3 stocks that have risen 50% since the beginning of the year and are not stopping

Despite the fact that the economic situation in the world is still not ideal (but it is gradually improving) there are titles that do not address this. They are looking at the development of the whole market from the heights they have reached and waiting for further growth.

1. Confluent ($CFLT-1.1% )

Streaming data is a technology that is rapidly growing in importance to businesses as consumers consume more and more information from their digital devices and services.

Confluent is an industry leader and some of the largest companies in the world are flocking to its platform.

Cloud computing enables businesses to operate online, where every interaction within their digital ecosystem generates data. The ability to use this information instantly is "game changing" for customers. For example, a retailer can manage inventory in real time so products never run out of stock.

Confluent, Inc.

CFLTAn online sports betting platform can offer live betting during the game because streaming data allows them to calculate odds, provide them to users, and accept bets - all in seconds .

The technology has applications for almost every industry. International Data Corp. predicts that 90% of the world's 1,000 largest companies will use it by 2025.

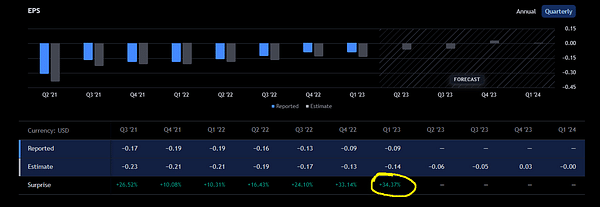

In the first quarter of 2023, Confluent generated revenue of $174.3 million, a 38% year-over-year increase and well above its forecast of $168 million.

But there was an even more impressive number: the number of companies that spent $1 million or more on Confluent's platform grew 53% - more than three times faster than the company's overall customer base grew.

Despite the current share price increase, it remains 70% below its peak which it reached in 2021.

2. DigitalOcean ($DOCN-3.7% )

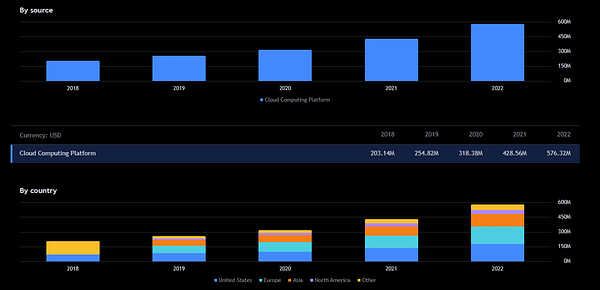

DigitalOcean is a provider of cloud computing services that allow its customers to store data, host websites, and even develop software.

A significant difference separates it from its main competitors, such as Amazon Web Services (AWS) and Microsoft Azure: DigitalOcean focuses on small and medium-sized businesses with fewer than 500 employees.

It's a lucrative segment of the cloud market because DigitalOcean can develop relationships with businesses in their early stages and then reap financial rewards when they start to thrive. (Just brilliant...)

The company offers personalized services, low prices and a simple cloud platform with tools that are one-click to operate and designed to suit target customers. Other cloud providers focus more on large enterprises and customers, so they don't typically offer a competitive value proposition for small businesses.

The company generated $165.1 million in revenue during Q1 , up 30% year-over-year . This was a faster growth rate than AWS (16%), Microsoft Azure (27%) and Alphabet's Google Cloud (28%) achieved in the period.

DigitalOcean's share price has jumped 57% this year, but is still 70% below its peak at $95. The company is in the cloud industry, which is worth $98 billion and could double by 2026.

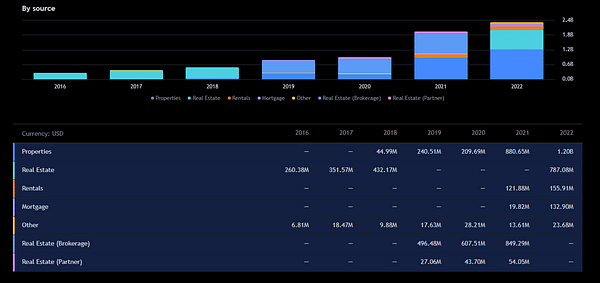

3. Redfin ($RDFN-2.8%)

The real estate technology company has struggled over the past 18 months as the U.S. Federal Reserve has launched the most aggressive interest rate hike in its history to combat soaring inflation.

This is directly affecting housing demand as consumers cannot afford to borrow as much money, leading to a slowdown in Redfin's business.

First, the company was forced to end its RedfinNow direct purchase business, where it bought homes directly from willing sellers and tried to "flip" (re-sell) them for profit.

Redfin Corporation

RDFNIt was too risky to hold hundreds of homes in inventory while home sales slowed and prices leveled off. Closing the segment was an opportunity for the company to refocus on its core brokerage business and plan a path to profitability.

Redfin employs 1,876 senior agents who cover 98% of the U.S. housing market (geographically), allowing the company to operate at a level that smaller independent real estate brokers cannot match.

As a result, it charges listing fees as low as 1%, which is well below the normal 2.5% rate and creates a win-win for Redfin and its sellers.

Due to the absence of direct home purchases, Redfin's Q1 revenue fell 45 % compared to the same quarter last year (as expected). However, Redfin is now a much leaner and healthier business and expects to deliver positive non-GAAP earnings before interest, taxes, depreciation and amortization (EBITDA) this year.

That's primarily why investors have sent Redfin stock sharply higher in 2023, and maybe this is just the beginning.

This isn't financial advice. I am providing publicly available data and sharing my views on how I would handle myself in these situations. Investing is risky and everyone is responsible for their decisions.