Nvidia reported its fourth quarter results that beat expectations for profit and revenue, with the company predicting better results for the following quarter. The tech giant achieved such strong revenues thanks to its artificial intelligence business.

Nvidia recorded revenue growth of an impressive 265% compared to the previous yearwhich is mainly due to strong sales of AI chips for servers. These chips are an integral part of its product portfolio, which now account for the majority of the company's revenue. Revenue from these chips grew an impressive 409% to $18.4 billion. Meanwhile, the gaming business, which previously dominated the company's sales, achieved "only" 56% year-on-year growth to $2.87 billion.

While $NVDAshares rose after the results, they also saw a minor decline. The reason for the decline was a significant slowdown in sales in China, which caused the stock to drop by about 2%. Still, all of the company's key data center areas delivered very solid sales, which beat analyst expectations , and the stock is up despite the slight decline. Thegaming business remains important to the company, with sales reaching 2.9 billion dalars, which also beat analyst expectations.

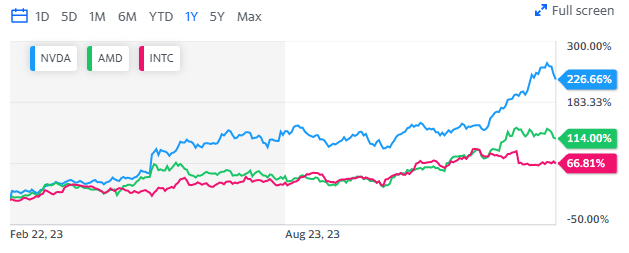

Nvidia has seen extreme growth in its share price over the past 12 months by more than200%, outperforming its competitors AMD$AMD and Intel$INTC. This increase in value is primarily due to its position as the world's leading manufacturer of artificial intelligence chips . Despite current challenges in the form of slowing sales in China and uncertainty, Nvidia remains a key player in future technology.

Disclaimer: You will find a lot of inspiration on Bulios, but stock selection and portfolio construction is up to you, so always conduct thorough self-analysis.

Source.