SunPower Analysis: Huge Growth Opportunity for Bold Investors

The future of the energy industry is bright and it is important to follow the companies that want to be there. In this article, we'll take a look at what makes SunPower Corporation so unique and how it's dealing with competition in the solar industry.

A basic overview

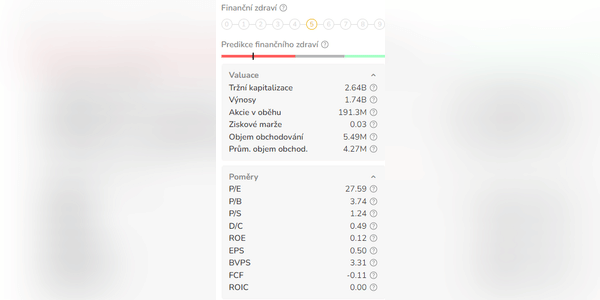

SunPower Corporation $SPWR is an American company that specializes in manufacturing solar panels and solar solutions for homes, businesses, and government organizations.

Competition

The solar industry is generally considered to be a very promising sector with great growth potential. CSIQ has superior solar panel manufacturing technology and a strong financial track record, allowing it to become a key player in the industry. However, the competition in the solar industry is very high and depends on many factors such as government programs, economic situation and the development of energy prices in the market.

With the growing interest in…