Feed

Zobrazit další komentáře

I was stammering that the drop was bigger but didn't know why so thanks for the info. I do have Alxie PFE in my portfolio, but they make up and I want them to make up a smaller portion of the portfolio.

Zobrazit další komentáře

Pfizer reports its results tomorrow, which I'm very interested in. The stock is currently at a great price and so I was still overbought last week and I'm interested to see if $PFE stock will rise or fall after the results.

Do you own shares of $PFE and are you overbought at the current price?

Zobrazit další komentáře

Yes, I'm shoveling it in. At least I could buy into the size of the position I'd envisioned for this company. 😊

Shares of $PFE are down more than 30% this year. The current price is very nice and I would say the stock is even undervalued. For me, the share price is perfectly fine for a buy under $40 and the indicator here on Bulios confirms it for me. I will be buying shares of this company this week and will be looking forward to the dividend :D.

Investors, what stocks did you buy or sell this month?

I've been buying $MO stock this month and this week on Monday I was overbought $CVS stock as it dropped a few % again and got below the $70 level and then on Monday I was overbought $BAC and $PFE stock as they are also at a great price. As far as selling goes, I have sold off all shares of $MMM at a profit during this month.

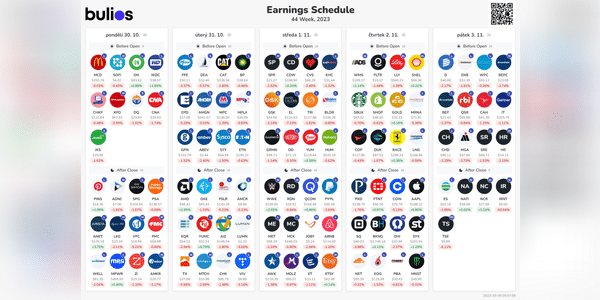

Pfizer $PFE reported results today. You could say that the results beat expectations, but the revenue just missed expectations. Revenue was down from Q1 this year as sales of the Covid-19 vaccine fell 83% and revenue from the Paxlovide antiviral treatment fell 98%.

I've been buying $PFE shares recently as they are currently at a really low price.

Investors, which company's results surprised you the most this week and which company's results are you looking forward to next week?

I was certainly pleased with $GOOGL's results and surprised by $MMM's results as I was expecting much worse given the situation they are currently in. As for next week, I'm looking forward to and interested in the results of $PFE, $CVS, $SBUX, $AM...

Read more

Investors, the pharmaceutical company Johnson & Johnson reported results today and the results beat expectations. Overall, I see potential in pharmaceutical and medical device companies and I like to invest in them. I already have $CVS in my portfolio and plan to add $PFE to my portfolio. I would like to add $JNJ to my portfolio, but it is at a high price and I fear it will be...

Read more

Zobrazit další komentáře

Drugmaker Pfizer $PFEsaidits North Carolina plant, one of the largest sterile injectable manufacturing facilities in the world, suffered severe damage from a tornado... Hopefully this will only be a short-term problem, as this plant produces nearly 30% of the company's sterile injectables.

The stock hasn't reacted to the news yet, so we don't have a chance to buy.

Zobrazit další komentáře

Interesting I didn't even know about that. I have been looking at this company and plan to buy its stock next week.

Pfizer $PFE ends development of obesity drug due to side effects. 🔴

You may remember my recent post that talked about the positive test results of Pfizer's obesity drug.

Today our stock dropped over 4% right after the market opened on the news that the development of this drug was being abruptly terminated.

Pfizer said it will instead focus on its other oral obesity drug,...

Read more

Zobrazit další komentáře

I don't invest much in pharma companies - I don't like the ambiguity around it... I prefer to pick oil or other mining companies.

What sector are you primarily focused on and what sector do you see the most potential in???

My main focus lately has been on the healthcare sector, as I see huge potential there. I think the healthcare sector is still moving forward and will grow even more in the future.

When I look at how many people have some health problems and medicine is needed more and more, or how many...

Read more

Zobrazit další komentáře

I understand the tobacco industry the most. Next would probably be the automotive industry, where I currently have only one representative. I also have quite a bit invested in the healthcare sector, although I don't move much in it. Then maybe 1 piece of each for diversification, my portfolio is constantly changing.

Charlie Munger and his view of healthcare in the US.

Charlie, a friend, partner of Warren, has recently been vocal about his concerns about US healthcare, literally stating that it is a system that prolongs death to make more money and comparing patients to African carcasses. 🤔

Read more

So we'll see how it turns out, as Marek writes, not every acquisition has to be so profitable. However, I have PFE shares in my portfolio and I am waiting for the growth.