Cardinal Health, one of the world's largest companies in the pharmaceutical sector, is teetering on a knife edge. On the one hand, it benefits from a huge demand for medical products, and on the other hand, it is crushed by high costs and a debt in excess of $5 billion. So is the company on the verge of improvement or is it going to get worse?

Cardinal Health $CAH is an American company that specializes in healthcare products and services. Its core businesses include distributing drugs and medical devices, providing information technology to the medical device and pharmaceutical industries, managing medical facilities, and providing clinical services. The company also manufactures and sells its own branded medical products such as surgical gloves, protective masks, and other medical supplies. Cardinal Health operates primarily in the U.S. market, but also has a global presence.

Cardinal Health is a major player in the medical products and services market. Its wide range of products includes drugs, medical devices, surgical instruments, and medical supplies. The company operates primarily in the US market, where it has a strong presence and is one of the largest distributors of drugs and medical supplies.

The company's competitive advantages include a wide range of products and services, high product quality, advanced technology and an efficient distribution network. Cardinal Health also focuses on providing comprehensive healthcare solutions that include not only product supply, but also consulting and management of healthcare facilities.

Another advantage of the company is its global reach and ability to provide services and products worldwide. Cardinal Health also has strong relationships with the pharmaceutical industry and many healthcare facilities, which allows it to provide favorable pricing and other benefits to its customers.

Finance

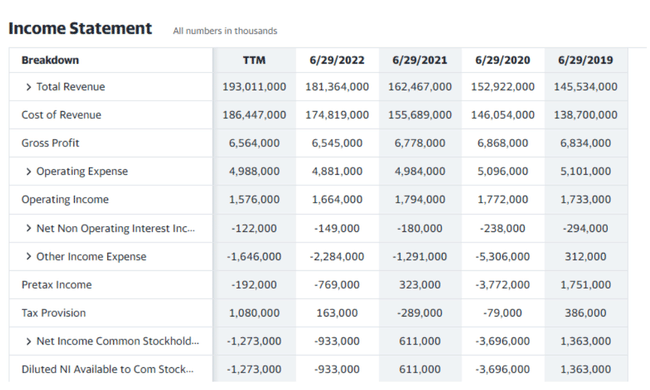

If we look at the financial performance of the company, it can be seen that it has seen an increase in revenue in recent years. For example, in 2022, the company will have revenues of $193 billion, which is significantly higher than the $146 billion in 2019. This growth was mainly due to the increased demand for medical products as a result of the COVID-19 pandemic.

On the other hand, it can be seen that the company also has high costs for the production and distribution of its products. For example, the cost of manufacturing and distribution in 2022 will reach $186 billion, which is more than 80% of the total revenue. This can be attributed to rising raw material prices and transportation costs, for example.

Balance Sheet

If we look at Cardinal Health's balance sheet, we can see that the company has an overall stable financial position. The company's total assets will reach $43.9 billion in 2022, which is slightly less than the $44.5 billion in 2021. On the other hand, the company's total liabilities in 2022 are $44.6 billion, which is higher than the previous year.

But the company has a negative equity value, which means it has more liabilities than assets. However, it can be seen that in 2022 the situation has improved from the previous year when the company had a positive equity value.

If we look at the capitalization of the company, we can see that the total capitalization value in 2022 was $4 billion. However, the total value of the company's debt in 2022 is $5.3 billion, which is higher than the previous year.

Cash Flow

If we look at Cardinal Health's cash flow, we can see that the company has positive cash flow from operations. For example, in 2022, cash flow from operating activities reaches $3.2 billion, which is more than the previous year. This can be attributed to factors such as increased sales and reduced manufacturing and distribution costs. On the other hand, cash flow from financing activities was negative.

Thus, overall, we can see that the company has a positive free cash flow. For example, in 2022, the free cashflow reached a value of $2.8 billion. This allows the company to invest in new projects and acquisitions, while paying off its liabilities and debts.

The P/E is not shown here, likely due to negative earnings per share (EPS) in the last 12 months. The company has a relatively low level of insider ownership (0.6%) and most of the shares are free float (256.52 million).

PEG is also not listed, likely due to negative earnings per share in the last 12 months. The company posted negative earnings per share in the past 12 months (-4.65 dollars per share) and is expected to return to earnings in the next year ($6.34 per share).

Institutional ownership is very high (93%) and the short float ratio is low (1.61%). The company has a relatively high ROE (94.3%), but an overall negative ROA (-2.9%). And lest I forget, the company also pays a dividend of 2.5%, which Cardinal Health began paying in 1983 and has been paying and increasing regularly ever since.

Analyst Predictions

The 15 analysts offering 12-month price forecasts for Cardinal Health Inc have a median target of 86.00, with a high estimate of 94.00 and a low estimate of 76.00. The median estimate represents an increase of +8.54% from the last price of 79.23.

- What do you think about the company? 🤔

Please note that this is not financial advice. Every investment must go through a thorough analysis.