Chinese electric car maker NIO presented us with its quarterly results today, resulting in NIO stock falling 4% in premarket trading. Today, we're going to take a look at the latest quarterly report, the numbers, and most importantly, expectations for the rest of the year. Many investors may be unpleasantly surprised, but for my part, nothing has changed in the long run.

Nio ES8

Nio shares are down again today on the back of quarterly results, with $NIO reporting a wider-than-expected loss in the second quarter and weak revenue estimates. Nio is currently experiencing strong headwinds with the recent emergence of new export restrictions from Nvidia, a supplier of Nio chips. Another issue is stiff competition, supply chains and other covid lockdowns in China.

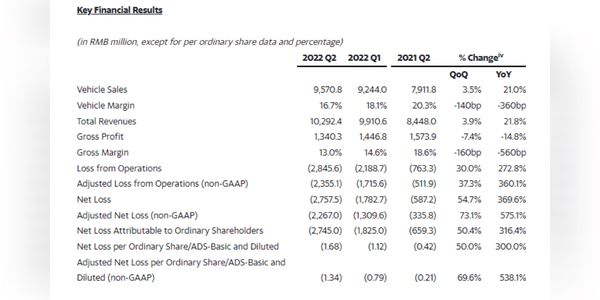

Quarterly results

- Nio's EV shipments grew 14% year-over-year in Q2. They slowed in July and August compared to June, but stayed above 10,000 in both months

- The company reported sales of $1.536 billion, up 21.8% from Q2 2021 (up 3.9%…

Chinese electric automaker Nio Inc (9866.HK), on Thursday reported a bigger quarterly loss due to a jump in costs, and said it expects deliveries to almost double in the current quarter.

Most Chinese electric vehicle (EV) makers are battling higher battery prices, intensifying competition and a rise in cost of sales.

Sales at Nio, Xpeng Inc (9868.HK) and Li Auto Inc (2015.HK) have surged in recent quarters on robust demand, helping them emerge as strong rivals to home-grown BYD Co (002594.SZ) and U.S.-based Tesla Inc (TSLA.O).

gdgf

Several growth stocks, including electric vehicle stocks, have advanced in 2023 following significant declines last year. We will discuss Wall Street analysts’ opinions about three EV stocks and pick the most attractive one.

very good

nice information