bad and good debt

Bad debt

We know bad debt when someone takes out a loan that doesn't make or save any money. For example, a loan for a holiday, a mobile phone, or someone borrows money to buy their family presents for Christmas. I see this bad debt as a problem, and I think a lot of people unfortunately take advantage of this bad debt.

Good debt

Good debt can be identified by someone borrowing money to start a business or to make an investment, and then when the person makes money from the business or investment, they can pay off the debt and still have a large amount of money left over. Or a mortgage can also be considered a good debt. I quite like this debt and will definitely use it in the future.

Thus, with good debt you can make money or at least save it, whereas with bad debt it is the other way around, since you don't make any money with bad debt. However, I am certainly not saying here that people should borrow money and start making money right away using debt. This method and borrowing money carries its own risks. But good debt can sometimes help and be profitable.

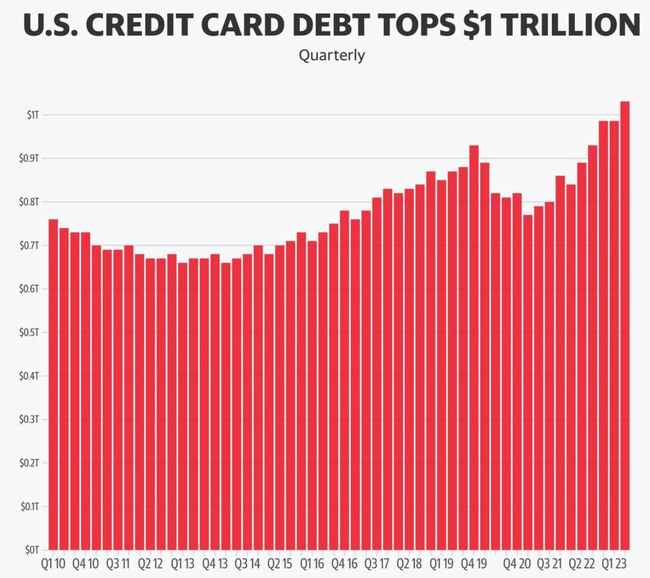

Americans are borrowing more and more money on credit cards and it doesn't look good. I wonder what people are still borrowing money for and if they are able to pay back the debt.

This chart shows how much money Americans as a whole are borrowing on their credit cards from Q1 2010 to Q1 2023 and you can see that Americans are borrowing more and more.

How do you view bad and good debt? Have you ever used good debt and what has been your experience with it?

Debt is a good servant but a bad master. 😉

They buy real estate on a mortgage or various ways to play with that good debt, re-price the property and "pull out" more cash. Fortunately, I never had bad debt and it still baffles me why people around me borrow money for a new TV with a completely unreasonable interest rate :( I could still understand it for a language course or some experience that is simply time-efficient to realize right away, but for things that you don't really need 🤔

We are seeing more and more of these bad debts. It's sad.

And then something like in The Big Short happens, right? :D

I have a mortgage, and once I pay it off, I'll take out another one. Real estate is a good investment.