The job market showed us results and helped us end the week in growth. 🚀

So friends, for once, good news too. The latest employment data is back in the US and it is slowly painting the picture all investors want to see and that is that the job market is cooling and so for the Fed this may mean no more hikes.

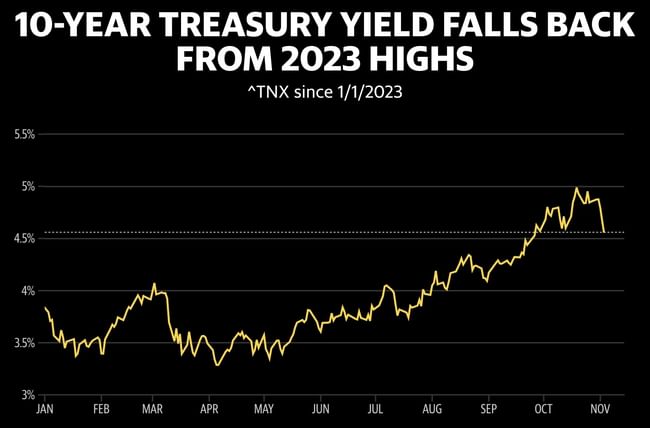

Only 150,000 jobs were added in October, falling short of expectations which were for 30,000 more. There have been 8 times the last 9 months of moderation in job growth. This week we see promising gains on indexes such as $^GSPC $^NDX $^DJI while Treasury yields fell. The yield on the 10-year Treasury note, which recently hit 16-year highs was considered a headwind to stocks, fell to 4.5% on Friday.

"The overall weakening in employment demand and wage growth supports our view that the Fed is done raising rates for the cycle," Nationwide chief economist Kathy Bostjancic wrote Friday.

Despite the rally in markets, the Fed has not made a clear decision on what to do next with rate hikes and has not yet discussed a rate cut, according to Powell. The Fed chairman highlighted Friday's jobs report as one of several key data points, including the next jobs update and two inflation prints coming ahead of the December meeting.

So we end this week green 🍀 and with a bit of the fix from last week. While it's good news and in my opinion the Fed will never tell us it's done and will always try to keep its news "veiled", the market is responding with a possible end to interest rate hikes. But for my part I am not cheering and as is always the case after a big move I expect a bit of a correction next week.

What about you investment friends? 😊 ... Have a great weekend. 🙏

Great news for the job market! 🙌 It's interesting to see how this impacts the Fed's decisions on rate hikes. The recent job growth moderation might indeed influence their stance. While the market is responding positively, I agree that some corrections could be on the horizon.

https://www.trippybug.com/best-places-to-visit-in-nandi-hills/

The signal's fine. However, I don't think I see it as a change and my strategy or behaviour doesn't change in any way.

Have a nice week. I see this as an opportunity to take profits before the storm. I'm pretty skeptical, bad news is good news, but at the same time a recession is looming.

Good news? They don't look good to me. The industry is slowing down. In boxing terminology, I'd say we dodged a left hook, but we're gonna hit a right hook. 😉

Great summary :)

It's going to be very interesting until the end of the year, I think next week will be the calm before the storm, but we'll see if it's a red/green storm. The data looks nice, and I'm slowly but surely starting to connect the dots between different market events thanks to Bulios. It's going to be a very interesting ride yet, but I'm rather hoping for some sideways trend for the rest of the year!

So the probability that the market will start to expect a rate cut and respond with significant growth by the end of the year is already higher than the opposite but the probability to the side is probably the highest. If I had to guess it would be 30 10 60