UFP Technologies: Can improving results continue to pull the company up?

UFP Technologies $UFPT is a well-established company that has a strong market position. Its financial results are positive and show the stability and growth of the company. So can UFPT stock be a good choice for an investor as well?

UFP Technologies $UFPT is an American company that manufactures specialized packaging and insulation materials for the industrial, medical and automotive sectors. Their products include protective packaging for sensitive products, soundproofing materials for the automotive industry, and medical cushions and pads, to name a few. The company also specializes in the production of high-quality insulation materials for special applications such as refrigeration unit insulation, acoustic cladding and more.

UFP Technologies was founded in 1963 in the U.S. As of today, the company has offices and manufacturing facilities in the U.S., Canada, Europe and Asia and has about 1,500 employees, according to data that is a few months old.

Main products:

Protective packaging for sensitive products - UFP Technologies manufactures various types of protective packaging for sensitive products such as electronic components, pharmaceuticals, cosmetic products and more.

Automotive soundproofing materials - The company manufactures soundproofing materials that reduce noise and vibration in automobiles to improve passenger comfort.

Medical Cushions and Pads - UFP Technologies manufactures various types of medical cushions and pads for use in hospitals, rehabilitation centers and home care.

Insulation materials for special applications - The company specializes in manufacturing high quality insulation materials for special applications such as refrigeration unit insulation, acoustic tiles and more.

Customized Products - UFP Technologies focuses on individual solutions for each customer and also offers custom-made products that are not commonly available in the market and meet the exact needs of the customer.

Competitive advantages

UFP Technologies boasts several competitive advantages and specialized products that set it apart from other packaging and insulation manufacturers.

One of the company's competitive advantages is its high level of technical know-how and innovative approach to developing new materials and products. UFP Technologies has its own research and development teams working on improving existing products and creating new solutions for different industries.

Another advantage is the specialization in the production of custom-made products tailored to the customer's needs. The company focuses on individual solutions for each customer, which allows it to offer special products that are not commonly available on the market and meet the exact needs of the customer.

Some of the specialty products that are rarely offered and are in high demand include bioabsorbable materials for medical applications, "silent packaging" for transportation vehicles, or highly thermally insulated materials for industrial applications.

Thanks to the above competitive advantages and specialised products, UFP Technologies maintains a strong market position and continues to win new customers.

Finance

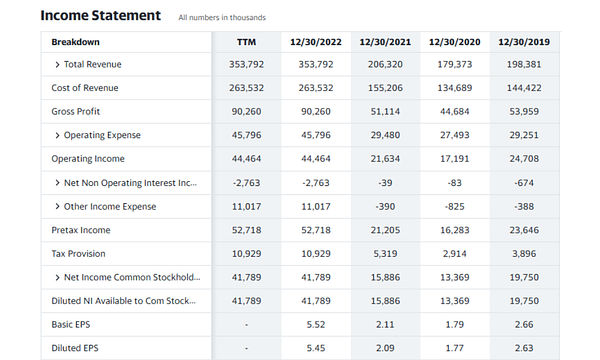

The company's revenue has increased by more than 75% since 2019, reaching $353.8 million in the most recent 12-month reporting period.

- The cost of manufacturing packaging and insulation materials (cost of revenue) makes up the majority of the total costs and was $263.5 million in the last reporting period.

- The company's gross profit was $90.3 million in the latest reporting period, representing a gross profit margin of 25.5%.

- Total operating expenses were $45.8 million in the most recent year.

- The company's total operating income was $44.5 million in the latest year and has been increasing regularly over the last few years.

An analysis of the profit and loss statement shows that UFP Technologies is making a solid profit while slowly increasing its revenues.

Thus, overall, the analysis of the profit and loss statement of UFP Technologies shows that the company's development and profitability is positive.

Balance Sheet

The company'stotal assets reached $378.2 million at the end of 2022, an increase of more than 80% compared to 2019.

The company'stotal liabilities , including minority interest (total liabilities net of minority interest), stood at $140.6 million in 2022.

TheCompany's total equity (total equity gross minority interest) was $237.5 million in 2022.

The company has solid financial resources and operates with positive capital, which allows it to invest in its growth and development. Overall, the analysis of the balance sheet of UFP Technologies shows that the company has a positive development and stability, which can contribute to its further growth and success in the market.

Cash Flow

The company'soperating cash flow was $17.7 million in the last year, a slight decrease from the previous year.

The Company'sinvesting cash flow was $1.3 million in the most recent year under review. The company has spent significant funds on investments in previous periods, which I include only as an explanatory note as the figure was negative in 2020.

The Company'scash flow in the most recent year under review was -$25.9 million. The main reason for the negative value was the debt repayment.

Overall, the cash flow analysis of UFP Technologies shows a slight decrease in operating cash flow and a negative value of financial cash flow due to debt repayment. However, the company has spent funds on investments and modernization in recent years, which may contribute to further growth and success in the market.

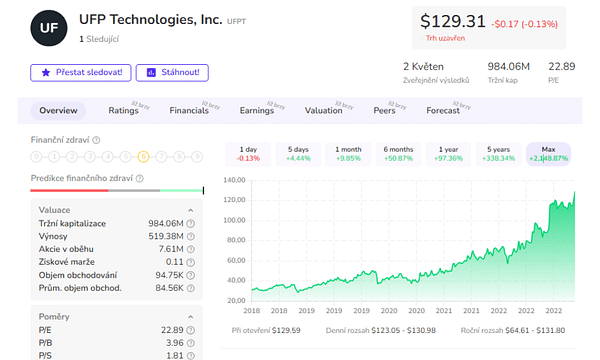

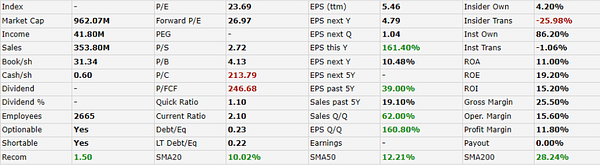

- The company is well established and has solid financial results. Its market capitalization stands at $962.07 million and based on the P/E ratio, the company's stock is relatively expensive, but at the same time, it points to the company's good performance. The company has stable and growing earnings (income), which indicates good performance and stability in the market.

- The P/B ratio shows that the stock is relatively expensive, but at the same time indicates the company's quality assets. The company has high profitability (ROI, ROA and ROE) which indicates efficient use of funds and assets.

Based on these factors, it can be expected that the company will be able to maintain its market position and will be able to continue to grow. Given the solid financial performance, it is also likely that the company will be able to pay dividends to its shareholders.

Analysts' forecasts

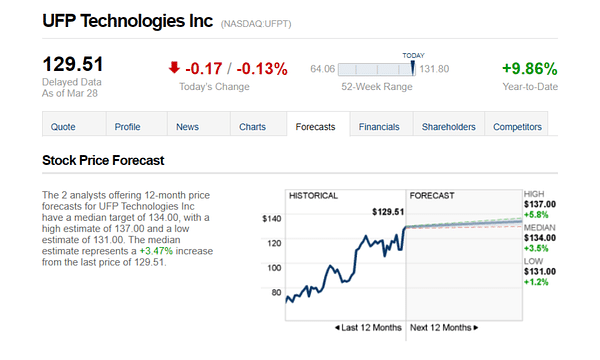

The 2 analysts offering 12-month price forecasts for UFP Technologies Inc have a median target of 134.00, with a high estimate of 137.00 and a low estimate of 131.00. The median estimate represents a +3.47% increase from the last price of 129.51.

- What do you think about the company? 🤔

Please note that this is not financial advice. Every investment must go through a thorough analysis.