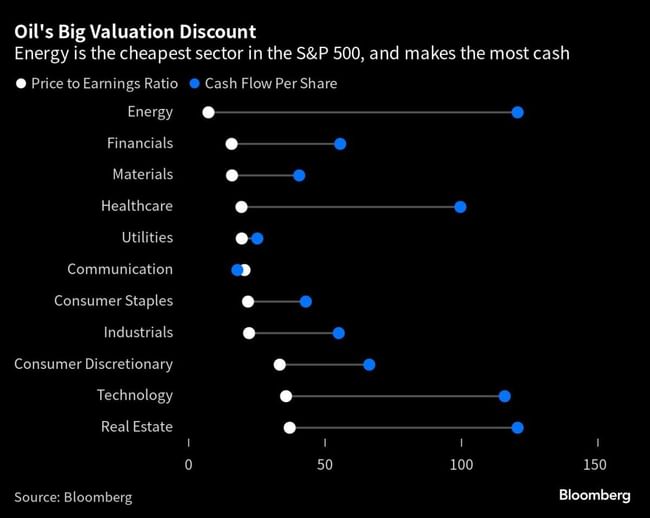

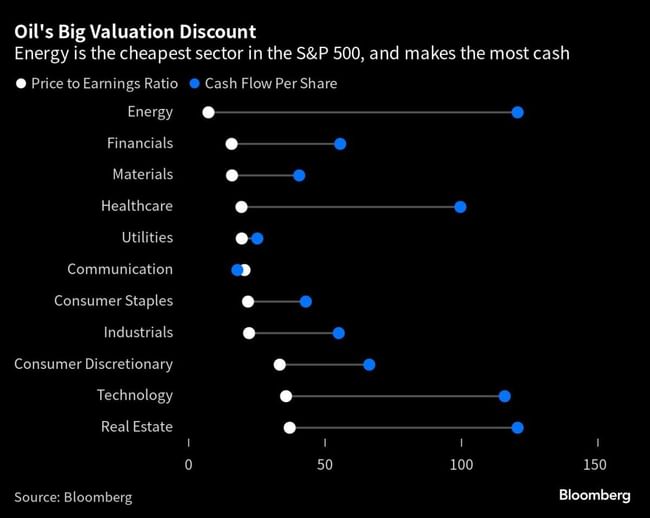

I came across this nice chart yesterday that shows us that the energy sector is the cheapest sector relative to profitability. It also generates the largest amount of cashe. Healthcare doesn't look bad either.

Who's your energy rep? Mine is $OXY.

I came across this nice chart yesterday that shows us that the energy sector is the cheapest sector relative to profitability. It also generates the largest amount of cashe. Healthcare doesn't look bad either.

Who's your energy rep? Mine is $OXY.

I'm not investing in that sector yet, but I plan to and so far I like $CVX and $OXY the best.

Interesting:) I don't own $OXY, but I've been looking for the right one from the energy sector for a while now.

For me also $OXY but I'm considering slowly retreating from it and that it will become the main either $CVX or $XOM because although Buffett has a lot in OXY, but his position is something different than for us, for me the company goes long sideways only and dividends not much, so I'm considering whether to still invest in it.

So according to this, it looks like we should just look for classic dividend stocks instead of tech. etc. stocks.