Nobody knows what's going to happen. The fear of a recession may have receded somewhat, but this view still generally persists. But Jamie Dimon is really positive and confident that we will come out of this situation well. Why?

Predicting the economy is not easy in the current environment, but JPMorgan $JPM Chairman and CEO Jamie Dimon sees room for optimism.

Dimon noted that consumers have money and are spending it. Jobs are plentiful. Wages are rising. Home values are down. That's all good news and something the country's largest bank is watching closely every day. But despite this, there remains uncertainty in the markets-

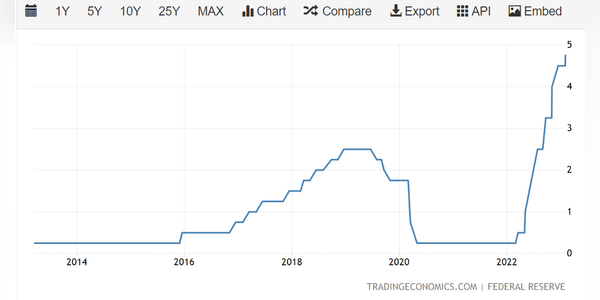

Looking ahead, Dimon assumes that the Federal Reserve implements a monetary policy of quantitative tightening that reduces the pace of reinvestment of Treasury yields. Interest rates and inflation are already rising. The war in Ukraine is affecting oil and gas trades.

"When you look at…