JP Morgan has taken a liking to these two high-yielding stocks. But are they quality stocks?

In these turbulent times, every investor is looking for a relatively defensive option. As a rule, these are income-producing assets. Such assets are favoured by JP Morgan, which has now introduced 2 high yielding stocks that will help investors build additional income into their portfolio.

While the latest inflation data shows a positive shift in the fight against inflation, it is still only a small step on the road to victory. In fact, we are still miles away from the Fed's target of 2%. So we can expect further increases in interest rates, which the Fed is using to fight inflation. Even JP Morgan CEO Jamie Dimon does not think inflation will return to normal any time soon.

So it's a good idea to include a defensive component in your portfolios in the form of high-yielding dividend stocks that will produce income for your portfolio. Here are 2 stocks that caught the eye of JP Morgan analysts.

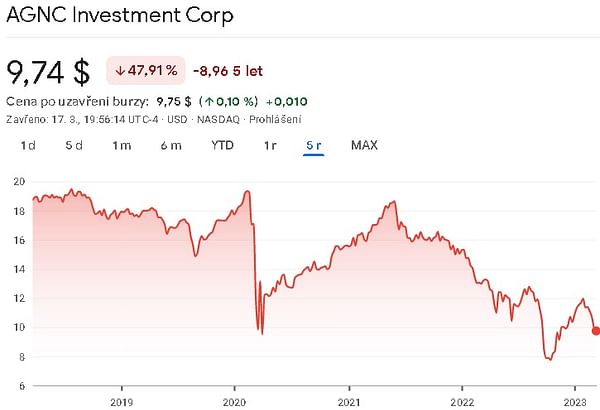

AGNC Investment $AGNC

AGNC Investment Corp. is a real estate investment trust (REIT) that specializes in investing in agency-backed securities (MBS) and collateralized mortgage obligations (CMOs).

AGNC Investment's primary business is to generate income by investing in agency mortgage-backed securities. The company raises funds through the issuance of common and preferred stock, as well as short-term and long-term debt. AGNC Investment invests primarily in fixed-rate mortgage securities, but may also invest in adjustable-rate mortgages and other securities that are guaranteed by the GSEs. The majority of the company's portfolio is invested in 30-year fixed mortgage instruments.

AGNC Investment's competitive advantage is its focus on agency mortgage securities. These securities have a government guarantee that provides a high degree of credit protection against default. This reduces AGNC Investment's credit risk and allows the company to focus on interest rate risk management. In addition, AGNC Investment's management team has significant experience in the mortgage industry, giving the Company a competitive advantage in investment selection and portfolio management.

One disadvantage of AGNC Investment is that its profitability is sensitive to changes in interest rates. When interest rates rise, the value of the company's portfolio declines, reducing the company's book value and earnings. Similarly, when interest rates fall, the value of the company's portfolio increases, which increases the company's book value and earnings. Another disadvantage is that the Company is subject to regulatory risk because changes in regulations or government policy may affect the Company's ability to invest in agency mortgage securities.

What appeals to dividend investors about this company is its high dividend yield, which is currently at 14%.

The quality of the portfolio can be gauged from the latest 4Q22 results. The bottom line is that the company realized net income per common share of 93 cents, slightly higher than the forecast of 66 cents. In addition to solid earnings, the company had $4.3 billion in cash on hand as of December 31, 2022. This amount represented 59% of AGNC's total equity.

JPMorgan analyst Richard Shane takes a bullish stance on the company in his notes.

We expect AGNC's primarily Agency MBS portfolio to lead a recovery in book value as MBS prices recover and offer investors credit protection in a deteriorating economic environment. AGNC's earnings fully cover the dividend and offer an attractive yield. AGNC is one of the best managed MREITs in our coverage universe. In our view, internal management is a long-term driver.

A total of 9 analysts have looked at this company in the past 3 months and have agreed on an average target price of $11.71 per share. We can see that the range of expectations here is quite narrow, which may indicate some confidence, and also a consensus of multiple analysts.

The thing to keep in mind when investing in this company is that it is a cyclical company that is dependent on interest rates. This means that if interest rates fall, the company will perform much better than it does now.

The Williams Companies $WMB

The Williams Companies is a leading energy infrastructure company based in Tulsa, Oklahoma. Founded in 1908, the company has grown to become one of the largest energy infrastructure companies in North America, focusing on natural gas gathering, processing and transportation.

The Williams Companies operates in several segments, including natural gas pipeline and midstream services, as well as natural gas liquids transportation and storage.

One of the key products and services provided by The Williams Companies is natural gas gathering and processing. This includes gathering and processing natural gas from various sources, including shale gas wells, and transporting the processed gas to end users such as power plants, industrial users and residential customers.

Another important segment of Williams Companies' business is natural gas transportation. The company owns and operates an extensive network of pipelines that transport natural gas across North America, from production areas to major markets. These pipelines provide critical infrastructure for the natural gas industry and ensure that natural gas can be reliably delivered to end users.

The Williams Companies also operates in the natural gas liquids (NGL) segment, which includes the transportation, storage and processing of natural gas liquids such as ethane, propane and butane. These products are used as feedstocks in the petrochemical industry, as well as in the production of fuels and heating products.

One of Williams Companies' competitive advantages is its extensive pipeline network, which provides critical infrastructure for the natural gas industry. The company also has a long history of operational excellence and has made significant investments in technology and infrastructure to improve the efficiency and reliability of its operations.

However, Williams Company also faces several challenges, including regulatory and environmental risks, as well as competition from other energy infrastructure companies. The company also operates in a volatile commodity market, which may affect its financial results.

What is also interesting about the company is its dividend yield, which is currently at 6.33%.

The company recently released its full-year and fourth-quarter 2022 results. For the full year, it reported revenue of $10.9 billion, compared to $10.6 billion in 2021. Of that, the company realized net income of $2.04 billion, or diluted EPS of $1.67. After drilling down to quarterly levels, net income was $668 million, or 55 cents per share. On a non-GAAP adjusted basis, this provided net income of $653 million on non-GAAP diluted EPS of 53 cents - a number that beat guidance by 3 cents and grew nearly 36% year-over-year.

JPMorgan analyst Jeremy Tonet has a bullish stance on the company, which he backs up with his comments.

WMB's premier existing "steel in the ground" footprint provides clear competitive advantages for executing the company's drilling strategy in the market... While the current natgas S/D dynamics are fueling fears of rig crashes and closures to balance the market, we see another piece of LNG demand balancing the market over the next one to two years and supporting an eventual increase in natgas production levels. As such, with the potential for mid-single digit EBITDA CAGR, YE22 leverage at 3.55x and top-line ESG performance, we see a constructive backdrop over time, with the current ~6% yield providing support.

A total of 13 analysts have looked at this stock recently, agreeing on an average target price of $37.91 per share. The consensus on the downside is then at $34 per share, meaning that even skeptical analysts see some modest upside potential here.

We have recently launched a new project, Bulios Dividends, whereby we manage a sample portfolio of dividend stocks as part of this project. These two stocks are not in our portfolio. If you would like to see which stocks we have selected for our portfolio that generate a stable dividend income of more than 7%, feel free to take a look here.

WARNING: I am not a financial advisor, and this material does not serve as a financial or investment recommendation. The content of this material is purely informational.