Ray Dalio still believes in the collapse of Europe: What about his $10.5 billion shorts against European companies?

Bridgewater Associates of legendary investor Ray Dalio announced in one of its statements that it has created short positions of $10.5 billion against European companies. Some at first called it a crazy move, but in the end it won Bridgewater recognition as many experts see Europe as having bigger problems than the US. The latest announcement shows (among other things) a number of new developments and, most importantly, some changes to the portfolio and its shorts.

Legendary investor Ray Dalio

Who is Ray Dalio?

Ray Dalio is an American billionaire investor and hedge fund manager who has been one of the two investment directors of Bridgewater Associates, the world's largest hedge fund, since 1985.

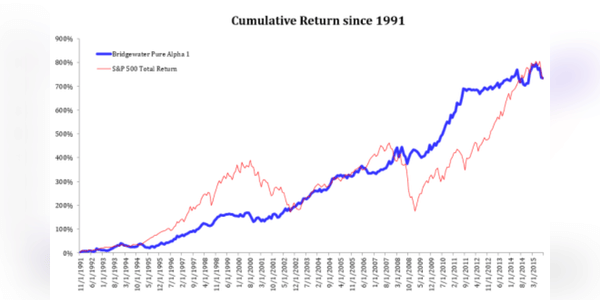

Bridgewater is the largest hedge fund in the world with approximately $150 billion in assets. Since its inception in 1975, Bridgewater has returned $52.2 billion in profits to its investors - more than any other hedge fund on the planet.

Unfortunately, I couldn't track down the complete chart until…

how am I good at trading, stocks, choosing a classy broker

Please help me