Feed

Bulios Black

Tento uživatel má díky předplatnému přístup k exkluzivnímu obsahu, nástrojům a funkcím.

Dividendovky

Zdravím všechny investory,

v portofiliu vlastním pár firem převážně.

Držím pár dividendových akcií konkrétně $PEP, $O, $WPC a $VICI. PepsiCo beru jako jistotu ve spotřebním sektoru, kde lidé utrácí v krizi i v růstu, a navíc firma dlouhodobě zvyšuje dividendu. Realty Income je pro mě srdcovka díky měsíční dividendě a stabilnímu portfoliu, které mi dává pravidelný...

Zobrazit více

Bulios Black

Tento uživatel má díky předplatnému přístup k exkluzivnímu obsahu, nástrojům a funkcím.

Nejlepší REIT

Zdravím všechny investory,

celý čas, co se na investičních trzích pohybuji se snažím přijít na nejlepší REIT.Samozřejmě při tomto procesu se člověk setká s myšlenkou vlastně do jaké specializace těchto nemovitostnich fondů chce být zainvestován.

Retail $SPG

YTD: 7.89%

Simon Property Group vlastní a spravuje obchodní centra, outletové areály, retailové nemovitosti ve...

Zobrazit více

Zobrazit další komentáře

Musíte si ujasnit, co vlastně chcete, stanovit si nějakou investiční strategii. Např. zda chcete akcie s růstem hodnoty nebo čerpat pravidelnou vysokou dividendu (samozřejmě že ideální by byla akcie s růstem i vysokou dividendou). Já jsem vzhledem ke svému věku typickým příjmovým investorem a příští rok sklidím přes 1 milion Kč v dividendách. Mám ryze příjmové portfolio tvořené převážně ze společností REIT a BDC, protože tyto společnosti nemusejí odvádět v USA daň z příjmu, pokud více jak 90 % zisku rozdělí mezi své akcionáře. Proto i výnosy z dividend jsou vysoké.

Bulios Black

Tento uživatel má díky předplatnému přístup k exkluzivnímu obsahu, nástrojům a funkcím.

Čau. Přemýšlím a trochu chci diverzifikovat portfolio. Mám přes 80 % v USA a po 10 % v asii a evropě. Mám 3 akcie na prodej o kterých přemýšlím. 3M $MMM, Disney $DIS, WP Carey $WPC. Co si o nich myslíte? Peníze z nich bych poslal do evropy a do asie.

1) 3M jsem nakupoval na 80 dolarech a je na ceně na nějakých 150.

2) Disney mi přijde, že se poslední roky moc nehýbe a nic se s...

Zobrazit více

Zobrazit další komentáře

Bulios Black

Tento uživatel má díky předplatnému přístup k exkluzivnímu obsahu, nástrojům a funkcím.

Čau, zo spomínanej trojice mám MMM a WPC.

3M som v zisku cca 35% a plánujem ich držať aj naďalej, ale nad WPC (kde som v miernej strate) už tiež nejakú dobu uvažujem o predaji, že by som to prelial niekde inde tie prachy.

Bulios Black

Tento uživatel má díky předplatnému přístup k exkluzivnímu obsahu, nástrojům a funkcím.

Zobrazit další komentáře

Bulios Black

Tento uživatel má díky předplatnému přístup k exkluzivnímu obsahu, nástrojům a funkcím.

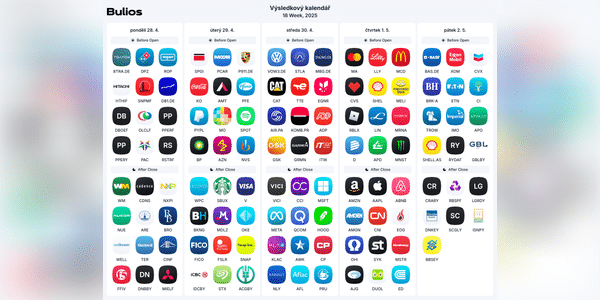

Budete toho tam hodně a já nejvíce budu sledovat $WM, $MO, $AMZN a $AAPL.

Bulios Black

Tento uživatel má díky předplatnému přístup k exkluzivnímu obsahu, nástrojům a funkcím.

W.P. Carey: Dlouhodobý potenciál po strategickém resetu

Společnost W.P. Carey $WPC (REIT) prošla v roce 2024 zásadní transformací, která zahrnovala odchod z kancelářského sektoru. Toto rozhodnutí bylo sice krátkodobě bolestivé, ale z dlouhodobého hlediska slibuje pozitivní dopad na finanční stabilitu a růst.

Klíčové změny a příležitosti

1. Odchod z kancelářského sektoru

• Prodej...

Zobrazit více

Zobrazit další komentáře

Bulios Black

Tento uživatel má díky předplatnému přístup k exkluzivnímu obsahu, nástrojům a funkcím.

Měl jsem dříve v portfoliu ale nelíbí se mi tolik to jejich portfolio a že jsou hodně zaměřené kancelářské budovy, takže jsem nedávno prodal.

Bulios Black

Tento uživatel má díky předplatnému přístup k exkluzivnímu obsahu, nástrojům a funkcím.

Zobrazit další komentáře

$AMD Třesu se na výsledky. Je to moje největší pozice a tento rok je na tom ta akcie fakt blbě. Tak jsem zvědavej.

Bulios Black

Tento uživatel má díky předplatnému přístup k exkluzivnímu obsahu, nástrojům a funkcím.

Zdravím všechny investory.

Tak co říkáte na tenhle týden, který je plný Q výsledků společností, které jsou nejvíce sledované: $ON, $MCD, $WPC, $SBUX, $AMD, $VICI, $META, $ARM, $INTC, $AAPL, $CVX, $MA, $MO a $KOMB.PR?

Určitě si všichni připraví kafe a hurá na analýzu, že?

Na watchlistu mám $ON a $AMT, u kterých přemýšlím nad nákupem, takže tento týden by mohl rozhodnout.

Zároveň mě...

Zobrazit více

Zobrazit další komentáře

Bulios Black

Tento uživatel má díky předplatnému přístup k exkluzivnímu obsahu, nástrojům a funkcím.

Je tam toho fakt hodně. Chci se určitě podívat na výsledky tech. společností a dále na ostatní, které mám zařazené v portfoliu.

Porovnání Realty Income, W. P. Carey a VICI Properties: Konkurenční výhody

Realty Income $O

Zaměřuje se na nemovitosti maloobchodu s nezbytným zbožím (např. lékárny, potraviny).

Vysoká dividendová stabilita (zvyšování dividendy 26...

Zobrazit více

Zobrazit další komentáře

Bulios Black

Tento uživatel má díky předplatnému přístup k exkluzivnímu obsahu, nástrojům a funkcím.

Pěkné shrnutí a rozhodně to sem také patří, pro mnohé co společnosti neznají, tak si udělají základní obrázek a pak si dál můžou hledat. Jinak za mě, těžká volba, protože mám všechny tři v portfoliu 😁 a tím jak je každá jiná, ale zároveň stejný typ a stabilní hlavně co se týká podnikání, tak je mám všechny. Jen u toho $WPC tam bylo trochu teď obav kolem těch kancelářských prostor, protože ty už nejsou moc lukrativní, ale právě proto dle mě udělali dobrý krok a pustili nějaké to portfolio kanceláří co měli, protože by to nebylo ziskové už. Takže do budoucna jim stále věřím v potencionální růst.

Bulios Black

Tento uživatel má díky předplatnému přístup k exkluzivnímu obsahu, nástrojům a funkcím.

Jaký REIT (kromě $O) je váš oblíbený?

Za mě to bude určitě $VICI, který je druhý a zároveň poslední REIT v mém portfoliu. Zajímavé jsou i akcie $WPC, které v portfoliu nemám, ale časem je do portfolia možná zařadím.

3 AKCIE KDE NYNÍ VIDÍM POTENCIÁL

Chtěl bych Vám nasdílet moje aktuální přemýšlení nad REITY (akcie velkých nemovitostních holdingů). A proč je taky aktuálně přikupuji do portfolia.

Věřím jim a proto v tomto sektoru nakupuji...

Zobrazit více

Zobrazit další komentáře

Platím si informace z více zdrojů a jedním je i Ondřej Koběrský. Jeho tvorbu sledují od samého začátku. Je to jeden z mála investorů se kterým sdílím stejnou ideologii.. spousta začínajících investorů nemá ani páru o tom co jsou REITy bohužel. Ondřejova tvorba je velmi kvalitní a přijde mi škoda se o ní podělit s lidmi zde na buliosu.

Dnes velmi jednoduchá otázka:

Co preferujete? Investování do jednotlivých REITŮ a třeba i diverzifikace na základě jejich zaměření nebo rovnou ETF a mít tak veškerý all-in v jednom?

Jaká je vaše top akcie a proč?

Bulios Black

Tento uživatel má díky předplatnému přístup k exkluzivnímu obsahu, nástrojům a funkcím.

Investoři, jaké REITy máte v portfoliu?

Já jsem v poslední době přikupoval hlavně $O a $VICI, jelikož ty ceny byly krásné a přemýšlím ještě nad $WPC.

Zobrazit další komentáře

Bulios Black

Tento uživatel má díky předplatnému přístup k exkluzivnímu obsahu, nástrojům a funkcím.

Ahoj, přesně tyto tři společnosti mám také a kupuji relativně pravidelně. 😊

Bulios Black

Tento uživatel má díky předplatnému přístup k exkluzivnímu obsahu, nástrojům a funkcím.

Společnost WP Carey včera reportovala své výsledky, které nebyly nějak dobré ani špatné za mě. Akcie $WPC jsou aktuálně na pěkné ceně a společnost také vyplácí pěknou dividendu.

Jak se koukáte na WPC vy a máte akcie $WPC v portfoliu?

Zobrazit další komentáře

Bulios Black

Tento uživatel má díky předplatnému přístup k exkluzivnímu obsahu, nástrojům a funkcím.

Akcie mám a budu držet dále, ty NLOP jsem hned prodal. Kanceláře jsou pasé za mě. Jinak výhled nějak moc slavný není ale tak chvilku to potrvá než se to stabilizuje. Teď nekupuji další a jak píše Marek, také to ale sleduji a případně bych přikoupil, uvidíme. 😊

Bulios Black

Tento uživatel má díky předplatnému přístup k exkluzivnímu obsahu, nástrojům a funkcím.

Investoři, které REITy máte zařazené v portfoliu?

Letos REITy poměrně dost klesají a tak jsem přikupoval akcie $O a $VICI a plánuji se podrobněji podívat ještě na $WPC. Akcie$O se dokonce minulý měsíc dostaly i pod 50$ a tak jsem přikoupil, ale cena je za mě pořád super a tak tento měsíc budu ještě něco málo přikupovat.

$WPC dnes padá o více než 7% po zprávě, že správní rada schválila plán na opuštění kancelářských aktiv v rámci svého portfolia.

Tento plán zahrnuje:

1) Spin-off do samostatného veřejně obchodovaného REITu, kdy 59 kancelářských nemovitostí bude převedeno do společnosti Net Lease Office Properties (NLOP).

2) Prodej kancelářských aktiv: 87 kancelářských nemovitostí zůstane ve...

Zobrazit více

Zobrazit další komentáře

Bulios Black

Tento uživatel má díky předplatnému přístup k exkluzivnímu obsahu, nástrojům a funkcím.

Společnost WPC mě velice zaujala. Ovšem z této zprávy mám smíšené pocity a s nákupem ještě nějakou dobu počkám.

Bulios Black

Tento uživatel má díky předplatnému přístup k exkluzivnímu obsahu, nástrojům a funkcím.

Kromě WPC mám všechny zmíněné akcie v portfoliu. Jsou to akcie, které stabilně rostou a vyplácí i slušnou dividendu. Solidní výkonnost by teď mohli mít REITy.