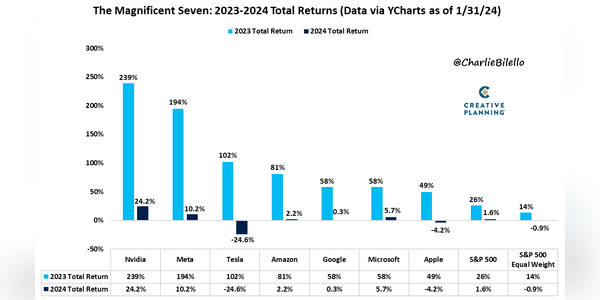

$MSFT, $GOOGL, $METAi $AMZNse předhánějí v tom, kdo bude mít výkonnější jazykové modely, kdo bude mít větší datacentra a kdo celkově bude víc investovat do dnešního fenoménu AI. 🤖

Jediný, kdo zatím tak trochu zaostává je Apple. Ten o nějakých AI novinkách mlčí a spíš to naopak vydává, že se vydává cestou využívání již funkčních pomocníků a jazykových modelů. Jako např. nedávná...

Zobrazit více

Bulios Black

Tento uživatel má díky předplatnému přístup k exkluzivnímu obsahu, nástrojům a funkcím.

Já naprosto souhlasím s Lukášem a vidím to velice podobně. Sice to teď není nic extra, ale nemyslím si, že by to mělo být až zas tak strašné.