The Fed's biggest victims: These are the consequences of raising interest rates

How did a year of rising interest rates hurt stocks, indices, bonds and spur the demise of FTX and Silicon Valley Bank? That's what we'll look at in this analysis of the most critical situations the Fed has caused in its own way.

It's been a year since the Federal Reserve began raising interest rates at the fastest pace in recent history, leading to a tumultuous 12 months in the markets and impacting several (then) promising companies.

The U.S. central bank raised rates from near-zero rates to nearly 5%, making four big rate hikes in a row, the fastest pace of monetary policy tightening in decades.

The Fed's goal was to curb rising inflation, but it picked up several high-profile casualties along the way, including the failed Silicon Valley Bank and cryptocurrency exchange FTX. U.S. stocks and bonds also plummeted, while the U.S. dollar embarked on its historic journey.

Let's take a look:

Stocks and indices

Between the start of the COVID-19 pandemic and the end of 2021, US stocks took a path to ATH. Low interest rates and loose fiscal conditions helped drive stock prices rapidly higher. But then came the reversal and the hard landing.

Conversely, when interest rates rise, future cash flows for companies decline. That's because it becomes more expensive for them to borrow money.

- So a year of rate hikes by the Fed caused many stocks to plummet.

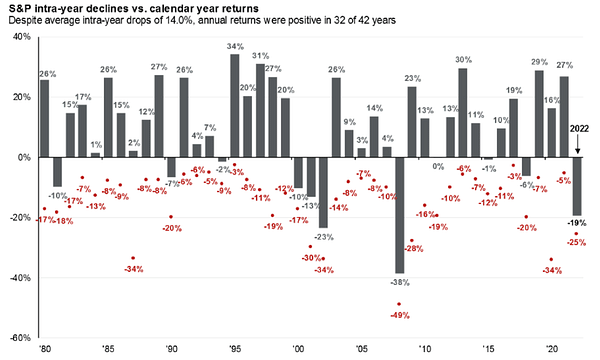

And at one point, for example, the S&P 500 fell as much as 19% over the course of the year, while the Nasdaq Composite technology index crashed 16%.

Bonds

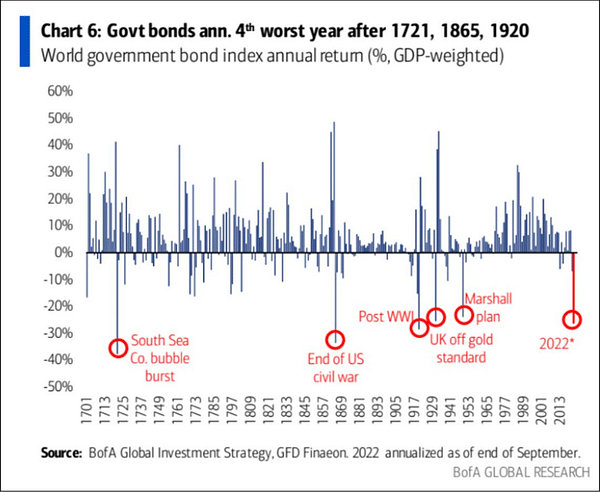

But the year was even more difficult for fixed-income investors. When interest rates rise, bond prices fall. Yields on 2-year U.S. government bonds have added 209 basis points to more than 4%, while yields on 10-year notes are 130 points higher and slightly below 3.5%.

Meanwhile, the Global Bond Index, which tracks the cost of investing in bonds around the world, plunged more than 20% in September, entering a bear market for the first time in decades.

"It's clearly been a very tough year for bond investors - the toughest they've ever experienced," said analyst John Kemp. "Only now are prices closer to fair value."

FTX

Further, the Fed's rate hikes have fueled two of the biggest corporate collapses in U.S. history - cryptocurrency exchange FTX and tech-focused Silicon Valley Bank. Rising credit costs have plunged cryptocurrencies into a brutal bear market, with the price of bitcoin $BTCUSD falling by such 40% over the past year.

FTX boss Sam Bankman-Fried reportedly responded to the crisis by using customer money to prop up his trading firm Alameda Research - now awaiting trial in the US on eight charges including fraud.

"Even though it was labeled as fraud, you could argue that the Fed's rate hike cycle exposed it because it reversed the enthusiasm for crypto, which ultimately exposed the corporate malfeasance at that company," the Deutsche Bank executive said.

SVB

Meanwhile, SVB collapsed in March 2023 - and rising interest rates were a big factor in its fall. SVB lost $1.8 billion on its bond portfolio as fixed-income prices fell, while its deposit base dried up due to the growing reluctance of tech startups to enter the stock market.

"Basically, this banking crisis is being caused by the Fed ," Larry McDonald said.

The U.S. dollar

But not all traditional assets have suffered over the past year 👇

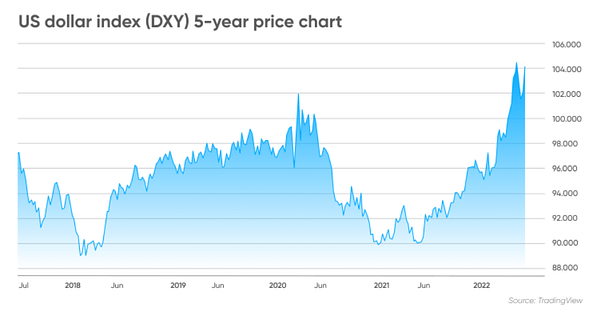

On the contrary, the U.S. Dollar Index saw a 16% increase between March and September. Rising interest rates in a country tend to strengthen its currency as they attract foreign investors seeking higher returns. The U.S. probably doesn't have interest rates at the level of its peers yet and will likely end up with a higher terminal rate, which could support the dollar even more.

"It's been a very exceptional year for the dollar as the Fed has been conducting the most aggressive monetary tightening in decades," said analyst Craig Erlam

Conclusion

So we can conclude that the Fed's interest rate hikes had a big impact on the markets and several promising companies, including Silicon Valley Bank and cryptocurrency exchange FTX. The rate hike led to a fall in stocks and bonds while the US dollar strengthened. Unfortunately, this is a harsh reality and the kind of sobering up from previous years that was needed.

Please note that this is not financial advice.