Nvidia has surpassed Alphabet in market capitalization, moving into third place among the most valuable U.S. companies. This success underscores the growing influence of artificial intelligence. What does this milestone mean for the future of the tech industry?

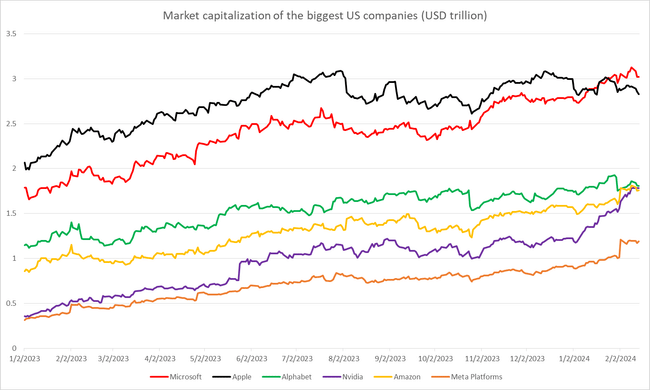

As Nvidia's stock rose more than 2% to close at $739 per share, the company surpassed the market value of Google. This small growth increased the company's market value to $1.83 trillion , compared to Google's market capitalization, which is currently $1.82 trillion. This change came shortly after Nvidia surpassed even Amazon in market value.

Nvidia's success clearly shows that it has become popular among investors due to its growth in sales of artificial intelligence chips. This is not only a significant milestone, but also a confirmation that Nvidia is better than some of the big software companies and cloud providers that are developing and integrating AItechnology into their products.

Nvidia has seen a huge demand for its AI server chips. These chips, which can cost more than $20, 000 apiece, are in demand by companies such as Google and Amazon for their cloud services. Before its focus on artificial intelligence, Nvidia was best known for itsgraphics processors, which were used in gaming computers.

Google was expected to have a head startin the world of artificial intelligence, but despite pioneering many of the techniques, $GOOG stock has only risen 45% in the past year . In contrast, Nvidia $NVDA, thanks to its focus on AI, has exceeded expectations and moved up to third place in the U.S. market, behind Apple a Microsoft.

Nvidia will report its results February 21 and analysts expect 118% annual revenue growth to $59.04 billion. This rapid expansion of the company's artificial intelligence business is a clear signal that represents growing potential and value of this company.

Disclaimer: There is a lot of inspiration to be found on Bulios, but stock selection and portfolio construction is up to you, so always do a thorough analysis of your own.