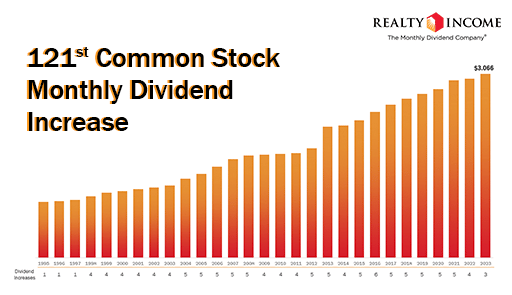

Not long ago, everyone here was worried about REITs and the real estate market, but somehow that topic has died down. Anyway, I have and continue to hold $O stock with peace of mind, which incidentally announced another increase in its monthly dividend to $0.2555 per share, for an annual amount of $3.066 per share. This is the 121st monthly dividend increase for the common stock since listing on the NYSE in 1994!

Do you know of a better stock in terms of stability and dividend increases?

Has anyone checked the performance against SPY? Yield including dividends for 1y,3y,5y,10y (1.45%, 19.5%, 50%, 124%) vs. SPY including dividends (18.55%, 50.6%, 71.8%, 223%)

I like REITY. Throw in some snuff and maybe an Apple and you're done👍

I also hold and am satisfied. I think of this as kind of defensive when you have growth stocks in your portfolio where there is more risk sometimes and it may not always work out. It's not growing at a breakneck pace here, but even when it's not the best of times like now, it's steadily paying a dividend so it'll cover some of that dollar down. I'm sure inflation isn't over yet, there may still be an opportunity to buy cheaper, but I wouldn't be afraid to buy cautiously now.

Nothing has changed at all since we were worried about REITs. Just investor sentiment. I'm still waiting on the possibility of buying a REIT and I believe the opportunity will come.

These stocks are just the grail. The dividends, the stability and the longevity. I have $O in my portfolio.

Well, I wouldn't get too optimistic about commercial real estate and REITs just yet. Has commercial occupancy improved significantly? I don't know about that. Also, the current price isn't appealing to me anymore either, it was still going up to that $55, I'd be cautious now.

Well this is exactly the type of investment I like, a reliable dividend yield year after year. In fact, I don't even know if anyone has that long a streak, maybe a couple of companies. But as a stable and good dividend stock, I'm fine with a 50 year streak of dividend increases like JNJ, PG and such.