Sysco is the world's leading distributor of food and related products with a market capitalization of $37 billion. While the company has a high debt ratio and pays most of its earnings in dividends, its business generates strong cash flow and growing demand for foodservice indicates a promising future.

Sysco $SYY is a leading global distributor of food and related products. The company supplies food and equipment to restaurants, hotels, schools, hospitals and other customers. Sysco has more than 67,000 employees and operates more than 330 distribution centers worldwide.

Founded in 1969, Sysco is headquartered in Houston, Texas. It is the market leader in foodservice distribution with a market share of approximately 17% in the United States and Canada. Sysco offers more than 600,000 products, ranging from fresh food to kitchen equipment to cleaning products.

Sysco operates in North America, Europe, the Middle East, Asia and the Pacific Rim. The company's largest markets are North America, the UK and Ireland. Thanks to its extensive distribution network and logistics, Sysco can deliver products virtually anywhere.

Sysco's main competitive advantages include:

-Expansive product offering: Sysco offers the widest selection of food and equipment in the industry. This allows customers to easily shop from one distributor.

-Logistics and distribution.

-Low cost: Sysco's high volume of purchases allows it to source products at competitive prices and pass these savings on to customers.

-Strong brand: Sysco is the most trusted brand in the industry with a long history and an excellent reputation. This attracts new customers.

-Professional service. This helps customers to be successful. With these factors, Sysco is well positioned to continue to grow and remain a leader in its industry. With the growing demand for food service around the world, Sysco has a promising future ahead of it.

Finance

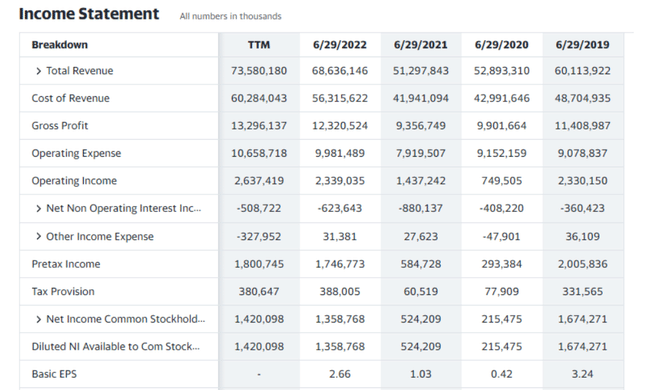

Sysco's overall sales are growing, up 22% over the last 4 years. The biggest increase was between 2020 and 2021, when revenues grew by 34%, likely related to the recovery from the COVID-19 pandemic.

Gross profit is growing slower than sales, up 17% over 4 years. This shows that costs are rising faster than sales, which reduces margins. Furthermore, gross profit then grows by 32% between 2020 and 2021. Operating costs account for more than 70% of sales, which is quite high and limits profit growth.

Operating profit and profit before tax have fluctuated over the last 4 years. They have recovered in 2021 after a pandemic-related slump in 2020. Net profit is growing slower than sales, up 18% over the last 4 years.

Earnings per share is growing slower than net income due to higher share count. However, earnings per share have more than doubled in 4 years, a positive trend.

Overall, Sysco's financial results show solid growth, but margins and profits are growing slower than sales due to rising costs. Controlling costs and improving operational efficiency will be key to improving Sysco's profitability. If Sysco can contain the rate of cost growth, it should be able to generate higher and more stable profits in the future. Sysco's financial position is strong overall, which is positive news for shareholders.

Balance Sheet

Total assets have grown by 23% over the past 4 years. The largest increase was between 2019 and 2020, when assets grew 26%, likely due to the acquisition of Sterno Products in December 2019.

Total liabilities grew faster than assets, up 34% over 4 years. This leads to a lower equity ratio, which fell from 58% in 2018 to 47% in 2021.

Overall, the balance sheet shows that Sysco has significantly increased debt in recent years in order to grow. While debt ratios remain at satisfactory levels, the continued high rate of debt growth could be unsustainable and threaten Sysco's financial stability going forward. Limiting debt growth and ensuring sufficient earnings and cash flow growth will be key to maintaining a strong financial position in the future.

Cash Flow

Operating cash flow is stable and has grown by 22% over 4 years. This is positive and shows that Sysco's operational performance is improving. Operating cash flow covered capital expenditure by 1.6 times which is satisfactory.

Investing cash flow is negative as Sysco continuously invests to grow the business. Investments have increased by 69% in 4 years, mainly due to large acquisitions.

Financial cash flow is negative as debt repayments and share buybacks exceed new borrowings. Overall, cash flow is down 19%. The lower cash flow is positive as it shows Sysco's lower reliance on debt financing.

Sysco's net cash decreased 46% over 4 years, reflecting negative investment and financing flows. Lower net cash may pose a risk to short-term liquidity if operating cash flow were to decline.

Free cash flow, which is available for dividend payments and debt reduction, has increased by 15% over 4 years. The ratio of free cash flow to net profit is 81%, showing that most of Sysco's profits are converted into cash.

Overall, cash flows indicate that Sysco's operating performance is improving. However, high investments and debt repayments are limiting the growth of cash reserves and funding most of Sysco's growth. To maintain a strong financial position, Sysco will need to ensure a balance between investing in future growth and generating sufficient cash to repay debt. By limiting debt growth and investments to sustainable levels, Sysco can increase its financial flexibility.

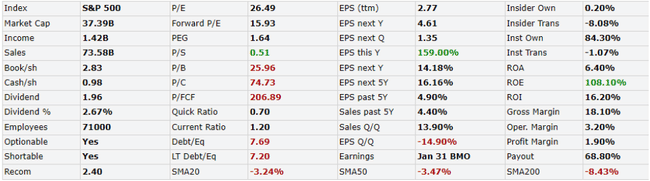

Sysco has a market capitalization of $37.4 billion with a share price of $73.48. The price-to-earnings (P/E) ratio is 26.49, which is higher than the average of the S&P 500 index, indicating that Sysco's stock is relatively expensive relative to the index.

The price-to-sales ratio of 0.51 is lower than the industry average, which is positive and shows that Sysco is generating strong earnings per share. The price-to-book ratio of 25.96 is high, indicating that the market is valuing Sysco at a premium to its book value.

The debt-to-equity ratio of 7.69 is higher, but understandable given the company's actions. While Sysco has a relatively strong capital structure, it should limit further debt increases to remain financially flexible.

Sysco has a solid operating margin of 3.2%, but its net margin of 1.9% is below the industry average. Improving net margin will be a key factor in boosting Sysco's stock value.

The dividend of 2.67% provides a decent yield at a payout ratio of over 68%. A lower payout ratio would allow Sysco to reinvest more cash into growing the business, however, the company is focused on rewarding shareholders.

Analyst expectations

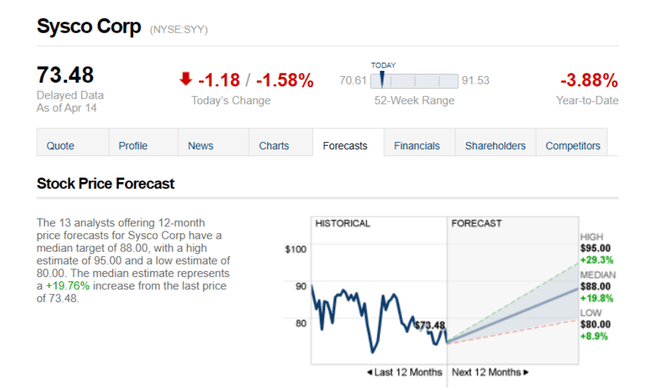

The 13 analysts offering 12-month price forecasts for Sysco Corp have a median target of 88.00, with a high estimate of 95.00 and a low estimate of 80.00. The median estimate represents an increase of +19.76% from the last price of 73.48.

- What do you think about the company? 🤔

Please note that this is not financial advice. Every investment must go through a thorough analysis.