Feed

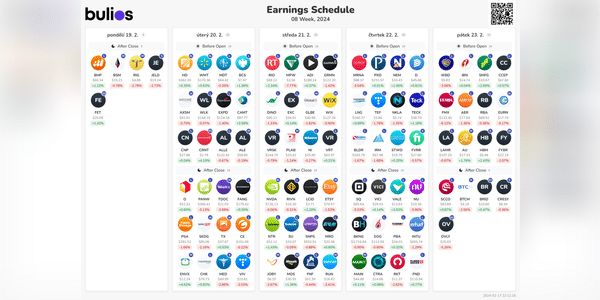

📊🚀 What to watch this week! 🌐💡

President's Day - Monday: The US stock market will be closed!

Walmart $WMT Earnings - Tuesday: Retail giant Walmart will release its earnings! 🛒💰 What will be the impact on their stock and the overall retail sector?

Home Depot $HD Earnings - Tuesday:🏡💼 What will be the impact on the construction and home building sector?

Fed FOMC -. Wednesday: Let's...

Read more

Zobrazit další komentáře

Super thanks for the recap, I just didn't have time to make it myself now :)

Zobrazit další komentáře

Zobrazit další komentáře

📈 I'm deciding between two REITs, which one do you choose? 🚀

🔍 $VICI vs. $O: Which one is more attractive to you ?

💹 Vici Properties Inc. $VICI 🍀

VICI is one of the key players in real estate investing, with an emphasis on the entertainment and hospitality sectors. Their portfolio includes attractive properties such as casinos, hotels and resorts that provide stable and...

Read more

Zobrazit další komentáře

Of the REIT sector, these are the only two I have and want. If it was just about attractiveness, I'd go with VICI, but given some stability in fundamentals, etc., I'd go with O. REITs are pretty well represented in my portfolio. I have a larger amount of money in O, but right after that is VICI where I also have little. I'm looking forward to when the Fed starts cutting rates :D

Zobrazit další komentáře

Moneta, KB, Vitesse Energy, Mercedes-Benz, Verizon, Société Generale, PKN Orlen ... my top two

Investors, is there a stock you've liked this year that you've bought often and has become your favorite?

I have become very fond of $ASML, $CVS and $O this year. I see potential in all three companies and think there is quite a bit of room for growth in the stock. I've bought the aforementioned stocks quite frequently this year and they already make up a large part of my...

Read more

Zobrazit další komentáře

Zobrazit další komentáře

Hi, I have exactly these three companies as well and buy relatively regularly. 😊

Good day to all investors here.

It's November here and I was wondering what stocks have you been buying over the last month? For me, the last month has been a bitcoin $BTCUSD reit change($O) and the addition of $TSLA in addition to the classic SNP 500 ETF. What interesting purchases did you make in October? :)

Reity for me too