Feed

Bulios Black

Acest utilizator are acces la conținut exclusiv, instrumente și caracteristici ale platformei Bulios datorită abonamentului său.

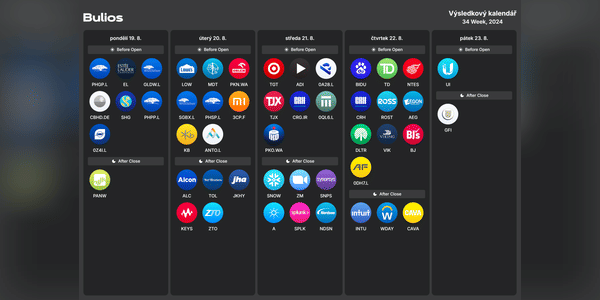

🗓️ Perspectivele de investiții ale săptămânii!

Săptămâna aceasta va oferi evenimente interesante, de la rezultatele principalelor lanțuri de magazine, la conferințe pe teme de tehnologie, la date de pe piața imobiliară și de la companiile industriale europene.

✈️ Luni

Rezultate înainte de deschiderea piețelor:

Ryanair $RYAOF - Transportatorul low-cost subliniază modul în care...

Citește mai mult

Bulios Black

Acest utilizator are acces la conținut exclusiv, instrumente și caracteristici ale platformei Bulios datorită abonamentului său.

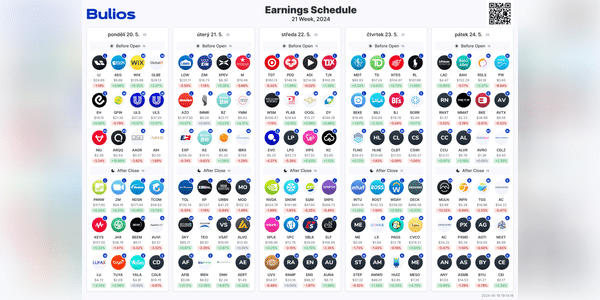

📅 Evenimentele-cheie din această săptămână: Rezultate corporative, date macro și dominația tehnologiei !📊

Noua săptămână aduce sezonul câștigurilor în plină desfășurare, împreună cu indicatori economici importanți. Personal, mă voi concentra pe rezultatele Nvidia, Dell, HP și Salesforce în timp ce datele macro precum PIB pe Q4 și datele privind inflația PCE vor fi cu siguranță...

Citește mai mult

Zobrazit další komentáře

Bulios Black

Acest utilizator are acces la conținut exclusiv, instrumente și caracteristici ale platformei Bulios datorită abonamentului său.

Vom vedea cum rezultatele $NVDA ies mâine și cum reacționează alte stocuri.

Bulios Black

Acest utilizator are acces la conținut exclusiv, instrumente și caracteristici ale platformei Bulios datorită abonamentului său.

🗓️ Evenimentele cheie care nu trebuie ratate în această săptămână!

Urmăriți cu atenție piețele în această săptămână, deoarece se anunță evenimente importante ce pot aduce atât oportunități, cât și provocări interesante. Nvidia va fi în centrul atenției, având în vedere că urmează să își publice rezultatele financiare, eveniment ce va influența semnificativ sectorul tehnologic.

🌍...

Citește mai mult

Zobrazit další komentáře

Bulios Black

Acest utilizator are acces la conținut exclusiv, instrumente și caracteristici ale platformei Bulios datorită abonamentului său.

Există din nou câteva evenimente interesante. Voi fi interesat să văd unele rezultate, iar ziua de luni ar putea fi și ea interesantă.

Bulios Black

Acest utilizator are acces la conținut exclusiv, instrumente și caracteristici ale platformei Bulios datorită abonamentului său.

Rezultatele căror companii vă vor interesa săptămâna viitoare?

Eu sunt curios să văd rezultatele de la $MDT, $PKN.WA și poate $LOW.

Zobrazit další komentáře

Sunt curios în legătură cu $TGT și apoi cum se va descurca sectorul construcțiilor, mi-ar plăcea să găsesc o companie la un preț interesant dacă nu este prea târziu, deoarece, odată cu scăderea treptată a ratelor și anul viitor, ar putea exista din nou mai multe construcții datorită banilor mai ieftini.

Bulios Black

Acest utilizator are acces la conținut exclusiv, instrumente și caracteristici ale platformei Bulios datorită abonamentului său.

Lowe's $LOW a raportat rezultatele astăzi. Deși acestea nu au fost catastrofale, cu siguranță nu au fost pozitive, reflectându-se într-o scădere cu 2% a acțiunilor. Chiar dacă nu dețin acțiuni Lowe's în portofoliul meu, dacă ar trebui să aleg din acest sector, m-aș orienta către acțiunile $HD.

Zobrazit další komentáře

Rezultatele au fost în final OK pentru mine. Avem o perspectivă mai proastă pentru acest an, dar acțiunile au scăzut în concordanță cu acest lucru. Dacă societatea are un EPS și vânzări mai mici, nu poate ajunge la un nou maxim. Sau, de fapt, poate, dar ne înțelegem😁.

Bulios Black

Acest utilizator are acces la conținut exclusiv, instrumente și caracteristici ale platformei Bulios datorită abonamentului său.

Care rezultate ale companiilor vă atrag atenția în această săptămână?

Sunt cu ochii pe rezultatele $NVDA și aștept cu interes rezultatele$LOW și $TGT.

Bulios Black

Acest utilizator are acces la conținut exclusiv, instrumente și caracteristici ale platformei Bulios datorită abonamentului său.

Lowe's Companies, Inc.: Rege stabil al dividendelor și creștere pe termen lung

Regele dividendelor stabile: Lowe's Companies, Inc. $LOW este un rege al dividendelor cu o creștere continuă a acestora timp de 51 de ani, oferă investitorilor siguranță și stabilitate. Cu un dividend trimestrial actual de 1,10 dolari pe acțiune și un randament de 1,96% în ultimele 12 luni, este o...

Citește mai mult

Zobrazit další komentáře

Bulios Black

Acest utilizator are acces la conținut exclusiv, instrumente și caracteristici ale platformei Bulios datorită abonamentului său.

Este o companie interesantă și, dacă aș vrea să investesc în acest sector, aș fi cu siguranță interesat de această companie. Cu toate acestea, mie personal nu-mi place foarte mult acest sector și, prin urmare, mi-am plasat banii în altă parte.

Bulios Black

Acest utilizator are acces la conținut exclusiv, instrumente și caracteristici ale platformei Bulios datorită abonamentului său.

📈 5 Companii cu o calitate ridicată și un randament stabil al dividendelor!💸

Vă gândiți și la acțiuni care vor genera un venit pasiv din dividende timp de zeci de ani? Eu am ales aceste 5 piese!

Pentru mine, o astfel de companie trebuie să îndeplinească criterii importante:

Oferă produse pe care oamenii le cumpără fără ezitare și în mod regulat.

Poate rezista la o recesiune, prin...

Citește mai mult

Zobrazit další komentáře

Bulios Black

Acest utilizator are acces la conținut exclusiv, instrumente și caracteristici ale platformei Bulios datorită abonamentului său.

Frumos scris👍. Eu am doar PEP în portofoliu și îmi este suficient deocamdată.

Lowe's $LOW și-a redus previziunile privind vânzările și profitul pentru întregul an, în condițiile în care cererea de produse de bricolaj și inflația ridicată îi forțează pe consumatori să limiteze cheltuielile discreționare.

...Citește mai mult

Zobrazit další komentáře

Bună ziua, puteți detalia "spre deosebire de concurenții săi, nu poate crește efectiv prețurile și nu poate transfera presiunile inflaționiste asupra clienților"?

Practic, singurul concurent este HD, care a raportat și el recent rezultatele, iar căutarea lor actuală pentru marja operațională este între 14,3% și 14,0% (media pe 10 ani 14,28%), iar LOW și-a redus căutarea la 13,4% - 13,6% (media pe 10 ani 8,87%, 2022 - 10,47%, 2021 - 12,56%).

Rezultatele acestor companii sunt afectate în prezent nu doar de inflație și de criza imobiliară, ci și de presiunile deflaționiste asupra lemnului (prețul a scăzut cu aproximativ 20% în ultimele 3 luni).

Nu am urmărit încă rezultatele în detaliu, așa că mă voi bucura dacă îmi veți împărtăși câteva informații.

Hai să jucăm un joc! Construiți un imperiu al dividendelor. 🤑🤑🤑

Care sunt cele 5 companii care vor face parte din portofoliul tău? Anunță-mă. 💪👇

🌐 $V

🧰 $DE

🥤 $KO

🛠️ $HD

🚬 $PM

💳 $MA

💨 $MO

😷 $JNJ

🚜 $CAT

🛍️ $TGT

💰 $JPM

🏦 $BAC

🚂 $UNP

🛢️ 🛢️ $CVX

🏡 $LOW

⛽️ $XOM

🍔 $MCD

🛒 $WMT

🍎 $AAPL

🖥️ $MSFT

🦺 $MMM

🧪 $ABBV

📡 $AVGO

Voi fi cu ochii pe conferința Google și voi vedea ce va face PMI.