Elon Musk has come up with a proposal to end this banking crisis

The banking sector is currently going through probably the most difficult test since 2008, when we had the Great Depression. There are all sorts of proposals being floated everywhere to prevent the contagion in the banking sector. And Elon Musk has not been left behind, and he has also come up with a solution.

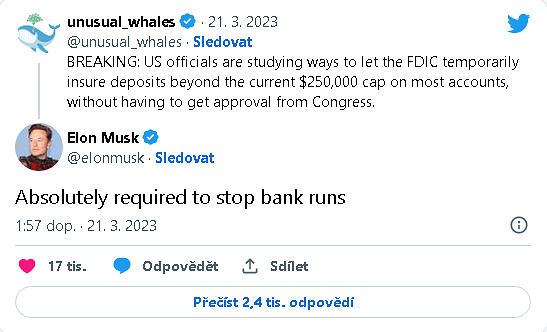

The ongoing crisis of confidence in the banking sector has led to the collapse of several large banks, prompting billionaire Elon Musk to call on the federal government to guarantee all deposits to stop bank runs. The current turmoil has been compared to the great financial crisis of 2008 with fears of contagion as the financial industry is still reeling from the fallout of those events.

How did it start?

Silicon Valley Bank $SIVB, the institution at the heart of the crisis, suffered a staggering net loss of $1.8 billion in its bond portfolio. The loss stemmed from the bank's inability to anticipate rising interest rates, leading to a run on SVB as it sought to raise $2.25 billion in cash withdrawals from affected customers.

https://www.youtube.com/watch?v=YUCEms8KMkA

Investors are increasingly concerned about a potential domino effect across the financial sector as it is believed that many regional banks may have made similar bets to SVB. This fear has manifested itself in a rapid decline in bank stocks and massive deposit withdrawals from banks perceived as fragile.

One victim of the crisis is Swiss banking giant Credit Suisse, which faced a staggering $10 billion outflow in a single day. That led Swiss authorities to force rival UBS to acquire the troubled bank for just $3.24 billion, a move that left some Credit Suisse investors and bondholders with significant losses.

So where is the problem?

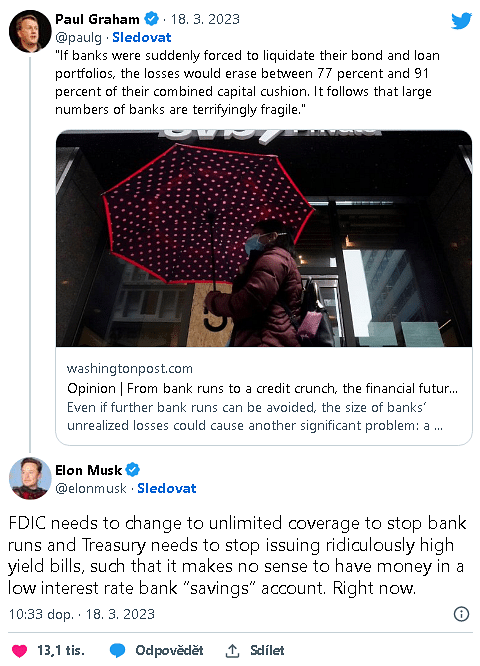

At the heart of the problem is the Federal Deposit Insurance Corporation's (FDIC) current limit on insured deposits, which is $250,000. This limit has been identified as a key factor driving bank runs, as customers with deposits in excess of this amount fear losing their savings in the event of a bank failure. This is particularly problematic for regional banks, which play a key role in commercial and industrial lending, as well as in financing residential real estate projects.

Elon Musk, CEO of Tesla and founder of SpaceX, has proposed that the federal government guarantee all deposits and lift the FDIC's $250,000 limit to combat the ongoing crisis and prevent banks from stopping essential funding for businesses and consumers. Musk says such a move is vital to stopping bank runs and restoring stability to the financial sector.

The billionaire's proposal follows a series of emergency measures taken by regulators in an effort to restore calm and protect depositors. Those measures include guaranteeing all deposits for customers of SVB and Signature Bank in New York, which was also shut down by regulators after an earlier bank run. In addition, the Federal Reserve has established a new facility to provide emergency funding to distressed banks to avert a liquidity crisis.

With the financial industry on edge and the effects of the crisis still unfolding, it remains to be seen whether the federal government will heed Musk's call to action and adopt his proposed solution to stop bank runs and restore confidence in the banking sector.

WARNING: I am not a financial advisor, and this material does not serve as a financial or investment recommendation. The content of this material is purely informational.