Kevin O'Leary claims that the government has nationalised the banking sector. Instead, it favours this type of stock.

The interventions that the government has made recently to bail out some threatened banks have split the public in two. The first half sees these interventions as a salvation and the other half is sceptical about them. This second half includes Kevin O'Leary, who has said that he will never put his money in bank stocks again.

The recent failures of Silicon Valley Bank and Signature Bank have left investors and depositors spooked. Shark Tank star Kevin O'Leary believes that this should change the way investors view the banking industry, as he believes that the government has effectively nationalized it.

Over the weekend, they effectively nationalized the U.S. banking system. It's no longer a risk. It's no longer private in any sense. It is now backed by the government, ultimately by the taxpayer.

So the actual problem that O'Leary sees here with this "nationalization" is the potential tightening of regulations on these banks. So, he says, investors will have to expect that new regulations will have a negative impact on the profitability of the banks, which will be reflected in share prices.

I would never put my money in bank stock again.

https://www.youtube.com/watch?v=0ns9d9b5V8Q

As a result, he advises investors to look at dividend stocks instead.

When I started doing research, I discovered an interesting fact that changed my investment philosophy forever.

According to O'Leary, dividends have been responsible for 71% of market returns over the past 40 years, making them a crucial consideration for investors looking for long-term returns. In particular, he recommends two stocks he holds in his flagship ETF, the ALPS O'Shares US Quality Dividend ETF $OUSA.

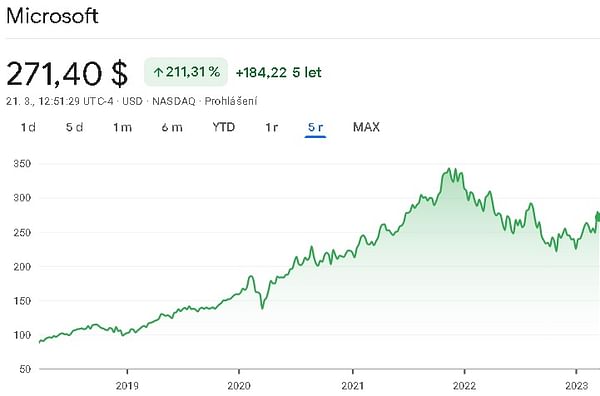

Microsoft $MSFT

The first company that O'Leary recommends is Microsoft $MSFT. Despite being a technology stock, Microsoft has a long history of paying dividends, with a 10% increase in its quarterly dividend announced in September 2022. At the current stock price, Microsoft provides an annual dividend yield of just over 1%. In addition, Microsoft is currently the largest holding in O'Leary's $OUSA with a weight of 5.08%.

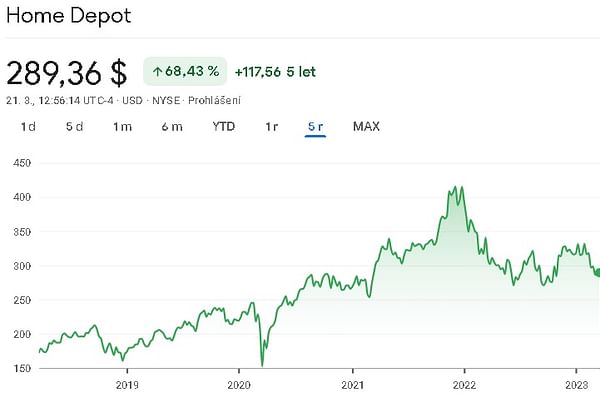

Home Depot $HD

The second company that O'Leary recommends is Home Depot $HD. Home Depot is a brick-and-mortar retailer that has shown impressive growth during the pandemic, with sales growing nearly 20% to $132.1 billion in fiscal 2020. Home Depot has continued its momentum as the economy has reopened, with fiscal 2022 sales up 4.1% year-over-year and earnings per share improving 7.5%. Last month, the company raised its quarterly dividend 10% to $2.09 per share, up 2.9% at the current share price. Home Depot represents 4.81% of the weight in O'Leary's $OUSA.

O'Leary's strategy of investing in dividend stocks can provide investors with a stable source of income while offering the potential for long-term growth. Given the recent failures of Silicon Valley Bank and Signature Bank, O'Leary's approach of focusing on safe and sound dividend stocks like Microsoft and Home Depot can help investors weather uncertain economic times.

We recently launched a new project, Bulios Dividends, where we manage a model portfolio of dividend stocks. These two stocks are not in our portfolio. If you would like to see which stocks we have selected for our portfolio that generate a stable dividend income of more than 7%, feel free to take a look here.

WARNING: I am not a financial advisor, and this material does not serve as a financial or investment recommendation. The content of this material is purely informational.