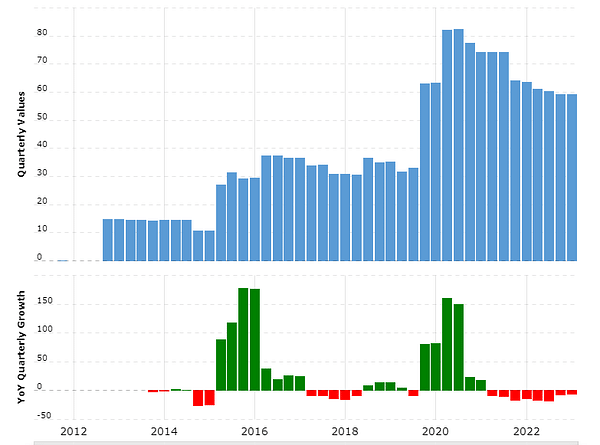

In terms of growth potential, MPX has several challenges. They are one of the smaller players in the recreational boat market, which is largely dominated by a few large manufacturers. The recreational boat market is relatively stable and growth is very gradual. The COVID pandemic has temporarily boosted demand for boats, but MPX's longer-term growth prospects are limited. Currently, however, it has shown great strength.

Marine Products…

MPXAs for the dividend, the company pays a dividend yield of over 3%. However, the payout is at a nice 40%. Overall, MPX has its boat offering at competitive prices. However, their small size and limited new product push means they don't have many growth engines.

The company had good Q1 results for FY 2023. Revenues were up 55% and net income even up 62%. EBITDA and operating cash flow also improved.

But there are big risks - such as the slowing economy. But management says strong conditions will remain in 2023, according to their annual report. Full-year earnings estimates suggest an attractive valuation,, even though the price is now very high.

Compared to peers, Marine Products shares appear more or less fairly valued. In absolute terms, they are also close to that, although they may offer some upside. The macroeconomic situation could be a threat. Fortunately, Marine Products is healthy enough to handle such a downturn. It has no debt and has cash and cash equivalents of $62.6 million. That's an excellent position for a company with a market capitalization of less than $600 million.

Disclaimer: This is in no way an investment recommendation. It is purely my summary and analysis based on data from the internet and other sources. Investing in the financial markets is risky and everyone should invest based on their own decisions. I am just an amateur sharing my opinions.