A dividend of almost 10% and improving results? This is Ambev SA, one of the leaders in its field

The growth in sales, net income and margins in the latest quarter suggests that Abev could rebound to the upside. However, if this doesn't sound like enough to you, the dividend yield, which is close to 10%, clearly appeals. Let's take a look at that.

Ambev SA $ABEV is a Brazilian company that specializes in the production and distribution of beverages. The company produces and sells a wide range of beverages, including beer, soft drinks, water, juices and energy drinks. Ambev SA is the largest brewery in Latin America and one of the largest in the world. In addition to the production and distribution of beverages, Ambev SA also engages in advertising, marketing and sponsorship of sporting and cultural events. The company was founded in 1999 and is headquartered in São Paulo, Brazil.

Ambev SA is a global company that operates mainly in Latin America, but also in some other regions of the world. The company has offices in Brazil, Argentina, Colombia, Peru, Ecuador, Paraguay, Uruguay, Bolivia, Dominican Republic, Costa Rica, Panama and Nicaragua. In addition, Ambev SA also has offices in Canada and in some European countries such as Belgium, Germany and the United Kingdom. The company exports its products to more than 20 countries worldwide.

Does the company have any competitive advantages?

Wide range of products: Ambev SA produces and sells a wide range of beverages, including beer, soft drinks, water, juices and energy drinks. This diverse product mix allows it to appeal to different customers and remain competitive in the market.

Strong distribution network: Ambev SA has a strong distribution network that covers the whole of Latin America and some other regions of the world.

Strong brands: Ambev SA has strong brands such as Skol, Brahma, Antarctica, Guaraná Antarctica and others. These brands are well known and popular among consumers, which helps it to maintain its position in the market.

Collaboration with strategic partners: Ambev SA works with strategic partners such as AB InBev, PepsiCo and Nestlé to take advantage of their expertise and reach new markets. These collaborations allow it to gain access to new customers and expand its product portfolio.

Of course, it must not be forgotten that investors see Brazil as one of the riskier countries, where the situation may not be stable in terms of the economy and politics, which could have an impact on the company over time.

Finance

Ambev SA's total revenue shows an increase from US$52.6 billion in 2019 to US$79.7 billion in the last 12 months ending December 30, 2022. This represents a 51% increase in revenue compared to 2019. Cost of revenue (COGS) has also increased from US$21.7 billion in 2019 to US$40.4 billion in the last 12 months, an increase of 86%. Gross profit (gross profit) increased from $30.9 billion in 2019 to $39.3 billion in the last 12 months, an increase of 27%.

- Fluctuations in raw material prices are likely behind the rise in costs.

Operating expenses (operating expense) increased from $14.8 billion in 2019 to $21.9 billion in the last 12 months, an increase of 48%.

Net income (operating income) increased from $16.1 billion in 2019 to $17.4 billion in the past 12 months, an increase of 8%.

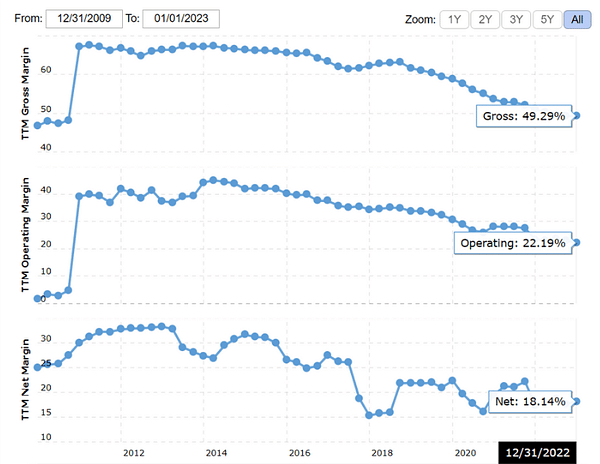

Ambev SA has seen growth in total revenue and profit, but has also had to deal with an increase in production and operations costs. The cost of production is rising faster than total revenue, which may be a result of rising raw material prices or production and distribution costs. Although the company has seen an increase in profits, the development of Other Income Expense (OIE) is an area for attention as it has deteriorated and negatively impacted overall net profit.

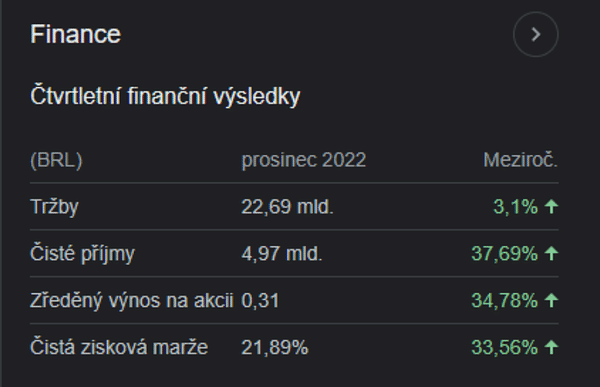

A look at the company's latest quarterly results

Margins

Balance Sheet

Ambev SA's Balance Sheet shows that total assets increased from $101.7 billion in 2019 to $138.6 billion in 2022. This represents an increase of 36%. Total liabilities, including minority interests, increased from USD 39.2 billion in 2019 to USD 54.6 billion in 2022, an increase of 39%.

The company has sufficient working capital (Working Capital) in recent years. Conversely, their working capital is worse off and has gone into negative numbers. Invested Capital (Invested Capital) has increased from $62.2 billion in 2019 to $83.1 billion as of December 30, 2021, an increase of 34%.

Overall, Ambev SA has strong financial resources and a stable financial position, which allows it to grow its business and invest for the future.

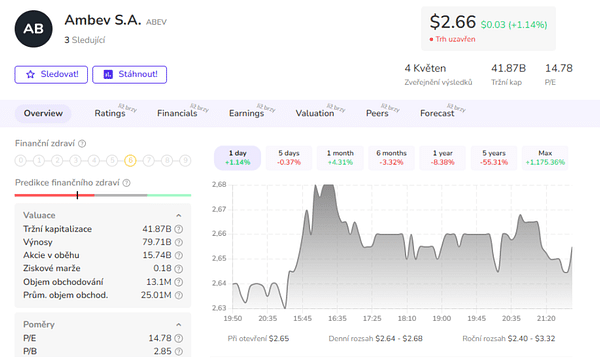

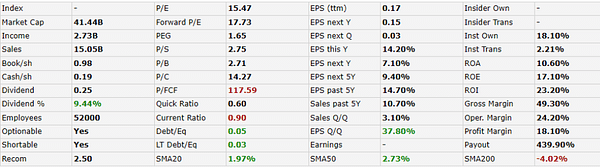

Valuation

Ambev has a market capitalization of $40.97 billion and a P/E of 15.29 and a forward P/E of 17.53, indicating that the market expects the company to grow. The PEG (price/earnings-to-growth) ratio is 1.63, suggesting that the stock may be slightly overvalued due to earnings growth.

Thecompany pays a dividend of $0.25 with a dividend yield of 9.54%. In the past years, the company's earnings have grown at 14.2% per year. Over the next five years, earnings are expected to grow by such 9.4% per year.

The P/B and P/S ratios are 2.71 and 2.75, which is slightly above the industry average, but not terrible. ROA (return on assets) is 10.6% and ROE (return on equity) is 17.1%.

The company's dividend yield and relatively low debt may be attractive to investors looking for stable investments. Given the company's relatively stable financial position and positive results in recent years, the predicted target price ($3.5) may be realistic, in my opinion.

- What do you think of the company? 🤔

Please note that this is not financial advice. Every investment must go through a thorough analysis.