A lot of investors today are looking for, and expecting, a Fed win over inflation. For the most part, investors believe that once inflation is tamed, we will go back to the way things were. But that may not be the case at all. In fact, according to Nassim Taleb, we may be preparing for a new order in the investment world.

Do you also expect us to go back to the old and established ways once inflation is tamed? That may not be the case. In fact, according to Nassim Taleb, there may be a situation in the US markets that many investors will not be prepared for, and that many investors have not even experienced.

Nassim Nicholas Taleb

Who is Nassim Taleb? He is a former options trader, mathematical statistician and risk analyst. Taleb has been through a lot of positions, which gives him a pretty good perspective on the current situation. He is also an expert in mathematical finance, a hedge fund manager and derivatives trader, and is currently listed as a research consultant at Universa Investments .

Taleb has criticized the risk management methods used by the financial industry and warned of financial crises, subsequently profiting from the financial crisis of the late 21st century. He is an advocate of what he calls a robust society, which means a society that can withstand events that are difficult to predict.

The past

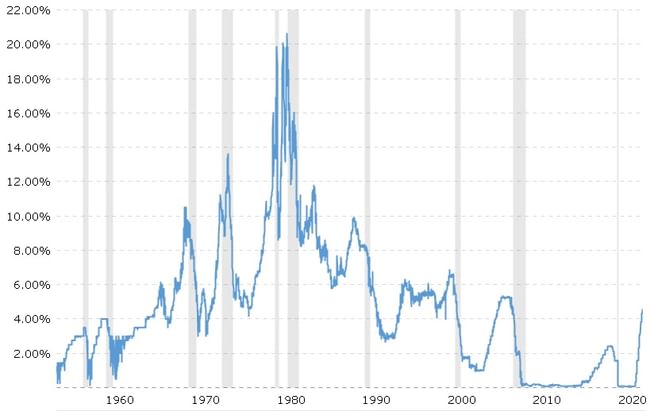

To understand what Taleb means by changing the order, we need to look a little into the past. Specifically, we will focus on interest rates. These may be the main stumbling block. If we look at the past, for the last 10 to 15 years, interest rates have been around 0, with the exception of 2019 where they peaked at just under 2.5%. So, many investors have not experienced a period where interest rates were above 1%.

In fact, a lot of people discovered the magic of investing after the big drop in the markets in 2020 where interest rates were very low again. In short, there was almost free money on the market for anyone to take. Companies, of course, took advantage of this. So companies had no problem finding money to invest in their expansion for practically free. This applies not only to companies, but also, for example, to real estate, where households were able to build a house with money that was practically free. This situation drove stock and real estate valuations to absurd heights. Taleb likens this time to Disneyland.

Disneyland is over, kids are going back to school. It's not going to be as smooth as it has been for the last 15 years.

In short, Taleb thinks that in the future retail investors won't have it as easy as they think, and a lot of them will get the school of life.

Share

According to Taleb, there is currently a fairly large generation of investors in the markets who have either forgotten the importance of cashflow or simply have not taken this importance into account. In short, the situation in the markets over the last three years has been that whatever you bought was simply going up. Investors are not afraid to invest in companies that do not produce any cash flow. They simply justify the lack of cashflow by investing in the future and in the potential of the company.

But there is one small problem. With high inflation, which the Fed is trying to tame by raising interest rates, all the cheap money has suddenly disappeared from the market. This has contributed to a cooling of the economy, with companies and consumers trying to save as much as possible while trying not to take on unnecessary debt.

This situation has contributed to a decline in major corporate investment in expansion, which is mostly financed in part by debt. Demand for mortgages for property purchases has also continued to fall. High inflation has also pushed up the prices of all products and services, thus dampening household spending quite a bit. All these factors are reflected in stock prices and also in property prices.

All these years assets have been inflating like crazy, it's like a tumour, I think that's the best explanation.

I'll give Taleb the benefit of the doubt here, because even some of the companies that have made layoffs have cited layoffs in their statements as a result of rapid growth in the past, when they are currently stagnating in place, or possibly not growing as fast. This means that they have a surplus of employees from the period of rapid growth. Quite simply, high interest rates are quite a big problem for growing companies. Especially for those that show no cash flow.

The new order

According to Taleb, but also in the chart above, we can see that interest rates are currently reaching levels that were quite common in the past. As we can see from the chart above, such large interest rate cuts were only used in crises when the Fed was using this to try to get the economy moving again as quickly as possible.

Quite simply, there is no cheap money in the market anymore. But the big problem, according to Taleb, is that investors are still counting on the fact that once the Fed succeeds in taming inflation, interest rates will go back to somewhere around 0, and cheap money will start raining down on the markets again. In short, this is the only state of affairs that most investors know.

But these investors may well be taught quite a lesson by the Fed in the future. In fact, according to Taleb, it is quite likely that we will not return to the days of cheap money. Once the Fed wins the battle over inflation, it is likely to be more cautious and keep interest rates above one or two percent. This situation will slow the growth of companies and their profits. Companies that are not generating any cash flow now will be in big trouble in this situation.

Given that Taleb sees the future regarding the markets as simply lacking cheap money that companies can use to expand in a big way, he thinks investors are now overvaluing the markets. In short, they are pricing the markets as if interest rates will continue to be near 0 in the future, and cheap money will return to the market. But Taleb says that won't happen, and investors should get used to the new environment of higher interest rates, which will cool the economy slightly.

Taleb believes that we may not see such high growth and stock returns in the future precisely because of higher interest rates. In short, we're going to go back in history when it wasn't very common for interest rates to be very close to 0, and there's going to be a whole new situation for investors that they're not used to.

WARNING: I am not a financial advisor, and this material does not serve as a financial or investment recommendation. The content of this material is purely informational.

Sources:

https://finance.yahoo.com/news/black-swan-taleb-warns-disneyland-141920232.html

https://www.macrotrends.net/2015/fed-funds-rate-historical-chart