The U.S. Department of Justice (DOJ) has expanded its investigation into Nvidia, a global leader in the AI chip market, for suspected violations of antitrust laws. The DOJ has already sent subpoenas to the company and other tech firms, compelling them to provide key information.

The investigation is focusing on practices that could limit competition and penalize customers who do not exclusively use Nvidia products. The move comes at a time when Nvidia $NVDA is making record profits thanks to its dominance in artificial intelligence and facing increasing regulatory scrutiny.

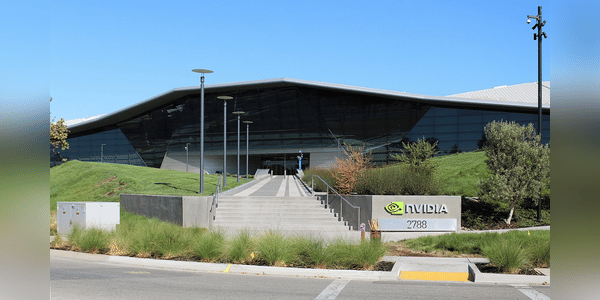

Nvidia under scrutiny

Nvidia, a company best known for its graphics cards, has transformed itself into one of the most important players in the field of artificial intelligence in recent years. Its chips have become an indispensable part of the infrastructure for machine learning and other AI applications, giving the company a dominant position in the market. However, this rapid growth has not gone unnoticed by…